China’s Oil Giants Outline Major Spending Splash

(Beijing) — China’s dominant oil firms have loosened their investment purse strings, apparently confident that profits will climb on rebounding crude prices following last year’s dry spell.

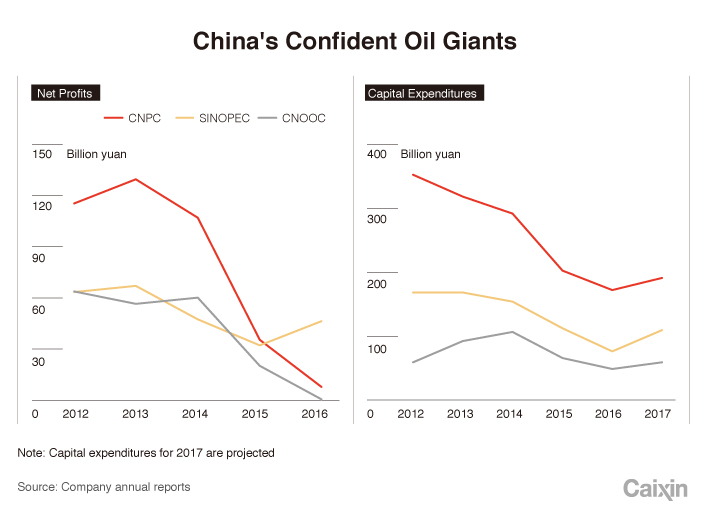

The Big Three — China National Petroleum Corp. (CNPC), China National Offshore Oil Corp. (CNOOC) and China Petroleum & Chemical Corp. (Sinopec) — recently committed to ambitious investment schedules for 2017 by announcing plans to spend around 371 billion yuan ($54 billion) combined. Budget plans were outlined in annual reports released by each company in between March and April.

China’s oil majors described their new confidence in the context of global and domestic market developments.

CNPC, the country’s top oil and gas explorer, said 75% of this year’s investments will target drilling and extraction projects at home and abroad in order “to stabilize oil exploration volume while increasing natural gas reserves.”

The company said it will boost capital spending 11% to 191 billion yuan this year after four consecutive years of investment cuts. The company scaled back considerably after splashing out 352 billion yuan in 2012, and said it cut investment last year “due to oil price fluctuations and market changes.”

CNOOC, which focuses on offshore extraction, unveiled plans to spend between 60 billion and 70 billion yuan this year — a range reflecting a 40% increase from last year’s all-time low for new investment.

“Looking forward to 2017, the global economy will continue to recover slowly and international oil prices are expected to stay at a relatively low level despite a certain rebound,” according to CNOOC’s annual report. “The company remains confident and persistent.”

And Sinopec, a downstream supplier specializing in oil refining and retail sales, said it’s moving forward with 110 billion yuan in new spending this year. About half of that amount will be used to target oil exploration and extraction.

“Looking forward to 2017,” Sinopec said, “the global political and economic environment is becoming more complicated, and global oil prices will still fluctuate at a low level.”

Nevertheless, Sinopec is upbeat about its domestic business, predicting “more positive changes” for the China market as “demand for oil and petrochemical products will grow at a relatively fast pace.”

|

The confidence shared by China’s oil companies is set against the backdrop of price pressure for global crude prices and production cuts by the OPEC bloc of oil-producing nations and partners.

Energy analysts with consultancy Wood Mackenzie recently cited downward pressure on crude prices in recent months in part because “global demand has disappointed so far this year.”

“Last year’s big rally in oil markets was triggered initially by confidence that two years of financial pain was forcing OPEC to shift strategy and support prices,” according to an analysts’ report.

While projecting confidence, CNPC and CNOOC are trying to put 2016 financial nightmares far behind them.

CNPC reported a slump in net profits attributable to shareholders to 7.8 billion yuan last year, down 78% from the 2015 level. CNOOC said its profit attributable to shareholders fell by half year-on-year to 637 million yuan.

Disappointing financial results prompted CNPC to shrink inventories. The company’s crude reserves fell 13% year-on-year to 7.4 billion barrels at the end of 2016.

CNOOC’s crude reserves declined nearly 10% from 2015 levels to 3.9 billion barrels of oil at the end of 2016. Chief Financial Officer Zhong Hua cited low crude prices and high production costs for the change. Moreover, output was affected by a pipeline break in 2015, an explosion early last year, and a devastating wildfire in May 2016 at an oil-sands project in Canada that’s now partly idled. It is undergoing repairs, CNOOC President Yang Hua said.

Sinopec, meanwhile, hopes to build on last year’s success, underscored by a 43% increase in 2016 earnings from the previous year to 46.7 billion yuan. The company, which cut inventories 31% from 2015 to 1.5 billion barrels last year, benefited from the gap between fluctuating crude prices and retail prices in China, which are set by the National Development and Reform Commission (NDRC).

The NDRC, which reviews prices for possible adjustments several times every year, decided in January 2016 to freeze retail prices in China if the global crude price fell below $40 per barrel. Prices dipped below that level in early 2016 but have since rebounded overall.

Strategic Differences

While pursuing separate investment strategies this year, each of the Big Three has been following a different path.

CNPC plans to maintain its dominance in oil-rich regions such as Daqing in northeastern China’s Heilongjiang province and Changqing in northern China’s Ordos Basin. The company also plans to do more exploring for natural gas in northern and western China.

“New investments are aimed at retaining production capacity,” said a staffer at CNPC’s oil exploration department who asked not to be named. “A new well can’t be put to use within the year it’s drilled, so we should plan ahead.”

Sinopec plans to keep its downstream focus while stepping up energy extraction work, particularly in the shale gas sector. The company plans to increase annual shale gas production capacity in Chongqing to 10 billion cubic meters this year from 7 billion cubic meters in 2016, according to company Vice President Jiao Fangzheng.

Complementing Sinopec’s major refineries in Shanghai and the provinces of Guangdong, Zhejiang and Jiangsu are an oil refining plant and 820 gas stations recently acquired in Africa. The company agreed to buy the facilities in South Africa and Botswana from Chevron for $900 million in March.

Meanwhile, CNOOC plans to target countries outside China for 48% of all asset investments this year. Over the next two years, Yang said, the company plans to develop deep-water offshore drilling projects in the Gulf of Mexico’s Stampede and Appomattox fields as well as Nigeria’s Egina field.

Given the current market climate, there’s no guarantee that the investment plans rolled out by the Big Three will pay off.

Indeed, the Big Three are now showing less caution than global industry counterparts including Chevron Corp., Royal Dutch Shell PLC and Total SA, which plan to cut capital spending this year by11.6%, 7.4% and 9.8% respectively.

ExxonMobil Corp., on the other hand, says it will boost investment 15% to $22 billion this year. And BP PLC’s 2017 investment target is $16 billion to $17 billion, similar to last year’s.

A recent rebound for crude oil prices is no reason for excessive optimism as there is still a glut, said Yuan Guangyu, a CNOOC deputy general manager.

True, China’s oil companies started 2017 on a positive note. CNPC reported a 5.7 billion yuan first-quarter profit compared to a 14 billion yuan loss in the same period last year. Sinopec’s quarterly profit surged 168% to 16.6 billion yuan. And CNOOC hasn’t released the first quarter financial result.

But uncertainty is clouding the global industry. Significantly high crude oil inventories lately have hung like a dark cloud over oil companies, said BP’s chief economist, Spencer Dale.

The future direction of crude oil prices may depend on ongoing OPEC supply decisions. OPEC member Saudi Arabia and Russia agreed May 15 to extend current output cuts until March 2018, Reuters reported. Other OPEC members were expected to decide whether to match that pledge by the end of June.

“The key question for 2018 supply is the return of OPEC and Russian production,” according to a Wood Mackenzie report. “Full return would result in a strong surge in supply, with output rising by 2.4 million (barrels per day) in 2018.”

Contact reporter Coco Feng (renkefeng@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas