China’s A-Shares Break Into Global Big Leagues With Inclusion in MSCI Indexes

(Beijing) — As China’s A-shares finally crack into MSCI Inc.’s global indexes, Xu Liang might get busier.

As an investor-relations manager at Spring Airlines Co., China’s first low-cost carrier, Xu frequently travels to Hong Kong and Europe, answering tough questions from overseas fund managers and potential investors.

When MSCI on Wednesday decided to add Spring Airlines, alongside the other 221 Chinese A-share companies, to its benchmark indexes beginning in June 2018, Xu appeared ready to up the game.

“Our strategy so far has met investors’ demands,” Xu said.

After three straight years of failed attempts, China’s domestically traded A-shares finally broke into the MSCI benchmarks tracked by $11 trillion of institutional funds globally. The U.S. index compiler estimates the inclusion could lure up to $18 billion of fresh funds to Chinese market “to start with.”

|

China’s securities regulator applauded MSCI’s decision.

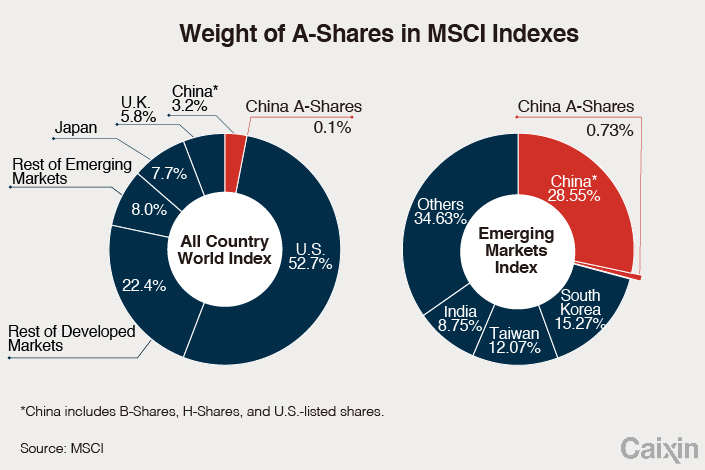

Earlier this year, the index compiler proposed to include only 169 A-share companies with a 0.5% index weighting. MSCI said the final list, which now includes 222 companies with a 0.73% weighting, was expanded to include A-share companies that are dual-listed as H-shares in Hong Kong.

A-shares are yuan-denominated equities traded on the Shanghai and Shenzhen stock exchanges. H-shares are Chinese companies traded in Hong Kong dollars on the Hong Kong bourse. Large companies such as ICBC Ltd. are dual-listed as A- and H-shares.

Fourth time’s the charm

China has for years conducted painstaking financial reform in a bid to convince international investors that A-shares are investable.

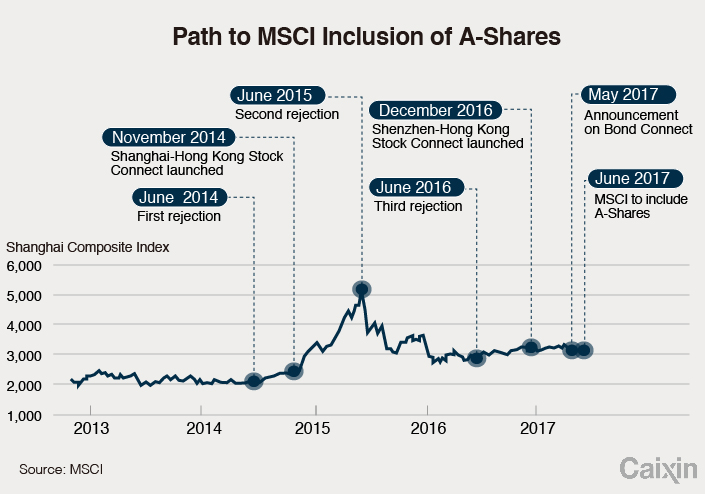

Market watchers believe improved accessibility of the A-share market is one of the key reasons behind the inclusion. For one thing, China launched the Stock Connect program, offering mutual access for investors between the Hong Kong Stock Exchange and the Shanghai bourse, in 2014. In December, another trading link connecting Hong Kong and Shenzhen was added.

MSCI said this year’s decision is also a result of the loosening by the local Chinese stock exchanges of preapproval requirements that can restrict the creation of index-linked investment vehicles globally.

|

MSCI vetoed A-share inclusion over the past three annual reviews, citing limited market access for global investors, capital controls, and the opaque regulatory framework.

Hong Hao, chief China strategist at Bocom International Holdings Co., said the inclusion underlines China’s efforts to improve stock-trading suspension rules, create stock-trading links with Hong Kong, as well as relax new-product preapproval.

A lift for the large caps?

Having said that, only 5% of the market capitalization of the entire A-share universe will be added to the benchmarks this time. Market watchers believe initial inflows will likely be moderate.

Credit Suisse said the inclusion may extend the recent rally of Chinese blue chips. The investment bank predicted fresh funds will likely flow toward 25 large caps, and their daily turnover could be double or more because of the inclusion.

Chinese stocks edged only marginally higher Wednesday, partly because equities had gained ahead of the MSCI decision.

The Shanghai Composite Index closed 0.52% higher at 3,156.21 points, while the Shenzhen Component Index added 0.76% percent to 10,367.17 points. The Shanghai Shenzhen CSI 300 Index, which tracks the top 300 big caps in the market, jumped 1.17% to 3,587.96 points.

What lies ahead

MSCI said Wednesday that in the future, it may include up to 450 A-shares, depending on the improvement of China’s investment environment.

Bank of America Merrill Lynch predicted that MSCI might need six to nine years to fully integrate A-shares into its Emerging Markets Index. The process could be even longer, depending on the progress of the opening-up of the market and the nation’s capital convertibility.

“This would mean not banning major stockholders from selling shares during periods of market turbulence, not suspending the trading of stocks outside the use of predetermined circuit breakers, and therefore not creating the conditions that lead to moral hazard,” said Ken Jerret, president of the American Chamber of Commerce in Shanghai.

For the newly included Chinese companies, one of the challenges is meeting international standards on information disclosure and corporate governance usually demanded by overseas fund managers, said Gao Ting, chief China strategist at UBS Global Asset Management Co.

Transparency appeals a lot to foreign investors, Gao added.

Looks like Spring Airlines’ Xu had it right — and early.

“If we are required to disclose more information following the MSCI inclusion, we are willing to do that,” he said.

Contact reporter Leng Cheng (chengleng@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas