Majority of U.S. Businesses in China Oppose Trump Tariffs: Survey

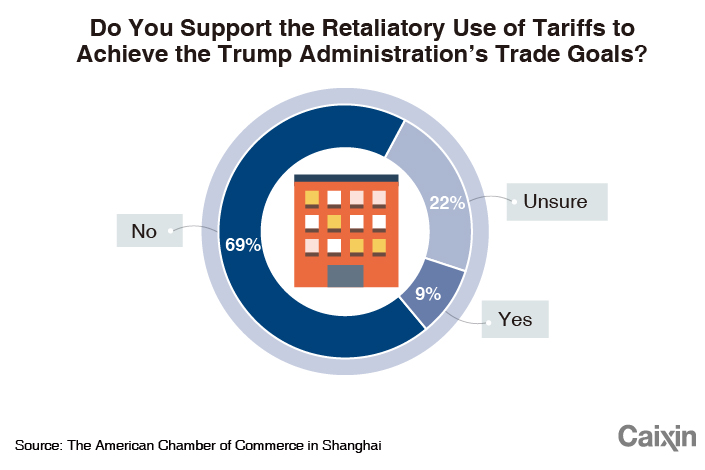

A majority of American companies in China said they don’t support their president’s use of retaliatory tariffs to achieve the U.S.’ trade goals, according to a survey compiled by the American Chamber of Commerce in Shanghai (AmCham Shanghai).

This year’s survey, released shortly after U.S. President Donald Trump’s fresh threats to impose tariffs on $200 billion worth of Chinese goods, provides a barometer of the sentiment of American multinational companies on the looming trade war.

A total of 69% of respondents said they did not support tariffs, far in excess of the 9% who said they did and the 22% who were unsure. Businesses involved in nonconsumer electronics, chemicals, agriculture and food were among the strongest in opposition to tariffs, while those working in education, training and legal services showed relatively strong support for tariffs as they have less to lose, AmCham Shanghai’s 2018 China Business Report showed.

As the situation has significantly escalated since the survey was held, businesses’ opposition to the tariffs is likely to have intensified following the implementation of the first wave of tariffs, said AmCham Shanghai President Kenneth Jarrett, as “there is growing anxiety about regulatory retaliation, and companies are turning cautious about seeking approvals for new investments.”

|

Despite debate on the future of the business environment, U.S. firms said their performance remained in good shape in 2017. The survey showed that nearly 58% of companies reported higher revenue growth in China than globally, up 7.7% from last year. Some 76.5% of respondents reported profitability in China last year, and 25% of respondents said their China operations significantly contributed to U.S. head offices’ profits.

Fewer companies than expected, around 53% of respondents, made additional investments in China last year — well under the predicted 62.8% — while more companies said that China was their top investment priority in 2017, jumping to 27% from 3% the year before last, the survey showed.

On this point, Jarrett mentioned American electric-car maker Tesla Inc. during a media briefing on the survey. The company made headlines by signing an agreement in Shanghai for its first overseas gigafactory two days ago, which Jarrett described as “a good example and reminder of benefits of trade and investments.”

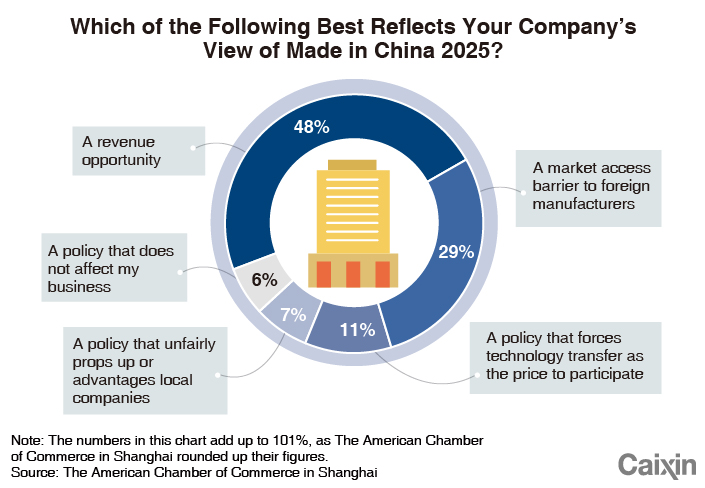

Notably, while it is seen as a threat by the Trump administration, the Chinese government’s “Made in China 2025” campaign — which aims to boost the country’s high-end manufacturing capabilities — was seen as a revenue opportunity by 48% of the respondents, the survey showed, as business people focused on long-term opportunities instead of short-term impact on trade.

|

The survey also mentioned the growing number Communist Party organizations that have been set up in American companies, as part of Chinese President Xi Jinping’s attempt to strengthen the role of the party in Chinese society. A total 25% of the respondents said having a Communist Party branch in their company is “inconsequential to commercial success,” and another 11% consider it “beneficial to commercial success.”

“Members are definitely sensitized to this as a trend,” Jarrett said. “But so far the party’s role in companies hasn’t crossed the line of trying to interfere or reshape business decisions. It’s also interesting to see that the level of concern on party organizations is much higher in finance and legal services.”

AmCham is a nonprofit, nongovernmental organization that represents more than 3,300 individuals from 900 companies operating across China. This year’s survey, released together with the consultancy PwC China, contained views from 434 companies.

This story has been updated to correct a chart about U.S. corporate support for the retaliatory use of tariffs.

Contact reporter Leng Cheng (chengleng@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas