Mastercard Caixin BBD China New Economy Index(May 2017)

Released: 10:00 am Beijing Time June-02-2017

The official version of the Mastercard Caixin BBD China New Economy Indexwill be released from this month on. We made adjustment to the previously released trial version Based on big data, new economic development, and reference guideline, adding “Culture, Sports, and Entertainment” sector to the original index.

Overview

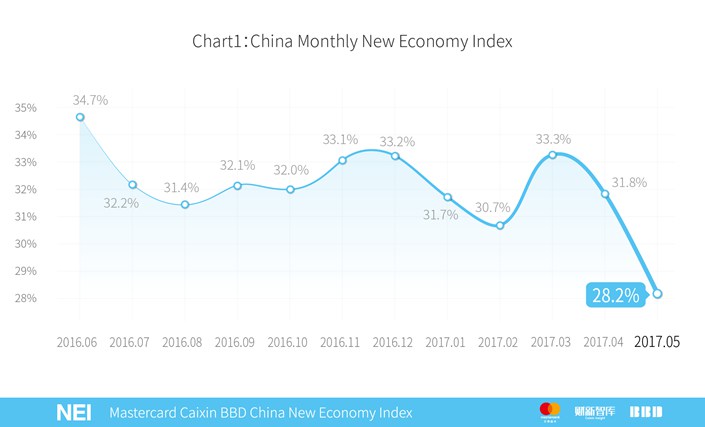

In May 2017, the Mastercard Caixin-BBD New Economy Index (NEI) reading came in at 28.2, indicating that the New Economy accounted for 28.2% of overall economic input activities that month, down 3.6 ppts from April (Chart 1). The declining NEI was in large part due to the changes of new economy share in tendering and new OTC market. Recruitment and new enterprises registration data remained stable. Nevertheless, the downtrend of new economy share in past year is noticeable, based on a series of NEI indicators. We attribute the change to recovering traditional industries. However, it's noteworthy that the recovery of traditional industries was stimulated by supply-side structural reform and will be jeopardized by weak demand. Once the old economy stops recovering, new economy will bounce back as the driving force. New economy is defined as following: 1) human capital intensive, technology intensive and capital light; 2) sustainable rapid growth, and 3) in line with the strategic new industries defined by the government. Please refer to our previous reports (March 2016 and March 2017) for the list of NEI sectors.

|

Primary Inputs

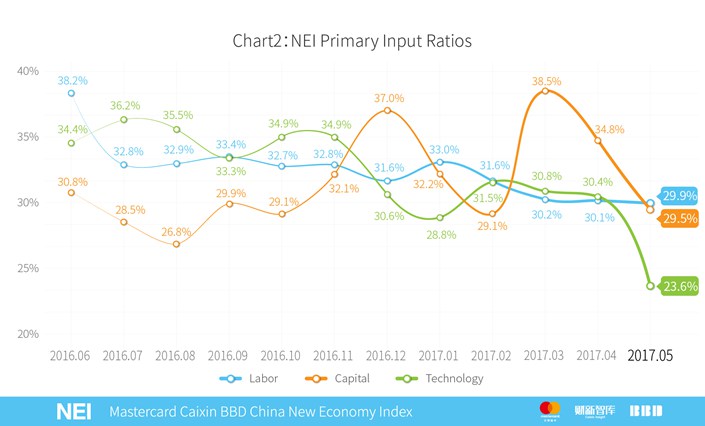

The NEI includes labor, capital and technology inputs that account for 40%, 35% and 25% of the total weight of the index, respectively. Among the primary inputs, the decrease in the May NEI reading came primarily from decreasing capital and technology inputs. Capital investment showed wide fluctuations in the recent half year; it further declined in April, coming in at 29.5. Labor inputs declined moderately, dropping to 29.9 from 30.1 in April, the lowest number since 2017. Technology inputs declined significantly to 23.6 from 30.4 a month ago (Chart 2).

|

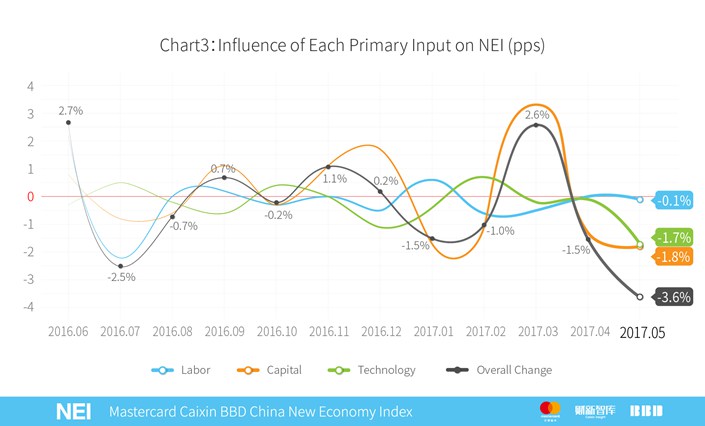

Percentage changes in labor, capital and technology inputs were -0.1, -1.8 and -1.7 ppts, respectively. After accounting for the sum of their weightings, the net NEI change was a 3.6 ppts decrease from April (Chart 3).

|

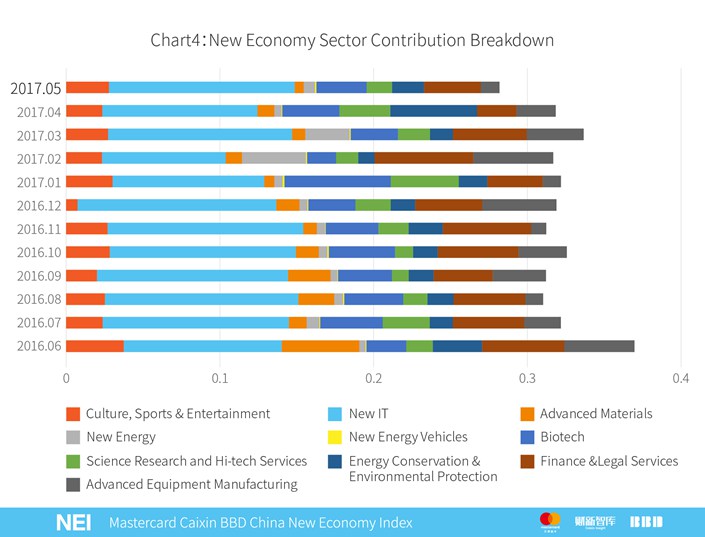

Looking at the sectors, the New IT industry formed the largest proportion of the New Economy Index, contributing 12.1 ppts to NEI. Financial & Legal Services came second, contributing 3.7 ppts, the highest ranking since the recent half year. Biotech ranked the same as April as the third largest contributor with 3.3 ppts. Energy Conservation & Environmental Protection dropped to the fifth contributor with 2.1 ppts, about a half of the number in April (Chart 4).

|

New Economy Employment

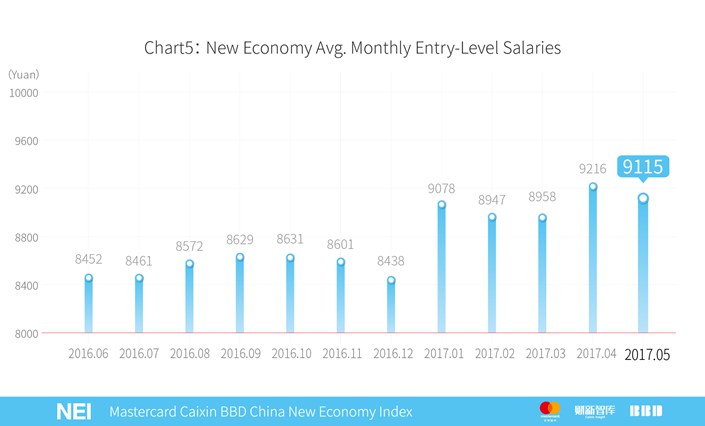

In May 2017, the average monthly entry level salary of the New Economy was RMB 9,115 per month, dropping slightly from last month’s level of RMB 9,216 (Chart 5). New Economy wage information is compiled from online websites of career platforms and recruitment services including 51job and Zhaopin, as well as other sites that list job demands.

|

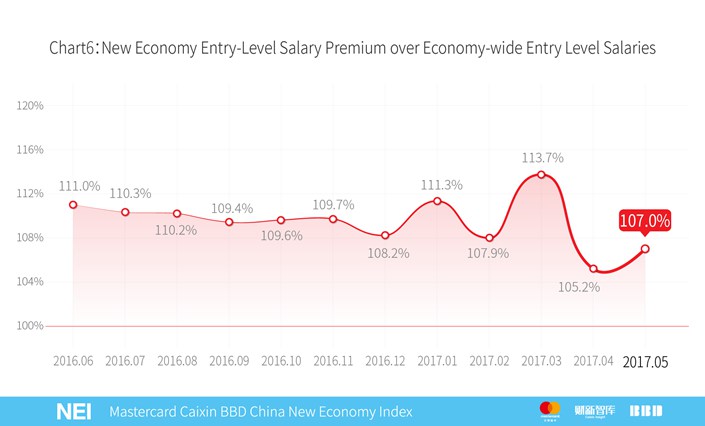

Hiring in the New Economy sectors accounted for 28.9% of total hiring in February, a decrease from the previous month’s 29.3%. The compensation share of New Economy sectors remained the same at 30.9%. The entry level salary premium of the New Economy was 7.0% as compared to economy-wide counterparts, an increase from 5.2% in April (Chart 6). In the recent half year, the average salary premium of the New Economy saw an increase in January and March, respectively, with more than 10%, and experienced a solid decline in the other months, while the figure saw an increase again this month.

|

Decomposition of New Established Enterprises

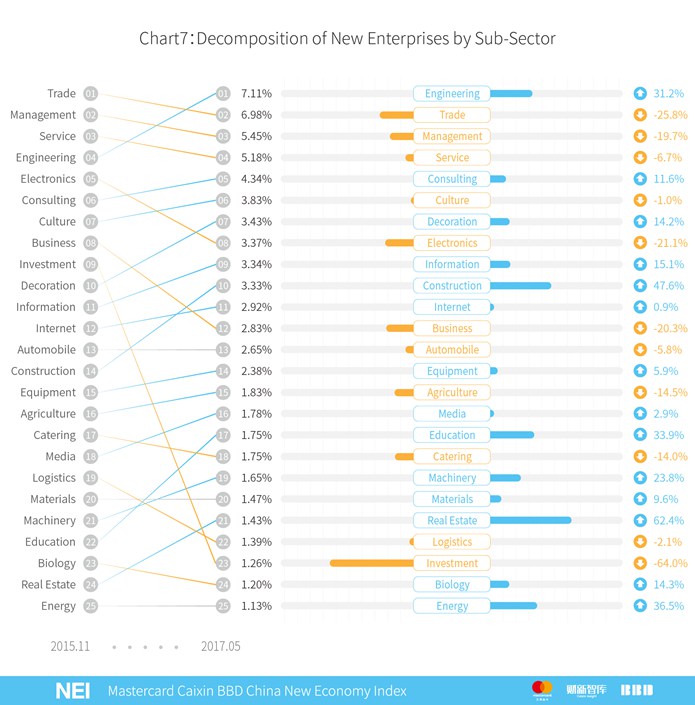

We use newly-established enterprises data to monitor new enterprises in sectors. Top 25 key words associated with enterprises were used (Chart 7). We decompose new enterprises by sub-sector every six months, in November 2016, May 2016 and November 2015, respectively. Sub-sectors are ranked by the proportion of new enterprises in the sub-sector to all new enterprises.

|

Ranking up sub-sectors (from November 2015 to May 2017) include the following: Engineering (No.1 in May 2017, No.4 in November 2015, 31.2% increases in proportion), Decoration (No.7 in May 2017, No.10 in November 2015, 14.2% increases in proportion), Construction (No.10 in May 2017, No.14 in November 2015, 47.6% increases in proportion), Real Estate (No.21 in May 2017, No.24 in November 2015, 62.4% increases in proportion). Changes in key words above indicated that infrastructure and construction investment, both led by government, started to rise again. Moreover, education investment also saw a ranking-up to No.17 in May 2017 from No.22 in November 2015 with a proportion increase of 33.9 ppts, which is the only ranking up sub-sector other than Construction & Engineering.

Ranking down sub-sectors (from November 2015 to May 2017) include the following: Electronics (No.8 in May 2017, No.5 in November 2015, 21.1% decreases in proportion), Business (No.12 in May 2017, No.8 in November 2015, 20.3% decreases in proportion), Logistics (No.22 in May 2017, No.19 in November 2015, 2.2% decreases in proportion), Investment (No.23 in May 2017, No.9 in November 2015, 64.0% decreases in proportion). Apart from investment, which is subject to business registration restriction, the other ranking down sub-sectors are in large part associated with e-commerce, which might start cooling off.

Changes in New Job Openings

In May we explored new job openings based on recruitment data. Recruitment involves three elements: enterprise, location/city, and opening. An opening is defined as a “New Job Opening” when it’s first posted in a span of three months. This indicator was used in our report in November 2016.

New job openings are of significant difference from “old” job opening in many aspects. Existence of old job opening indicates that the opening has been posted before in the same city. Three potential scenarios arise here: 1) the continuous growth in related business requires an increase in personnel; 2) the high turnover rate of employees requires new labor input; 3) previous offers are not good enough to attract qualified candidates. A new job opening implies that one of three elements (enterprise, location/city, and opening) is new, at least. In this sense, new job openings are closely related to New Economy Index.

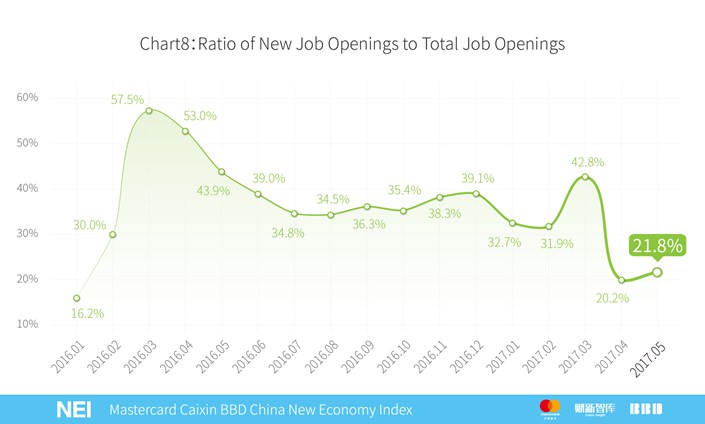

Chart 8 shows that the ratio of new job openings to total job openings rose rapidly from January 2016 and climaxed in March 2016, when approximately 60% of the job openings were new. The ratio stayed above 40% in April and May 2016 and dropped afterwards. From July 2016 on, the ratio stabilized around 35% to 40%.

|

The ratio climbed to 42.8% in March 2017, and dropped again afterwards. We might conclude that the pattern of ratio in spring is related to Chinese New Year. Generally, labor market demands peaks after Spring Festival. However, the ratio experienced a significant YoY decrease in April and May 2017, implied that new momentum is slowing down. In history, the change of new job opening ratio coincides with our observations on government squeeze effects.

Recovery in Investment Based on Employment Data

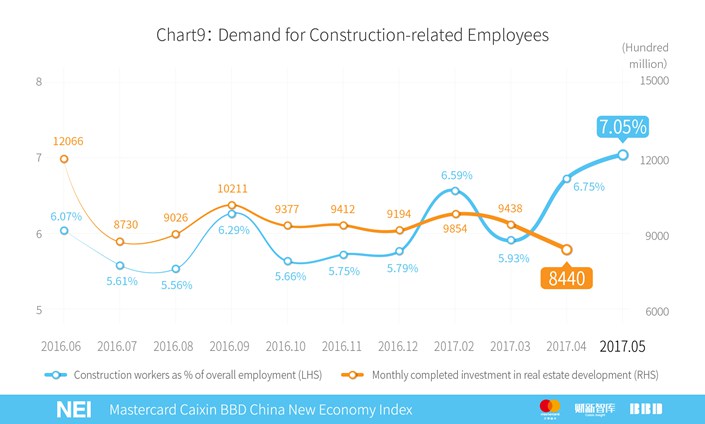

We use monthly completed investment in real estate development and demand for construction employees to analyze the current state of investment. In the following chart, the two indexes showed an identical trend before April 2017. Demand for construction employees reached 6.75% in April 2017, an increase by 0.82% from 5.93% in March 2017, while April completed investment in real estate development dropped by 10.6% as compared with March 2017. This was the first time the two indexes diverged.

This month continues seeing an increase in demand for construction employees, reaching a 24-month peak at 7.05% (Chart 9). Given the historical accuracy of the index, we still forecast that real estate investment increases next month.

|

City Rankings of the New Economy

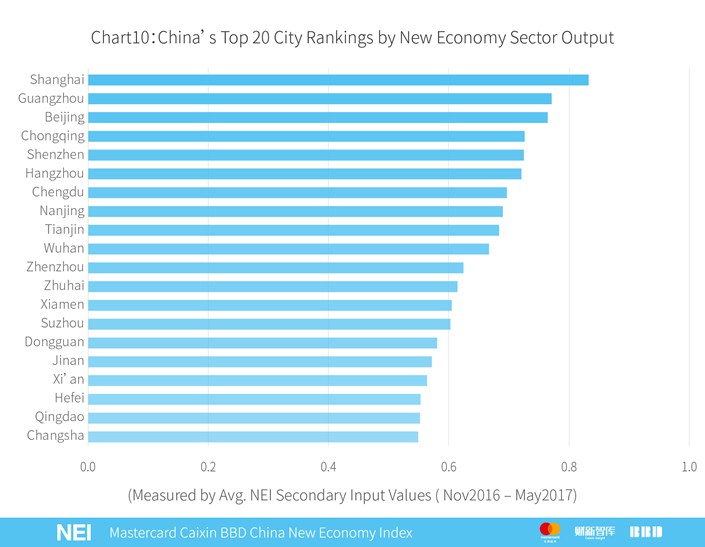

Based on overall New Economy rankings, the top twenty cities are shown in Chart 10. The top five cities are Shanghai, Guangzhou, Beijing, Chongqing, and Shenzhen. Rankings are based on a weighted average of the percentile rank of indicators for the city in the past 6 months.

|

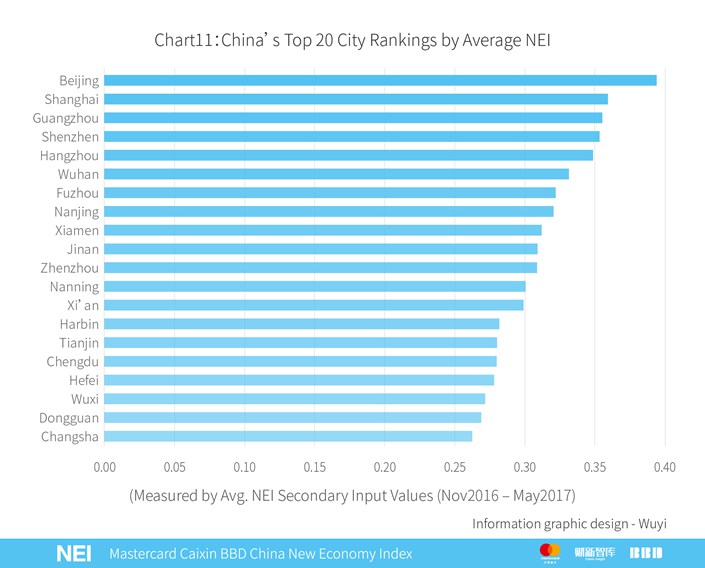

Chart 11 showed the average NEI city rankings between November 2016 and May 2017. The top five cities are Beijing, Shanghai, Guangzhou, Shenzhen and Hangzhou.

|

For further information please contact:

Mastercard

Mr. Wu Huanyu, Director, Communications

Tel:+86-10-8519-9304

Email:Huanyu_wu@mastercard.com

Caixin Insight Group

Dr. Wang Zhe, Senior Economist

Tel:+86-10-85905019

Emails:zhewang@caixin.com

Ma Ling, Public Relations

Tel:+86-10-8590-5204

Email:lingma@caixin.com

BBD

Dr. Chen Qin, Chief Economist

Tel:+86-28-65290823

Emails:chenqin@bbdservice.com

The Mastercard Caixin BBD China New Economy Index is the fruit of a research partnership between Caixin Insight Group and BBD, in collaboration with the National Development School, Peking University. The subject of a year of research, the NEI was first publically released on March 2, 2016 and will be issued the 2nd of every month at 10:00am China Standard Time.

About Caixin

Caixin Media is China's leading media group dedicated to providing financial and business news through periodicals, online content, mobile applications, conferences, books and TV/video programs. Caixin Media aims to blaze a trail that helps traditional media prosper in the new media age through integrated multimedia platforms. Caixin Insight Group is a high-end financial data and analysis platform. For more information, please visit www.caixin.com.

About Mastercard

Mastercard (NYSE: MA), www.mastercard.com, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. Mastercard’s products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MastercardAP and @MastercardNews, join the discussion on the Beyond the Transaction Blog and subscribe for the latest news on the Engagement Bureau.

About BBD (Business Big Data)

BBD is a leading Big Data and quantitative business analytics firm specializing in the analysis of the high-growth industries emerging in Mainland China. Through dynamic data tracking, credit analysis, risk pricing and economic index construction, BBD provides its clients with a wide range of services at both the macro and micro level. For more information, please visit http://www.bbdservice.com/.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas