Caixin China General Services PMI(February 2019)

Composite output expands at softest rate for four months

Summary – Services and Composite PMI data

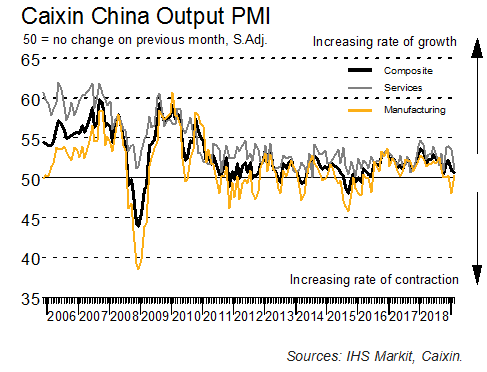

The Caixin China Composite PMI™ data (which covers both manufacturing and services) indicated a softer rise in Chinese business activity during February. At 50.7, down from 50.9 at the start of 2019, the Composite Output Index pointed to a marginal expansion of output that was the slowest in four months. Nonetheless, business activity across China has now risen on a monthly basis for the past three years.

The slowdown was largely centred on the services sector, which registered the softest increase in business activity since last October. Notably, the seasonally adjusted Chinese Services Business Activity Index posted 51.1, down from 53.6, to signal a marginal rate of growth that was weaker than the long-run trend. Manufacturing production meanwhile returned to expansion in February, though the rate of increase was fractional overall.

The relatively subdued rise in services activity coincided with a slower increase in new business in February. Notably, service providers signalled the least marked expansion of new orders since last October amid some reports of relatively muted demand conditions. In the manufacturing sector, new orders rose for the first time in three months, albeit only slightly. At the composite level, new business expanded at a slightly faster, but still marginal, pace during February.

The trend in exports meanwhile deteriorated midway through the first quarter of 2019. Overall, foreign sales declined marginally, driven by a renewed fall at manufacturing companies. At the same time, new export order growth eased to a five-month low at services companies.

Employment trends continued to differ by sector, with services companies registering the fifth successive monthly rise in staffing levels as manufacturers continued to scale back their workforce numbers. That said, the latest expansion of service sector payrolls was only marginal, having eased since the start of the year. At the same time, goods producers saw a slightly quicker rate of job shedding compared to January. As a result, composite employment fell back into contractionary territory in February.

Services companies in China signalled lower backlogs of work for the second month in a row during February. Though moderate, the rate of depletion was the quickest seen since September 2015, with some firms citing greater efforts to clear incomplete orders. In contrast, outstanding workloads continued to increase modestly across the manufacturing sector. Nonetheless, the steeper reduction in the level of work-in-hand at service providers underpinned the first fall in unfinished business at the composite level for three years.

Operating expenses faced by services firms continued to rise in February. The rate of increase quickened slightly since the start of the year, by remained modest overall. Meanwhile, average purchasing costs for manufacturers declined for the third consecutive month, albeit only slightly. At the composite level, input cost inflation picked up from January’s three-year low and was moderate.

February data showed that both manufacturers and service providers raised their output prices only slightly. That said, it marked the first increase in factory gate prices for four months. Where higher selling prices were reported, panellists generally linked this to firmer overall demand conditions.

Chinese companies continue to expect activity to increase over the next year in February. Optimism was widely linked to new products, company expansion plans, greater investment and expectations that overall market conditions will improve. However, the level of positive sentiment softened since January, with confidence easing slightly across both the manufacturing and service sectors.

Key points

• Services activity expands at softer pace, while manufacturing output returns to growth

• Inflationary pressures remained subdued

• Services companies see steepest decline in backlogs for nearly three-and-a-half years

Comment

Commenting on the China General Services PMI™ data, Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said:

“The Caixin China General Services Business Activity Index dipped to 51.1 in February from 53.6 in the previous month. Among the gauges included in the survey:

1)The gauge for new business dropped, suggesting slowing growth in demand across the services sector;

2)The measure for employment edged down despite staying in positive territory, indicating the sector’s weaker capacity to absorb workers;

3)Both gauges for prices charged by service providers and input costs edged up. The measure for business expectations continued to fall despite staying in positive territory, reflecting services providers’ weakening confidence in prospects.

“The Caixin China Composite Output Index inched down to 50.7 in February from 50.9 the month before.

1)Although the gauge for new export business returned to contractionary territory, the one for overall new orders remained in expansionary territory and rebounded marginally, reflecting a recovery in domestic demand — especially for manufacturing. However, the measure for backlogs of work fell for the second month in a row into contraction, and hit its lowest level since February 2016, reflecting downward pressure on overall orders;

2)The employment gauge returned to negative territory, implying that pressure on the labor market remained.

3)Both gauges for input costs and output charges rebounded, suggesting that the downward trend in prices was cushioned.

4)The measure for future output, which reflects business confidence, dropped despite staying in positive territory.

“In general, domestic manufacturing demand recovered significantly in February. However, with downward pressure on employment, expansion in the services industry slowed notably. Increased infrastructure investment may have prevented a sharper decline in economic growth.”

|

For further information, please contact:

Caixin Insight Group

Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis

Telephone +86-10-8104-8016

Email zhongzhengsheng@cebm.com.cn

Ma Ling, Director of Communications

Telephone +86-10-8590-5204

Email lingma@caixin.com

IHS Markit

Annabel Fiddes, Economist

Telephone +44-1491-461-010

Email annabel.fiddes@markit.com

Jerrine Chia, Marketing and Communications

Telephone +65 6922-4239

E-mail jerrine.chia@ihsmarkit.com

Bernard Aw, Principal Economist

Telephone +65-6922-4226

E-mail bernard.aw@ihsmarkit.com

Notes to Editors:

The Caixin China General Services PMI™ is based on data compiled from monthly replies to questionnaires sent to purchasing executives in over 400 companies. The panel has been carefully selected to accurately replicate the true structure of the services economy.

Survey responses reflect the change, if any, in the current month compared to the previous month based on data collected mid-month. For each of the indicators the ‘Report’ shows the percentage reporting each response, the net difference between the number of higher/better responses and lower/worse responses, and the ‘diffusion’ index. This index is the sum of the positive responses plus a half of those responding ‘the same’.

Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change. An index reading above 50 indicates an overall increase in that variable, below 50 an overall decrease.

The Purchasing Managers’ Index™ (PMI™) survey methodology has developed an outstanding reputation for providing the most up-to-date possible indication of what is really happening in the private sector economy by tracking variables such as sales, employment, inventories and prices. The indices are widely used by businesses, governments and economic analysts in financial institutions to help better understand business conditions and guide corporate and investment strategy. In particular, central banks in many countries use the data to help make interest rate decisions. PMI surveys are the first indicators of economic conditions published each month and are therefore available well ahead of comparable data produced by government bodies.

Historical data relating to the underlying (unadjusted) numbers and seasonally adjusted series are available to subscribers from Markit. Please contact economics@ihsmarkit.com.

About Caixin:

Caixin Media is China's leading media group dedicated to providing financial and business news through periodicals, online content, mobile applications, conferences, books and TV/video programs.

Caixin Insight Group is a high-end financial data and analysis platform. The group encompasses the monthly Caixin China Purchasing Managers' Index™, components of which include the Caixin China General Manufacturing PMI™ and Caixin China General Services PMI™. These indexes are closely watched worldwide as reliable snapshots of China's economic health.

For more information, please visit www.caixin.com and www.caixinglobal.com.

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2019 IHS Markit Ltd. All rights reserved.

About PMI:

Purchasing Managers’ Index™ (PMI™) surveys are now available for over 30 countries and also for key regions including the eurozone. They are the most closely-watched business surveys in the world, favoured by central banks, financial markets and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends. To learn more go to www.markit.com/product/pmi.

The intellectual property rights to the Caixin China General Manufacturing PMI provided herein are owned by or licensed to IHS Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without IHS Markit’s prior consent. IHS Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers’ Index™ and PMI™ are either registered trade marks of Markit Economics Limited or licensed to Markit Economics Limited. Caixin use the above marks under license. IHS Markit is a registered trade mark of IHS Markit Limited.

If you prefer not to receive news releases from IHS Markit, please joanna.vickers@ihsmarkit.com. To read our privacy policy, click here.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas