Caixin China General Manufacturing PMI (June 2019)

Modest fall in new work drags production into contraction in June

Summary

June data highlighted a challenging month for Chinese manufacturers, with trade tensions reportedly causing renewed declines in total sales, export orders and production. Companies responded by reducing headcounts further and making fewer purchases of raw materials and semi-finished items. At the same time, selling prices were raised following another increase in input costs, though rates of inflation were negligible. Business sentiment was broadly neutral at the end of the second quarter, with firms mainly concerned about the US-China trade dispute.

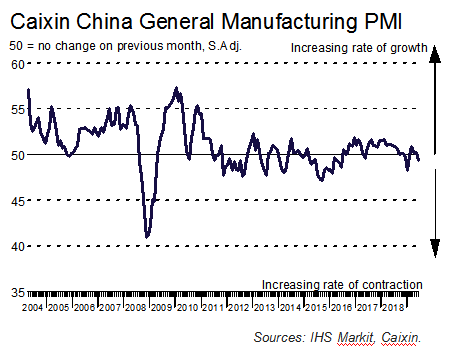

Falling from 50.2 in May to 49.4 in June, the headline seasonally adjusted Purchasing Managers’ Index™ (PMI™) – a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy – was below the critical 50.0 threshold for the first time in four months. The latest figure was, however, indicative of only a marginal deterioration in operating conditions.

Amid reports of trade tensions, total new business and international sales declined at the end of the second quarter. The former contracted for the second time in 2019 so far, albeit moderately. Concurrently, the fall in exports followed from a renewed increase in May.

Goods producers lowered output in June, thereby ending a four-month sequence of expansion. That said, the pace of contraction was only slight. Sub-sector data indicated that consumer goods bucked the trend and was the only category to record production growth in June.

As has been the case since April, Chinese manufacturers shed jobs during June. The pace of contraction was broadly similar to those seen in the remainder of the second quarter. Anecdotal evidence suggested that voluntary leavers had not been replaced.

Ongoing job shedding added pressure on the capacity of manufacturers’ operations, with outstanding business up again in June. The rate of backlog accumulation was slight, however, and broadly similar to those seen earlier in the second quarter.

Amid reports of a lack of new work and lower production needs, quantities of purchases decreased in June. The fall reversed the upturn noted in the prior survey period, but was only slight.

Despite reaching a seven-month high in June, the rate of input cost inflation remained mild in the context of historical survey data. Similarly, there was a slight rise in factory gate charges, following no change in May.

Inventory trends diverged in June, with holdings of inputs rising and that of finished goods decreasing. The fall in the latter was associated with lower production and the delivery of products to clients.

Overall sentiment towards the 12-month outlook for production among Chinese manufacturers was broadly neutral in June. Some companies expected the launch of new products and expansion plans to boost output in the year ahead, while others were concerned about the US-China trade tensions.

Key Points

• Output and new work intakes decline for first time since January

• Renewed reduction in export sales

• Goods producers cutback input purchasing and payroll numbers

Comment

Commenting on the China General Manufacturing PMI™ data, Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said:

“The Caixin China General Manufacturing Purchasing Managers’ Index was 49.4 in June, the second lowest since June 2016, indicating a clear contraction in the manufacturing sector.

1) The subindex for new orders slid into contractionary territory, pointing to notably shrinking domestic demand. The gauge for new export orders returned to contractionary territory, but was better than the levels seen from last April to last December. Front-loading by exporters was likely to support this gauge as the China-U.S. trade relationship was under great uncertainty.

2) The output subindex fell into contractionary territory. The employment subindex remained relatively stable in negative territory, likely due to government policies to stabilize the job market. The State Council set up a leading group on employment in late May.

3) While the subindex for stocks of purchased items remained slightly higher than the 50 mark that divides expansion from contraction, the measure for stocks of finished goods stayed in contractionary territory, indicating that manufacturers were reluctant to replenish them. The subindex of suppliers’ delivery times stayed in contractionary territory, pointing to delayed delivery and also suggesting relatively low inventory levels and willingness to restock.

4) The gauges for input costs and output prices both edged up into expansionary territory. Due to supply-side structural reform, prices of industrial products remained stable.

5) The subindex measuring sentiment toward future output plunged further, albeit staying in expansionary territory, a reflection of continuously weakening business confidence amid the Sino-U.S. trade conflict.

Overall, China’s economy came under further pressure in June. Domestic demand shrank notably, foreign demand was still underpinned by front-loading exports, and business confidence fell sharply. It’s crucial for policymakers to step up countercyclical policies. New types of infrastructure, high-tech manufacturing and consumption are likely to be the main policy focuses.”

|

For further information, please contact:

Caixin Insight Group

Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis

Telephone +86-10-8104-8016

Email zhongzhengsheng@cebm.com.cn

Ma Ling, Director of Communications

Telephone +86-10-8590-5204

Email lingma@caixin.com

IHS Markit

Annabel Fiddes, Principal Economist

Telephone +44-1491-461-010

Email annabel.fiddes@markit.com

Joanna Vickers, Marketing and Communications

Telephone +44 (0) 207-260-2234

E-mail joanna.vickers@ihsmarkit.com

Bernard Aw, Principal Economist

Telephone +65-6922-4226

E-mail bernard.aw@ihsmarkit.com

Notes to Editors:

The Caixin China Report on General Manufacturing is based on data compiled from monthly replies to questionnaires sent to purchasing executives in over 420 manufacturing companies. The panel is stratified by company size and Standard Industrial Classification (SIC) group, based on industry contribution to Chinese GDP. Survey responses reflect the change, if any, in the current month compared to the previous month based on data collected mid-month. For each of the indicators the ‘Report’ shows the percentage reporting each response, the net difference between the number of higher/better responses and lower/worse responses, and the ‘diffusion’ index. This index is the sum of the positive responses plus a half of those responding ‘the same’.

The Purchasing Managers’ Index™ (PMI™) is a composite index based on five of the individual indexes with the following weights: New Orders - 0.3, Output - 0.25, Employment - 0.2, Suppliers’ Delivery Times - 0.15, Stock of Items Purchased - 0.1, with the Delivery Times index inverted so that it moves in a comparable direction.

Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change. An index reading above 50 indicates an overall increase in that variable, below 50 an overall decrease.

Historical data relating to the underlying (unadjusted) numbers and seasonally adjusted series are available to subscribers from Markit. Please contact economics@markit.com.

About Caixin:

Caixin Media is China's leading media group dedicated to providing financial and business news through periodicals, online content, mobile applications, conferences, books and TV/video programs.

Caixin Insight Group is a high-end financial data and analysis platform. The group encompasses the monthly Caixin China Purchasing Managers' Index™, components of which include the Caixin China General Manufacturing PMI™ and Caixin China General Services PMI™. These indexes are closely watched worldwide as reliable snapshots of China's economic health.

For more information, please visit www.caixin.com.

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and expertise to forge solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 key business and government customers, including 85 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

IHS Markit is a registered trademark of IHS Markit Ltd. All other company and product names may be trademarks of their respective owners © 2019 IHS Markit Ltd. All rights reserved.

About PMI:

Purchasing Managers’ Index™ (PMI™) surveys are now available for over 30 countries and also for key regions including the eurozone. They are the most closely-watched business surveys in the world, favoured by central banks, financial markets and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends. To learn more go to www.markit.com/product/pmi.

The intellectual property rights to the Caixin China General Manufacturing PMI provided herein are owned by or licensed to IHS Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without IHS Markit’s prior consent. IHS Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers’ Index™ and PMI™ are either registered trade marks of Markit Economics Limited or licensed to Markit Economics Limited. Caixin use the above marks under license. IHS Markit is a registered trade mark of IHS Markit Limited.

If you prefer not to receive news releases from IHS Markit, please joanna.vickers@ihsmarkit.com. To read our privacy policy, click here.

- 1Luckin-Backer Centurium Capital to Buy Blue Bottle Coffee From Nestlé

- 2Two Sessions: With 4.5%-5% Growth Target, China Aims to Create Space for Reform

- 3China Business Uncovered Podcast: Brazil’s ‘Very Chinese Moment’

- 4Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 5First Tanker Crosses Strait of Hormuz Since Iran’s Closure Threat

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas