Caixin China General Services PMI(June 2019)

Manufacturing slowdown drags business activity growth down to eight-month low

Summary – Services and Composite PMI data

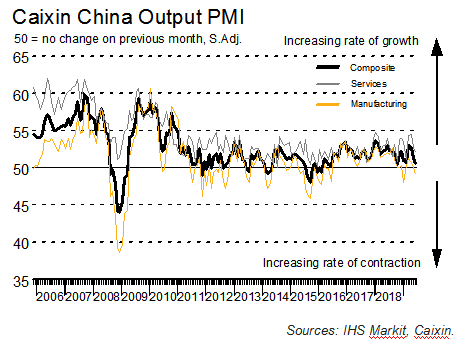

The Caixin China Composite PMI™ data (which covers both manufacturing and services) showed that business activity in China rose only marginally overall. The rate of expansion slowed to the weakest since last October, as signalled by the Composite Output Index edging down from 51.5 in May to 50.6 in June.

The lower headline index reading was driven by falls in the sector headline readings for both services and manufacturing. The seasonally adjusted Chinese Services Business Activity Index fell from 52.7 in May to 52.0 in June, signalling only a modest rate of expansion that was the slowest since February. At the same time, manufacturing output declined for the first time in five months, albeit only marginally.

Total new business at the composite level also rose at a softer pace in June compared to May. Services firms reported a slightly stronger increase in new work, supported by state policies that boosted client spending. There were also mentions of new product launches and a general improvement in market conditions. In stark contrast, factory orders received by Chinese manufacturing firms decreased during the month amid reports of trade tensions.

Disruptions to trade led to a slight reduction in new work from abroad at manufacturers in June. The latest data marked the third drop in external demand at Chinese factories in the year to-date, although the latest fall was only fractional overall. Notably though, a decline was also recorded at service companies for the first time in nine months.

With regards to employment, composite data indicated a second consecutive fall in job numbers across China’s private sector economy. Similar to that seen in May, the rate at which employment decreased was slight, and mainly driven by reduced staffing at manufacturing companies. Services firms meanwhile reported a broadly unchanged level of employment, as greater hiring to meet higher new business was weighed on by the non-replacement of voluntary leavers.

Outstanding business at Chinese private sector firms increased marginally in June. That said, this represented the fastest rise in backlogs since the end of 2018. As service providers continued to reduce the amount of work-in-hand, the rise was centred on goods producers who related this to lower production levels and sustained job shedding.

Price pressures remained historically subdued in June, as the rate of overall input price inflation at Chinese companies was broadly in line with that seen in May. Services firms saw a moderate increase in operating costs, reportedly linked to higher staff expenses and elevated purchasing activity. At the same time, manufacturers reported only a marginal uplift in input prices. However, this still represented the quickest rise in overall costs faced by goods producers since November 2018.

With input price inflation still soft, private sector companies afforded another marginal increase in selling charges. Both services and manufacturing firms recorded a similarly slight uptick, although the overall rise was the strongest for three months. For manufacturers, the mark-up in output prices during June followed an unchanged price level in May.

Lastly, expectations at Chinese firms regarding future activity fell to a record-low for the second consecutive month in June. While service sector companies remained strongly optimistic, the outlook among manufacturers was only marginally positive overall. Some companies expected the launch of new products and expansion plans to boost output in the year ahead, while others were concerned about the China-US trade tensions.

Key points

• Manufacturing output falls, as service sector business activity increases modestly

• New business rises only marginally

• Business confidence weakens to new record low

Comment

Commenting on the China General Services PMI™ data, Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said: “The Caixin China General Services Business Activity Index fell further to 52 in June from the previous month.

Among the gauges included in the survey:

1) The gauge for new business rebounded and was higher than the levels seen for most of last year, likely due to the reacceleration of fiscal policy support. New export business returned to contractionary territory, pointing to subdued foreign demand.

2) The employment measure fell further but remained in positive territory, suggesting that the capacity of the services sector to absorb labor weakened.

3) Gauges for input costs and prices charged by service providers both fell but stayed in expansionary territory, with the former still higher than the latter, showing that services companies remained under significant cost pressure.

4) The measure for business activity expectations rebounded slightly but remained at a relatively low level, reflecting that companies’ confidence in their future prospects remained subdued.

“The Caixin China Composite Output Index fell further to 50.6 in June from the month before, dragged down by both the manufacturing and services sectors.

1) While the gauge for new orders dropped further it stayed in positive territory. The measure for new export business meanwhile returned to contractionary territory. The weakening of foreign demand was obvious.

2) The employment gauge fell further into ontractionary territory, reflecting pressure on the jobs market, which was chiefly due to the reduced capacity of the services sector to absorb labor.

3) While the gauge for input costs inched down, the one for output charges edged up, pointing to easing cost pressure on companies.

4) The measure for future output fell to its lowest level since the survey added this gauge in early 2012, though it stayed in positive territory. This suggests sluggish business confidence.

“Overall, China’s economy came under greater pressure in June. The conflict between China and the U.S. impacted business confidence rather heavily. Although its impact on exports hasn’t been fully reflected in the short-run, the longerterm situation doesn’t look optimistic. Future government policies to stabilize economic growth are likely to focus on new types of infrastructure, consumption and high-quality manufacturing.”

|

| 1 |

For further information, please contact:

Caixin Insight Group

Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis

Telephone +86-10-8104-8016

Email zhongzhengsheng@cebm.com.cn

Ma Ling, Director of Communications

Telephone +86-10-8590-5204

Email lingma@caixin.com

IHS Markit

Annabel Fiddes, Economist

Telephone +44-1491-461-010

Email annabel.fiddes@markit.com

Jerrine Chia, Marketing and Communications

Telephone +65 6922-4239

E-mail jerrine.chia@ihsmarkit.com

Bernard Aw, Principal Economist

Telephone +65-6922-4226

E-mail bernard.aw@ihsmarkit.com

Notes to Editors:

The Caixin China General Services PMI™ is based on data compiled from monthly replies to questionnaires sent to purchasing executives in over 400 companies. The panel has been carefully selected to accurately replicate the true structure of the services economy.

Survey responses reflect the change, if any, in the current month compared to the previous month based on data collected mid-month. For each of the indicators the ‘Report’ shows the percentage reporting each response, the net difference between the number of higher/better responses and lower/worse responses, and the ‘diffusion’ index. This index is the sum of the positive responses plus a half of those responding ‘the same’.

Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change. An index reading above 50 indicates an overall increase in that variable, below 50 an overall decrease.

The Purchasing Managers’ Index™ (PMI™) survey methodology has developed an outstanding reputation for providing the most up-to-date possible indication of what is really happening in the private sector economy by tracking variables such as sales, employment, inventories and prices. The indices are widely used by businesses, governments and economic analysts in financial institutions to help better understand business conditions and guide corporate and investment strategy. In particular, central banks in many countries use the data to help make interest rate decisions. PMI surveys are the first indicators of economic conditions published each month and are therefore available well ahead of comparable data produced by government bodies.

Historical data relating to the underlying (unadjusted) numbers and seasonally adjusted series are available to subscribers from Markit. Please contact economics@ihsmarkit.com.

About Caixin:

Caixin Media is China's leading media group dedicated to providing financial and business news through periodicals, online content, mobile applications, conferences, books and TV/video programs.

Caixin Insight Group is a high-end financial data and analysis platform. The group encompasses the monthly Caixin China Purchasing Managers' Index™, components of which include the Caixin China General Manufacturing PMI™ and Caixin China General Services PMI™. These indexes are closely watched worldwide as reliable snapshots of China's economic health.

For more information, please visit www.caixin.com and www.caixinglobal.com.

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2019 IHS Markit Ltd. All rights reserved.

About PMI:

Purchasing Managers’ Index™ (PMI™) surveys are now available for over 30 countries and also for key regions including the eurozone. They are the most closely-watched business surveys in the world, favoured by central banks, financial markets and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends. To learn more go to www.markit.com/product/pmi.

The intellectual property rights to the Caixin China General Manufacturing PMI provided herein are owned by or licensed to IHS Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without IHS Markit’s prior consent. IHS Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers’ Index™ and PMI™ are either registered trade marks of Markit Economics Limited or licensed to Markit Economics Limited. Caixin use the above marks under license. IHS Markit is a registered trade mark of IHS Markit Limited.

If you prefer not to receive news releases from IHS Markit, please joanna.vickers@ihsmarkit.com. To read our privacy policy, click here.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas