A European business group in China is raising concerns over China’s social credit system as it applies to businesses, namely over its onerous data transfer requirements that the group worries could lead to intellectual property theft.

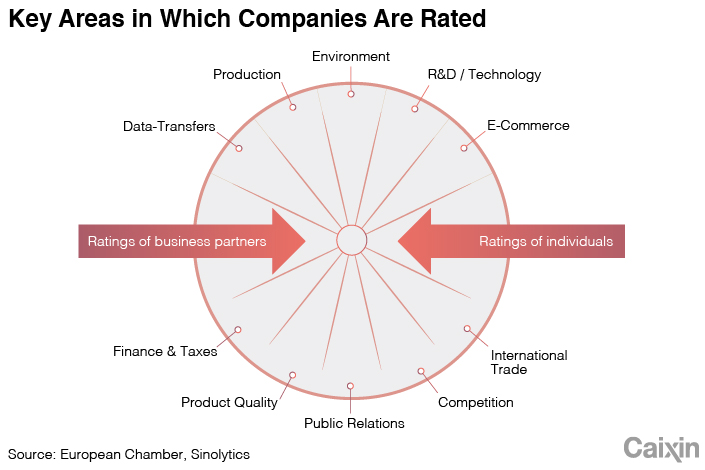

The corporate components of China’s social credit system will monitor a company’s operations in areas including production, environmental impact, finances, product quality, and even ratings of business partners and feedback on e-commerce platforms, according to the European Union Chamber of Commerce in China and Berlin- and Zurich-based consultancy Sinolytics. The organizations announced findings from their joint position paper at a press conference in Beijing last week.

|

Without understanding the new rules, the European chamber worries that noncompliance could lead to actions such as targeted audits, higher inspection rates and restricted approvals for permits, which “could spell life or death” for companies, according to Joerg Wuttke, the organization’s president.

In some cases, such as when registering new products for the Chinese market, an “enormous” amount of information, including technological details, must be submitted, said Björn Conrad, CEO of Sinolytics.

“Those are the areas where the data required is most enormous, and it’s where most of the hidden sensitive data points lie that companies really have to screen very closely,” he said.

“(Those data points) make us reconsider being a market player here,” Wuttke said.

|

At its regular press conference Thursday (link in Chinese), in response to a question on the corporate social credit system, Ministry of Commerce spokesperson Gao Feng said that the government would protect intellectual property and treat everyone equally under the law, though he added he wasn’t clear on the system being mentioned.

Beijing’s drive to build a social credit system dates as far back as 2003. Its scope has since been expanded upon to include creditworthiness in government affairs, finance, commerce, society and the judicial system.

Related: In Depth: Social Credit Scores as an ‘Everything Bucket’

Contact reporter Dave Yin (davidyin@caixin.com @yindavid)