Charts of the Day: Top 500 Private Companies Putting More Into Government Tax Coffers

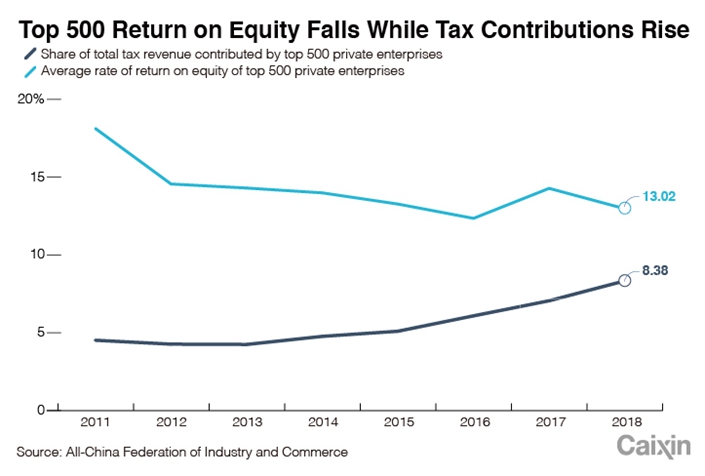

The latest annual survey of China’s top 500 private enterprises shows that their contributions to the government’s fiscal coffers continued to grow faster than their revenue last year, and that their share of the state’s total tax income increased even as their return on equity declined.

The revelations come in a report by the All-China Federation of Industry and Commerce, a body backed by the government that seeks to represent the non-state sector. The report (link in Chinese), which was published late last month, is based on a survey of private businesses with annual turnover of more than 500 million yuan ($70 million), covering a wide range of indicators including revenue, assets, personnel, and views on key social and economic issues.

|

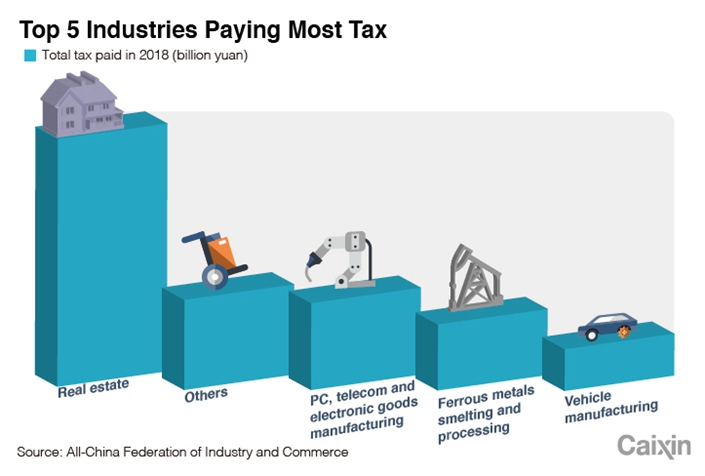

The top 500 private enterprises paid a total of 1.3 trillion yuan in taxes last year, a 27.8% jump over 2017 and accounting for 8.4% of the government’s total tax revenue, up from 7.1% in 2017, the report shows. The real-estate industry contributed the most tax last year, with the 39 property companies included in the Top 500 list of private enterprises paying a total of 371.57 billion yuan.

|

|

Rising labor costs were cited by private companies as their biggest obstacle for the fifth year running, according to the report. The two other top difficulties to doing business were high taxes and expensive borrowing costs, the same problems highlighted in the 2017 report.

|

Huawei Technologies Co. Ltd., the smartphone and telecoms infrastructure group, retained the No.1 spot on the list last year with annual revenue of 721.2 billion yuan, the report showed.

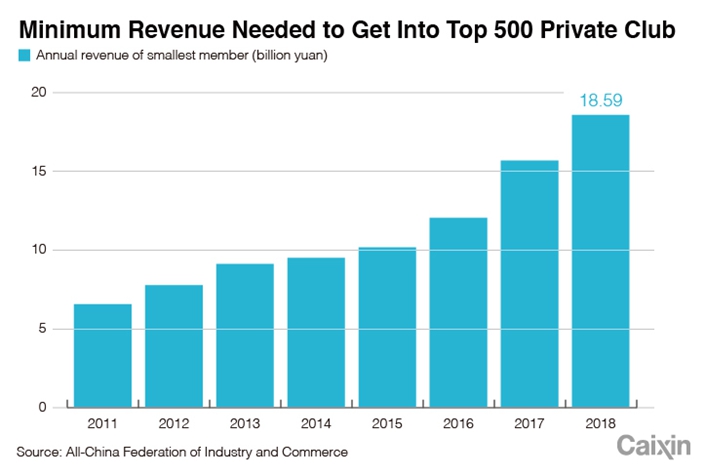

The combined revenue of the top 500 private companies rose at a slower pace last year, increasing 16.44% to 28.5 trillion yuan, down from a 26.43% jump in 2017. The turnover of companies seeking entry into the Top 500 club of private enterprises has grown steadily – in 2018, the revenue of the business at the bottom of the list in was 18.59 billion yuan, more than double the amount needed in 2011.

The list compiled by the federation is not comprehensive because only firms who agree to take part in the survey are included. Six of the 26 mainland China private enterprises listed in the Fortune Global 500 did not take part in the 2018 survey, including Nasdaq-listed e-commerce giant Alibaba Group Holding Ltd., which operates the Tmall internet platform, and Hong Kong-listed Tencent Holdings Ltd., which operates the WeChat social media platform.

The report shows that while the combined after-tax profit of the Top 500 private companies rose by 18% last year to 1.3 trillion yuan, average return on equity rate edged down 1.31 percentage points to 13.02% in 2018.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas