Charts of the Day: Leveraged Funds Flood Into China Stocks

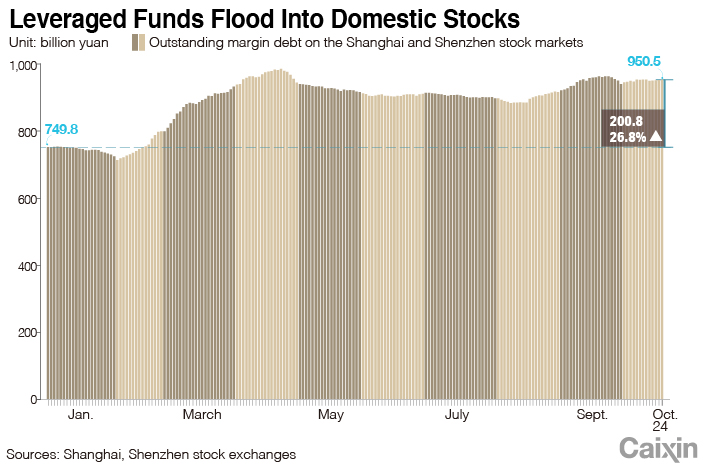

More leveraged funds have been flowing into domestic stocks this year as a growing number of investors have been signing up to bet on the market with borrowed money.

Outstanding margin financing, or the value of shares that investors have bought with borrowed funds, reached 950.5 billion yuan ($134.2 billion) after the markets closed on Thursday, according to data from the Shanghai and Shenzhen stock exchanges. That means a net 200.8 billion yuan of leveraged funds have flowed into the markets so far this year.

|

China rolled out rules nationwide in 2011 for margin financing and securities lending, but tight restrictions have made securities lending — a tool for short selling — much less used. When investors borrow money to buy a stock, it means they believe the stock’s price will rise; when they borrow shares of a stock to sell them, it means the other way around.

The flow of borrowed money into stocks picked up from February to April as the markets were rising on expectations of a trade deal between China and the U.S. at the time. However, the flow has since fluctuated, following the twists and turns in the trade talks.

Since mid-August, the outstanding value of borrowed funds entering the securities markets has been in general on the rise as China’s securities regulator allowed more stocks (link in Chinese) to be traded on margin or to be lent.

Individual investor sign-ups for margin financing and securities lending accounts have continued rising in 2019. The number of accounts reached more than 5 million at the end of September, nearly 26,300 more than a month earlier, according to data from China Securities Depository and Clearing Corp. Ltd. (CSDC), a state-owned agency that provides securities registration and settlement services.

|

It was the first time that the number of such accounts had hit 5 million since the securities regulator allowed CSDC to give each investor an integrated securities account that comprised all of their sub-accounts. That change in June 2015 resulted in a plunge in these accounts.

The benchmark Shanghai Composite Index closed at 2,954.9 on Friday, down 9.7% from the year-to-date high in April, but up 18.5% from the end of last year.

Chen Meng contributed to this report.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- 1Luckin-Backer Centurium Capital to Buy Blue Bottle Coffee From Nestlé

- 2Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 3First Tanker Crosses Strait of Hormuz Since Iran’s Closure Threat

- 4In Depth: China’s Sweeping Banking Law Rewrite Targets Hidden Risks

- 5Two Sessions: With 4.5%-5% Growth Target, China Aims to Create Space for Reform

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas