Chart of the Day: China’s First Euro Bond Sale in 15 Years

In its first euro-denominated sovereign bond sale in 15 years, China has issued 4 billion euros ($4.4 billion) of bonds, as the country moves to diversify away from dollar funding amid the trade war.

The Ministry of Finance announced (link in Chinese) that it issued in France on Monday 2 billion euros of seven-year debt, 1 billion euros of 12-year, and another 1 billion euros of 20-year bonds.

China last issued such bonds in 2004, and this marks the country’s largest single foreign-currency denominated bond sale to date, according to the ministry. The move shows the country values European financial markets, it said.

Demand was strong for the bonds, with the ministry saying that issuance had beat expectations by receiving more than 20 billion euros worth of bids, of which 57% came from Europe.

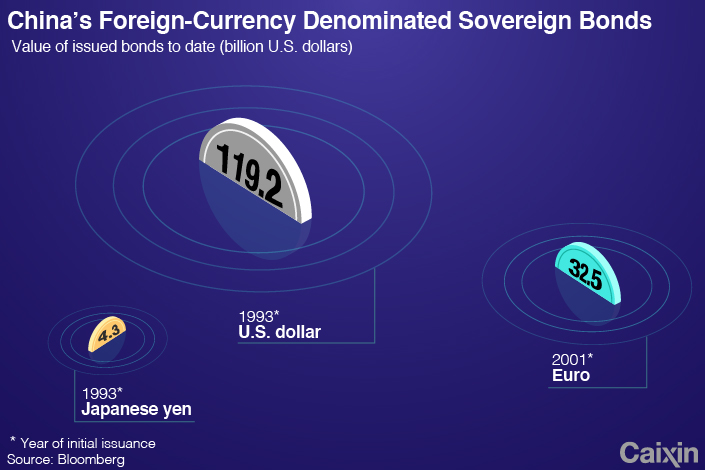

Over the past more than two decades, China has primarily sold sovereign bonds in U.S. dollars to tap the most liquid bond market in the world. In 1993, the central government issued its first dollar-denominated bonds, and to date it has issued $119.2 billion in dollar bonds.

|

By comparison, China has issued a combined $32.5 billion of euro-denominated sovereign bonds since it first started selling them in May 2001, and a total of $4.3 billion worth of yen sovereign bonds since its initial such issuance in 1993.

Contact reporter Tang Ziyi (ziyitang@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas