China’s drive for technology independence evaluated in research released at the 10th Credit Suisse China Investment Conference

Hong Kong, November 6, 2019 – China’s drive for technology independence in key manufacturing areas is evaluated in a new series of Credit Suisse research reports, the first two of which deep dive firstly into the localization of various key technology sub-sectors, and secondly into the prospects for China building its own aircraft engine. Credit Suisse is launching both reports at its three-day China Investment Conference (CIC), which starts today in Shenzhen.

Tech is the largest Chinese import. Localization is a national priority.

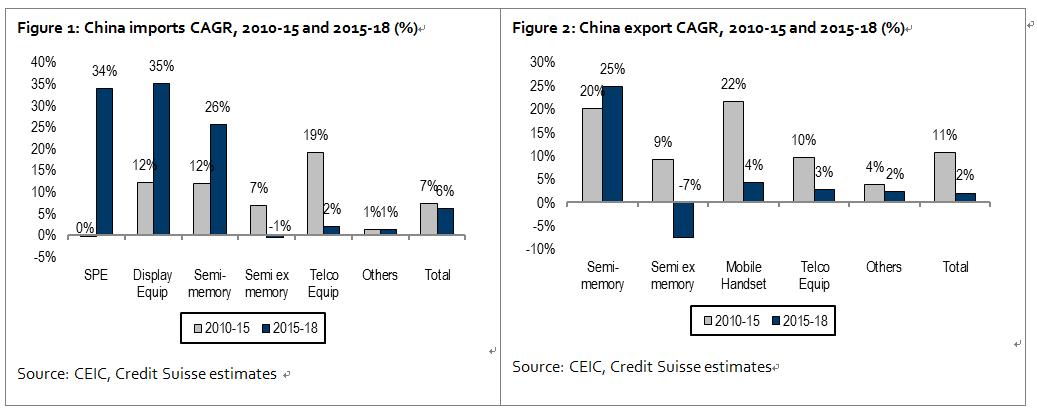

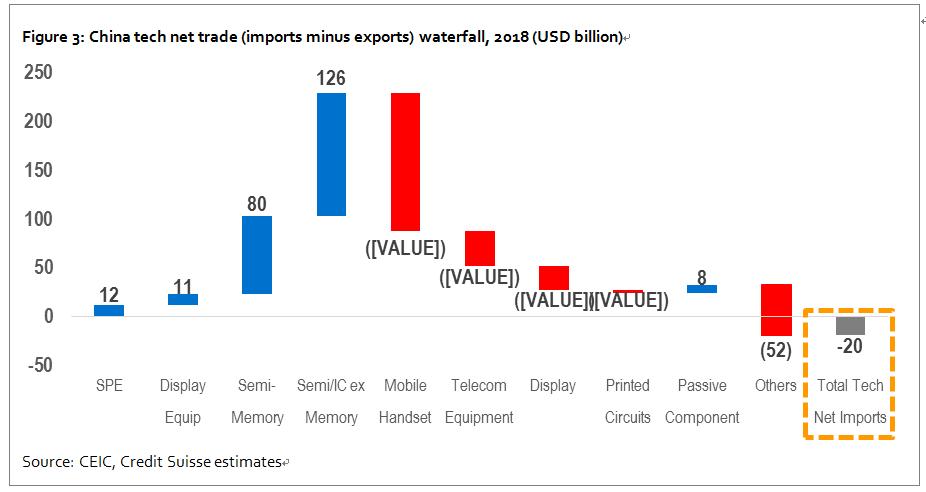

Entitled “China: Can it gain tech independence?,” the first report shows that the technology sector forms 21% of China's import basket, totaling up to USD449 billion in 2018, growing 19% year-on-year (YoY). Tech imports are the largest part of China’s total imports pie.

Within technology, the import of semiconductors by far constitutes the largest proportion (~70%, USD311 billion) of imports, with memory semiconductors totaling up to USD122 billion (~27% of total tech imports) and other semiconductors totaling up to USD189 billion (~42% of total tech imports) in 2018.

This heavy dependence on technology imports has led to several policy initiatives since 2000 from the Chinese government. The initiatives are designed to support the growth of the domestic technology industry for multiple reasons including because China wants to bolster its national security, secure a domestic supply of technology parts, and continue to grow its capabilities and human expertise in higher value add/intellectual property areas.

Geopolitical developments in recent years, particularly the inclusion of several Chinese entities by the US on its restricted Entity List, further adds urgency to this localization drive.

|

Kyna Wong, Head of China Technology Research at Credit Suisse, said: “China has achieved a lot of success in telecom equipment, hardware manufacturing, display and several key components, and has had some success stories in Integrated Circuit (IC) design, mainly in the mobile and consumer sectors. It is devoting significant resources to localizing semiconductor production and design, but so far with only modest success outside Huawei. China is still far from closing the gap on semiconductor manufacturing in advanced technology processes (both memory and logic) and its dependence on imported equipment and certain key materials is likely to remain unchanged over the medium term as well.”

The report’s conclusions for each of these sectors are as follows:

1) Memory semiconductors: China still has some distance to go before tasting any success

2) Logic semiconductors: China has pockets of strength in IC design, backend and mature foundry nodes, but still lags in several areas

3) Semi equipment and wafers: China is lagging in wafers, is far behind in equipment and is likely to remain so

4) Enterprise and servers: Chinese vendors are strong in networking; server expansion internationally may face challenges

5) Display: China will likely dominate TFT panels; it may succeed in OLED but it still lag in key tools and raw materials; Korea will largely leave the TFT space

6) Components: China is largely self-reliant and is expected to gain share in key areas

|

Entitled “China Reinvented series: Learning to fly,” the second report studies the prospects for China building its own aircraft engine, one of China’s six major science and technology projects, which it aims to complete by 2030.

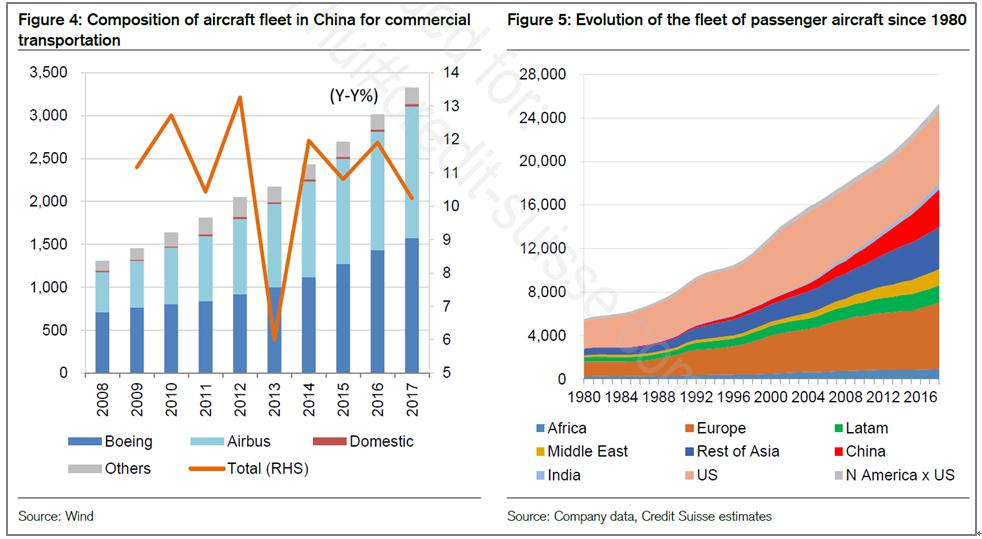

Thanks to China’s robust economic growth, the demand for air transportation has grown tremendously over the past 20-30 years, and China has been the biggest customer of Boeing and Airbus for a long time now. Credit Suisse estimates that China will purchase approximately 900 aircraft and import some 1,800 aero-engines in 2019-21, compared to China’s total aircraft fleet of 3,639 commercial aircraft.

China aims to start indigenous aircraft production in order to, at least partially, satisfy its strong domestic demand.

As the report explains, the development of strategic industries can bring long-term benefits to China’s economy by improving its overall science and technology knowhow, while enabling innovations and improvements in all areas.

Robust management framework and government resources are key

The key to China’s aircraft engine development is ensuring that the management framework is set up properly and that the government commits long-term resources to the project, according to Dr. Jingang Ni, President and Chief Designer, Sino-engine Technologies, who was consulted as part of the report.

Dr. Ni believes that even with a properly set up management framework and sufficient government resources firmly in place, it could still be ten years before China delivers its own civilian aircraft engine, given high entry barriers.

A new force in China’s aeroengine development

In the past few years, according to Dr. Ni, traditional State Owned Enterprise (SOE) aircraft component manufacturers were required to focus on the main project and thus stopped serving as Original Equipment Manufacturers (OEMs) for foreign aircraft manufacturers. As a result, a number of private companies stepped in to fill the breach. Some of these companies have grown fast and won international recognition. These could become a new force in China’s aeroengine development, he believes.

In modern manufacturing, it is impractical to be self-sufficient

The report notes that policy makers have to ensure that the drive towards technology independence does not hinder the country’s cooperation with the external world and integration in the global production chain.

It is also important to have a research grant allocation mechanism to help balance the short-term need for results and the long-term need for establishing a basic foundation for research, the report adds.

|

Follow us on our social media channels for the latest news from Credit Suisse Asia Pacific:

LinkedIn https://www.linkedin.com/company/credit-suisse/

Facebook https://www.facebook.com/creditsuisse/

Twitter @csapac

WeChat: 瑞信CreditSuisse

About Credit Suisse

Credit Suisse is one of the world's leading financial services providers and is part of the Credit Suisse group of companies (referred to here as 'Credit Suisse'). Our strategy builds on Credit Suisse's core strengths: its position as a leading wealth manager, its specialist investment banking capabilities and its strong presence in our home market of Switzerland. We seek to follow a balanced approach to wealth management, aiming to capitalize on both the large pool of wealth within mature markets as well as the significant growth in wealth in Asia Pacific and other emerging markets, while also serving key developed markets with an emphasis on Switzerland. Credit Suisse employs approximately 46,360 people. The registered shares (CSGN) of Credit Suisse AG's parent company, Credit Suisse Group AG, are listed in Switzerland and, in the form of American Depositary Shares (CS), in New York. Further information about Credit Suisse can be found at www.credit-suisse.com.

Copyright © 2019 Credit Suisse Group AG and/or its affiliates. All rights reserved.

Disclaimer:

Sponsored content: The views expressed in the post are those of the author.