The research report Tax Cuts and Fee Reductions and Enterprise Development was jointly issued by China Everbright Bank and Beijing National Accounting Institute

At the end of the 2019, it's time to ring out the old year and ring in the New Year. 2019 is the year of transition between the old era and the new one. Facing the increasing downward pressure, China’s economy has entered a “new normal”, transforming from high-speed growth to high-quality development.

“芳林新叶催陈叶,流水前波让后波。”又到年终盘点及新年展望时。2019年,作为中国经济新旧年代的转换之年,面对加大的经济下行压力,中国经济正在从“高增速”向“高增质”转换。

In order to cope with the downward pressure on the economy, the government of China has shown far more determination and boldness than ever before, stimulating the vitality of market entities, supporting high-quality development and upgrading the industrial structure. One of the most significant measures is to promote a series of tax cuts and fee reductions measures, including deepening the value-added tax(VAT) reform, the inclusive tax cut for small and micro businesses, and reforms of social insurance contribution and non-tax income.

为应对经济下行的压力,这次中央政府表现出远超以往的定力和魄力激发市场主体活力,支持高质量发展和结构升级。其中最显著的举措之一就是推动深化增值税改革、小微企业普惠性减税、社保费及非税收入改革等一系列减税降费措施。

The 10th Caixin Summit was held at the Diaoyutai State Guesthouse on November 8, 2019. A research report, entitled Tax Cuts and Fee Reductions and Enterprise Development, was jointly issued by China Everbright Bank(CEB) and the Fiscal & Tax Policy and Application Research Institute of Beijing National Accounting Institute(BNAI).

2019年11月8日,在钓鱼台国宾馆举办的第十届财新峰会上,中国光大银行与北京国家会计学院财税政策与应用研究所联合发布了《减税降费与企业发展》研究报告。

Based on tax cuts and fee reductions over the past year in China, the report offers in-depth theoretical analysis, makes questionnaire surveys and empirical research, and finally provides some constructive policy suggestions. As the report points out, a series of tax cuts and fee reductions measures has been implemented since the 18th National Congress of the Communist Party of China, which plays a positive role in reducing the tax burden of market entities and promoting economic structure optimization.

针对一年来减税降费措施,该报告作了深入的理论阐述、问卷调研和实证分析,并给出了建设性的政策意见。报告指出:党的十八大以来,我国积极推动深化增值税改革、小微企业普惠性减税、社保费及非税收入改革等一系列减税降费措施,在降低市场主体税费负担、促进经济结构优化等方面发挥了积极作用。

With the complicated domestic and international situation and the deepening of economic reform, tax cuts and fee reductions hit the pain points and difficulties of market entities directly, which will continue to be the inevitable policy choice for our country to boost the economy.

在目前国内外经济形势仍较为复杂、本轮经济改革持续深化的背景下,减税降费直击市场主体的痛点和难点,将继续成为我国提振经济的必然政策选择。

After an overview of the background and significance, the report comprehensively presents several major characteristics of the current round of tax cuts and fee reductions, from which we can see the original intentions of the policy measures.

报告在全面总结减税降费的背景、意义之后,全面梳理了本轮减税降费政策的几大特点,从中可以一窥政策举措的初衷。

First of all, tax cuts and fee reductions provide wide coverage. A inclusive tax cut is the major policy orientation of the current round of tax cuts, which provide indeed policy bonuses to most of the social subjects.

首先,减税降费政策受惠面广。普惠性减税是本轮减税政策的重要政策取向,真正让最广大的社会主体享受到了政策红利。

The VAT is the largest tax in China. The tax cuts of VAT this time have a far-reaching influence not only due to the intensity of the reform but also the scale of tax cuts. Specific policies include reducing the tax rate from 16% to 13% for the manufacturing sector , and the rate from 10% to 9% for transportation and construction sectors. Moreover, the policies of additional deduction of input VAT and tax refund of increased excess VAT paid are pioneering institutional innovations.

我国第一大税种就是增值税,此次增值税的减税无论是改革的力度及减税的规模上都是影响深远,包括将制造业等行业16%的增值税税率降至13%、交通运输和建筑等行业10%的增值税税率降至9%,并且进项加计抵扣以及增量进项留抵额的退税制度均为开创性的制度创新,覆盖面广。

Small and micro businesses account for a large proportion of the whole market in China, which has always been a focus group of tax cuts and fee reductions. By expanding the coverage of tax relief, introducing excess progressive rate of corporate income tax(CIT), and strengthening the tax incentives of VAT, the tax burden of small and micro businesses was effectively reduced and the overall economic development was prompted.

小微企业在我国市场主体中的数量占比较大,一直以来都是减税降费政策的重要目标。这轮减税降费通过扩大小微企业享受普惠性减税的适用范围、引入企业所得税超额累进计算方法、加大增值税优惠力度等方式,切实帮助小微企业切实减轻税负,促进了整体经济发展的动力。

Deepening the VAT reform support the development and growth of the real economy. Reducing the social security contribution rate alleviates the burden of businesses. Simultaneously, the inclusive tax cut is also reflected in the coverage of taxpayers. Through the reform of individual income tax, the disposable income increased, which can boost domestic demand and consumption.

深化增值税改革,为实体经济带来真金白银的利好;降低社保费率,减轻企业负担。同时,普惠式减税还体现在减税的纳税人范围上——通过推进个税改革,百姓得到实惠,有效带动国内消费增长。

"Through the reform of individual income tax, the purchasing power of consumers has been improved significantly, which helps consumption to play a basic role in economic development and provides strong support for the smooth running of economy." Professor Li Xuhong, director of Fiscal & Tax Policy and Application Research Institute of BNAI, said in an interview.

“通过个税改革,有效提升了消费者的购买能力,这有利于发挥消费对经济发展的基础作用,为经济平稳运行提供有力支撑。”北京国家会计学院财税政策与应用研究所所长李旭红教授此前接受媒体采访时如此表示。

|

The latest figures released by the State Administration Taxation confirmed the results of the measures above. In the first three quarters of 2019, the total amount of new tax cuts and fee reductions exceeded 1.78 trillion yuan, including over 1.5 trillion yuan in tax cuts and 272.5 billion yuan in social security fee reductions. In terms of tax categories, 703.5 billion yuan were made in the VAT reform, while 442.6 billion yuan was from the two-step reform of individual income tax in total, with 1,764 yuan per person on average.

国家税务总局发布的最新数据应证了上述举措的成果:今年前三季度全国累计新增减税降费超过1.78万亿元,其中新增减税超过1.5万亿元,新增社保费降费2725亿元。分税种看,增值税改革新增减税7035亿元。个税两步改革叠加新增减税4426亿元,累计人均减税1764元。

The report pointed out that in addition to the “inclusive tax cut”, there is also the "targeted tax cut", aimed at strengthening the orientation of tax cuts and fee reductions in structural adjustment, focusing on the real economy dominated by manufacturing, and giving appropriate preference to advanced manufacturing and modern services. In the process of deepening the VAT reform , the original 17 percent tax rate was reduced to 16 percent and then to 13 percent. The 11 percent rate was lowered to 10 percent and then to 9 percent.

报告指出,在“普惠降减”之外,这轮减税降费还有“定向降减”——旨在强化减税降费结构性调整导向,重点聚焦在以制造业为主的实体经济,并对先进制造业、现代服务业适当倾斜。在深化增值税改革的过程中,原适用17%税率的,降至16%再降至13%;原适用11%税率的,降至10%再降至9%。

In addition, in order to encourage enterprises to increase investment in R & D, China has repeatedly adjusted the pre-tax additional deduction of R & D expenses and optimized other policies to encourage innovation in recent years. The policy, which increased the deductible proportion for R & D expenses to 75%, was extended to all businesses last year. According to the final settlement data of CIT in May this year, the tax cut only from this policy achieved 87.8 billion yuan.

另外,为鼓励企业加大研发投入,近年来,我国多次优化调整研发费用加计扣除等鼓励创新政策,并于去年将研发费用加计扣除比例提高到75%的政策享受主体扩大至所有企业,根据今年5月企业所得税年度汇算清缴数据,仅此一项政策即新增减税878亿元。

Moreover, the report also analyzes the characteristics of strengthening countercyclical adjustment of tax cuts and fee reductions from the perspective of economics and public finance. When the downward pressure of economic growth increases, the government should adopt active fiscal policies, expand fiscal expenditure and implement the tax cut policies appropriately, so as to improve the quantity and quality of capital and labor investment in the whole society, and finally achieve the steady economic development.

另外,报告还从经济学和财政学角度分析了减税降费的强化逆周期调节特点,在经济增速下行压力加大时,政府应当采取积极的财政政策,适度扩大财政支出并实施减税政策,从而在全社会提高资本和劳动力投入的数量和质量,最终实现经济的稳步发展。

Beside the analysis of the tax cuts and fee reductions measures, the report comprehensively compares the policies of developed countries such as the United States and the United Kingdom and developing countries such as India and the Philippines, and summarizes the trends and characteristics of international tax reforms. In particular, the research report sent questionnaires to managers of finance and tax departments of 524 sample enterprises with the help of China Everbright Bank to understand the their managing situations and the impact of tax cuts and fee reductions on enterprises.

除了对此次减税降费举措的总结分析之外,报告全面对比美国、英国等发达国家以及印度、菲律宾等发展中国家的减税降费政策,总结国际税改趋势与特点。尤其,此次调研报告通过面向光大银行的524家样本企业中的财务、税务等部门管理人员发放调查问卷了解减税降费实施对企业的影响以及企业经营相关情况。

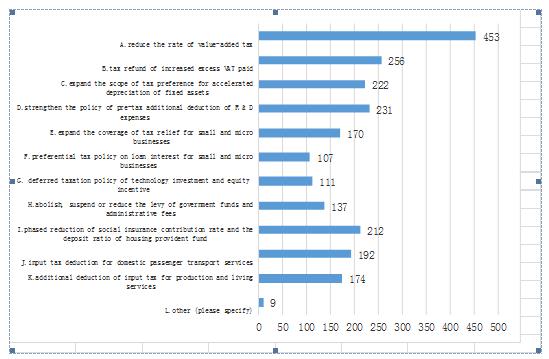

The results of the questionnaire survey on enterprises confirm the conclusions above as well. According to the survey, 86.45 percent of the sample enterprises focus on the reduction of VAT rate, much more than any other policies listed. Some enterprises also pay attention to other policies, such as tax refund of increased excess VAT paid(48.85%), pre-tax additional deduction of R & D expenses(44.08%), accelerated depreciation of fixed assets(42.37%), reducing the social insurance contribution rate and the deposit ratio of housing provident fund(40.46%).

报告的一线企业调研也进一步证实了上述结论。报告调研显示,超过 80%的被调查企业代表表示主要关注增值税税率的降低,占比为 86.45%,远高于其他项目。增值税期末留抵退税、加大研发费用税前加计扣除政策力度、扩大固定资产加速折旧税收优惠范围、阶段性降低社会保险费率和住房公积金缴存比例的关注度次之,占比分别为48.85%、44.08%、42.37%、40.46%。

|

Mainly Concerned Tax Cuts and Fee Reductions Politics |

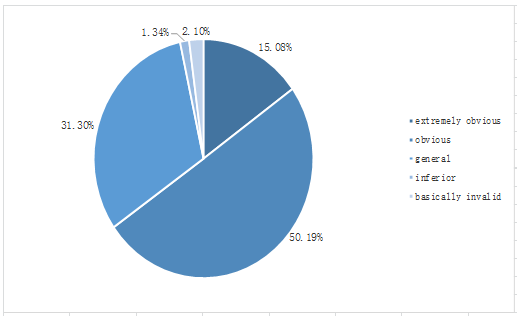

When asked about the implementation effects of tax cuts and fee reductions measures, only 3.44% of them think that the effect was poor or basically ineffective, indicating that the tax cuts and fee reductions policies work well, and the enterprises share a great sense of gain from the policies.

当被问及所在企业减税降费政策总体执行效果时,仅有3.44%的被调查者认为减税降费政策执行效果较差或基本没效果,表明减税降费政策总体执行效果良好,企业“获得感”较强。

|

Implementation Effects of Tax Cuts and Fee Reductions Policies |

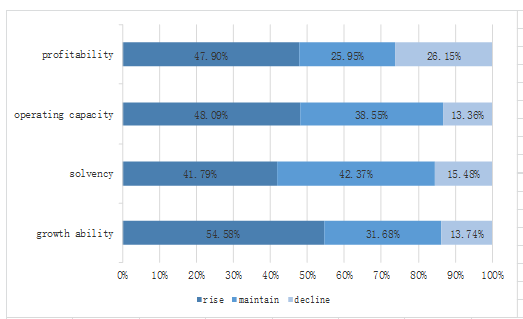

As for the change of their capabilities in several aspects in 2019 compared with last year under the influence of the tax cuts and fee reductions, more than half of them indicated that their growth capabilities have increased. In the meantime, a large proportion of surveyed enterprises get promotion in their debt paying capacity (41.79%), operation capacity(48.09%) and profitability(47.90%).

当被问及所在企业 2019 年各方面能力与去年同期相比的变化趋势时,超过五成的被调查者表示所在企业成长能力上升;同时,分别有 41.79%、48.09%以及 47.90%的被调查者认为企业偿债能力、营运能力及盈利能力上升。

|

Comparison of Various Capabilities of Enterprises in 2019 and 2018 |

The survey shows that the tax cuts and fee reductions can stimulate the vitality of the enterprises and improve their capacities, helping them raise the operating efficiency, improve the business conditions, and reduce the operating risks, so as to create economic and social values better. In general, most enterprises believe that the tax cuts and fee reductions reduce their tax burden effectively, and stimulate the development of the enterprises' capacities.

报告进一步发现,通过减税降费能够激发企业活力,提升企业的盈利能力、营运能力、偿债能力、成长能力,从而帮助企业提高经营效率、改善经营状况、降低经营风险,更好地创造经济价值和社会价值。总体而言,大部分企业认为减税降费政策明显,有效降低了企业的税费负担,促进了企业成长能力等各项能力的发展。

Base on the theoretical analysis, questionnaire survey and empirical research, the report puts forward several policy suggestions to the construction of China's taxation system from the perspectives of the legalization, marketization and internationalization, trying to provide some references to relevant researchs.

在综合了理论阐释、问卷调查、实证研究等方法之外,报告从税制法制化、市场化、国际化三个角度提出我国未来税制建设的政策建议,为相关政策研究提供参考。

The host of the report, Professor Li, pointed out that the design of tax system should consistently insist on the principle of efficiency and fairness. As the direct tax have a significant effect on the redistribution of income, it still needs to be emphasized in the future tax reforms. For now, it is obliged to carry out the tax cuts and fee reduction policies to adapt with the recent domestic and overseas economic situation. However, tax neutrality is another target that China needs to achieve in consideration of a long-term implication. Equity on both taxation and society can be gradually realized with the help of statutory taxation, meanwhile the market should be given a full play in allocating resource. Moreover, all of us need to keep the international tax reduction trend in perspective, enacting more effective tax rules within the framework of inclusive growth to globally rationalize the tax revenue distribution and get rid of harmful international competition.

报告主持人北京国家会计学院财税政策与应用研究所所长李旭红教授指出,税制设计应坚持效率与公平相结合的原则,直接税对于收入再分配具有重要的调节作用,未来税制改革仍需在收入分配方面强化直接税的调节作用。目前的减税降费政策是适应近期国际国内经济形势的必要措施,但在长效机制下,为适应未来发展,还需关注税收的中性问题,通过落实税收法定来实现纳税公平与社会公平,进一步发挥市场在资源配置中的作用。同时,还应该正确看待国际减税趋势,在包容性增长框架下,通过制定更为有效的国际税收规则,实现全球税收收入的合理分配,避免有害的国际税收竞争关系。

|

It is worth mentioning that it’s not the first chance for CEB and BNAI to have a collaboration work. As early as 2013, CEB cooperated with the Fiscal & Tax Policy and Application Research Institute of BNAI in the field of taxation services, which became one of the brand features with great reputation among banking industry provide by CEB Private Bank. During their symbiosis, they made great breakthrough and innovation in the taxation research field. A series of reports have been accomplished, such as Middle and Small-Sized Enterprises Tax Development Report, which supports the fiscal and taxation policies research of middle and small-sized enterprises; Environment, Taxation and Enterprise Development Report, which focus on sustainable development; International Taxation Report of High Net Worth Individual Clients Under CSR, which provides a guidance on making rational arrangements of global assets for High Net Worth Individuals; and Individual-Innovation-Drive Taxation Research Report, which optimizes the arrangements of individual-innovation-drive income and assets of High Net Worth Individuals. With the help of the research achievements, they provide interpretation and guidance on taxation issues most concerned by entrepreneurs, offer academic foundation to help high net worth clients make rational tax planning, and make good efforts on the improvement of China’s tax system.

值得一提的是,这次的《减税降费与企业发展》研究报告并不是中国光大银行与北京国家会计学院的首次合作。早在2013年,中国光大银行便携手北京国家会计学院财税政策与应用研究所在税务服务方面开展合作,目前已成为中国光大银行私人银行的品牌特色,在业内受到广泛关注。双方在税务研究领域突破创新,先后撰写、发布了支持中小企业财税政策研究的《中小企业税收发展报告》、关注可持续发展的《环境、税收与企业发展》报告,引导高净值客户全球资产进行合理安排的《CRS背景下高净值人士国际税收报告》以及引导高净值人士优化个人创新相关所得和资产的税收安排的《个人创新驱动税收研究报告》等,并借助财税论坛发布研究成果,为企业家关注的税务问题答疑解惑、指明方向,为高净值客户进行合理税收筹划提供依据,更为完善我国税收体制建言献策。

During 2019, tax cuts and fee reductions catch most people’s eyes in the taxation field, and it is an indispensable measure that makes great contribution in easing the burden on the market entities and activating their vitality. Small and micro businesses are benefitting from the implement of a series of incentive policies, and now the positive effect is getting stronger with the act of the new-round tax cuts and fee reductions. Based on all the efforts and books of reports, CEB united with BANI again, finished the report, Tax Cuts and Fee Reductions and Enterprise Development, after a comprehensively research of all private enterprise clients of CEB Private Bank. The report aims at helping private enterprises catch opportunities timely, grasp the key points of new policies and obtain benefits from the effective planning of taxation services provided by CEB Private Bank.

2019年,降税减费是当前税务领域备受关注的话题,也是我国减轻市场主体负担、激活市场活力的重要举措。今年一系列政策“红包”落地,使得小微企业享受了政策红利,目前,新一轮减税降费的积极效应正加速显现。基于以上背景,中国光大银行再次联合北京国家会计学院财税政策与应用研究所,结合目前国内及中国光大银行私行客户中民营企业主的现状,撰写了这份《减税降费与企业发展》财税报告,旨在帮助民营企业家及时把握住机遇,掌握政策要点,切实从税务服务帮助私行客户有效规划获得减税红利。

|

||

|

Disclaimer:

Sponsored content: The views expressed in the post are those of the author.