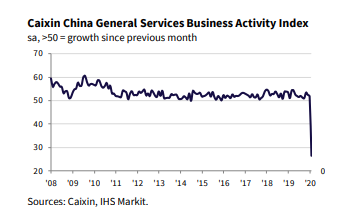

Caixin China General Services PMI (February 2020)

Coronavirus outbreak leads to record drop in business activity

Key findings

Sharp decline in activity due to travel restrictions and company closures

Record falls in total new work and export sales

Outstanding work rises substantially

February PMI data signalled the first reduction in business activity across China's service sector on record due to restrictions implemented to contain the recent coronavirus outbreak. Firms across all sectors reported on the damaging effect that the virus was having on the economy via company closures and travel restrictions, with total new orders also falling at a record pace. Restrictions around travel also impacted firms' ability to source workers, leading a renewed fall in staff numbers. Consequently, backlogs of work rose at a substantial pace.

At the same time, business confidence slipped to a survey low in February. A number of panel members were more cautious with their forecasts due to a greater degree of market uncertainty arising from the coronavirus outbreak.

Adjusted for seasonal factors, including Chinese New Year, the headline Business Activity Index fell over 25 index points from 51.8 in January to 26.5 in February. This marked a sharp decline in business activity that was also the first recorded since the survey began over 14 years ago. The vast majority of panel members identified the outbreak of the coronavirus as the key driver of reduced activity, with firms facing extended company closures after the Chinese New Year and strict travel restrictions.

Consequently, total new business also fell substantially during February, with the pace of decline the fastest in the series history. Demand softened both at home and abroad, with new export work falling markedly amid reports of client cancellations and limited travel.

The coronavirus outbreak also impacted labour supply in February, as travel restrictions resulted in many firms being unable to fill roles. Although falling only modestly, the rate at

which employment fell was the most severe since the survey began in late 2005.

|

A fall in the availability of workers and company closures led to a solid and accelerated increase in backlogs of work.

Reduced operational requirements and weaker demand for inputs underpinned a marked fall in operating expenses that was the quickest registered since data collection started over 14 years ago.

Average selling prices were meanwhile cut for the third month running, and at a faster rate. Though modest, the pace of discounting was in fact the steepest on record, with a number of firms lowering their charges as part of efforts to secure new orders.

Uncertainty relating to the coronavirus outbreak weighed on business confidence in February. Notably, the degree of optimism was only modest, having slipped to a survey low.

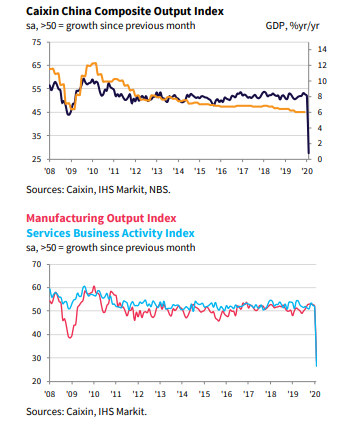

Caixin China Composite PMI™

Chinese output falls at record pace as companies shutdown in face of coronavirus outbreak

Composite indices are weighted averages of comparable manufacturing and services indices. Weights reflect the relative size of the manufacturing and service sectors according to official GDP data. The China Composite Output Index is a weighted average of the Manufacturing Output Index and the Services Business Activity Index.

The Composite Output Index signalled the sharpest decline in total Chinese business activity on record in February, as company closures and travel restrictions were put in place due to the coronavirus outbreak.

Composite new orders and employment also fell at the quickest rates in the series history. A lack of available workers and reduced capacity meanwhile led to a sharp increase in the amount of backlogged work across Chinese firms.

Prices data highlighted divergent trends, with costs rising modestly at goods producers but falling substantially at services firms.

Business confidence regarding the year ahead rose to a five-year high at manufacturers due to hopes that market conditions will recover. However, services firms were the least confident since the series began in late 2005.

|

Comment

Commenting on the China General Services and Composite PMI data, Dr. Zhengsheng Zhong, Chairman and Chief Economist at CEBM Group said:

"The Caixin China General Services Business Activity Index fell to 26.5 in February, about half the reading of the previous month, marking its first drop into contractionary territory since the survey launched in November 2005. Stagnating consumption amid the coronavirus epidemic has had a great impact on the service sector.

1) Demand for services shrank sharply. Both the gauges for total new business and new export business dropped to their lowest levels on record.

2) It was difficult for service providers to recruit workers, and backlogs of work climbed. The drop in the employment gauge was relatively small, but its February reading marked the lowest point on record. The measure for outstanding orders surged to a record high. Supply capacity across the service sector was insufficient amid restrictions on the movement of people.

3) The measure for input costs dropped at a steeper rate than that for prices companies charged customers, because of a sharp decline in supply capacity.

4) Business confidence also fell to a record low. Although policies have been introduced to provide tax and financing support for industries and small businesses heavily impacted by the epidemic, service companies were still concerned about uncertainties resulting from the epidemic.

“The Caixin China Composite Output Index dropped to 27.5 in February from 51.9 in the previous month. While the gauges for new orders, new export orders and employment all weakened to their lowest levels on record, the gauge for backlogs of work rose to a record high. The decline in input costs was greater than that in output prices because upstream industries’ supply capacity was less affected.

“The coronavirus epidemic has obviously impacted China’s economy. It is necessary to pay attention to the divergence of business sentiment between the manufacturing and the service sectors. While recent supportive policies for manufacturing, small businesses and industries heavily affected by the epidemic have had a more obvious effect on the manufacturing sector, it is more difficult for service companies to make up their cash flow losses."

Contact

Dr. Zhengsheng Zhong

Chairman and Chief Economist

CEBM Group

T: +86-10-8104-8016

zhongzhengsheng@cebm.com.cn

Ma Ling

Senior Director

Brand and Communications

Caixin Insight Group

T: +86-10-8590-5204

lingma@caixin.com

Annabel Fiddes

Principal Economist

IHS Markit

T: +44 1491 461 010

annabel.fiddes@ihsmarkit.com

Bernard Aw

Principal Economist

IHS Markit

T: +65 6922 4226

bernard.aw@ihsmarkit.com

Katherine Smith

Public Relations

IHS Markit

T: +1-781-301-9311

katherine.smith@ihsmarkit.com

About Caixin

Caixin is an all-in-one media group dedicated to providing financial and business news, data and information. Its multiple platforms cover quality news in both Chinese and English.

Caixin Insight Group is a high-end financial research, data and service platform. It aims to be the builder of China’s financial infrastructure in the new economic era

For more information, please visit www.caixin.com and www.caixinglobal.com.

About IHS Markit

IHS Markit (NYSE: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers nextgeneration information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

IHS Markit is a registered trademark of IHS Markit Ltd. and/ or its affiliates. All other company and product names may be trademarks of their respective owners © 2020 IHS Markit Ltd. All rights reserved.

About PMI

Purchasing Managers’ Index™ (PMI™) surveys are now available for over 40 countries and also for key regions including the eurozone. They are the most closely watched business surveys in the world, favoured by central banks, financial markets and

business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends. To learn more go to ihsmarkit.com/products/pmi.html.

If you prefer not to receive news releases from IHS Markit, please email katherine.smith@ihsmarkit.com. To read our privacy policy, click here.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to IHS Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without IHS Markit’s prior consent. IHS Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers’ Index™ and PMI™ are either registered trade marks of Markit Economics Limited or licensed to Markit Economics Limited. IHS Markit is a registered trademark of IHS Markit Ltd. and/ or its affiliates.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas