Electric Vehicle Upstart Faces Dwindling Cash

Nio Inc., the electric car maker once called the Tesla of China, said its future could be in jeopardy, as it reported its latest quarterly results that showed a narrowing but still sizable loss while it rapidly burns through cash.

Further dampening its outlook, Nio forecast its sales would drop sharply in the current quarter from the final three months of last year, in step with plummeting sales for China’s broader auto market as consumers put spending on hold and stay home over fears of catching Covid-19. The gloomy outlook sparked a sell-off of Nio shares, which tumbled 16% in Wednesday trading in New York, wiping out about $400 million in market value.

In its latest quarterly report, management drew attention to Nio’s “continuous losses, net cash outflows, negative working capital, negative equity and uncertainties on consummation of the financing projects” it would need to keep funding its business. “As a result of the relevant conditions and events … there is substantial doubt about the company’s ability to continue as a going concern,” it said.

|

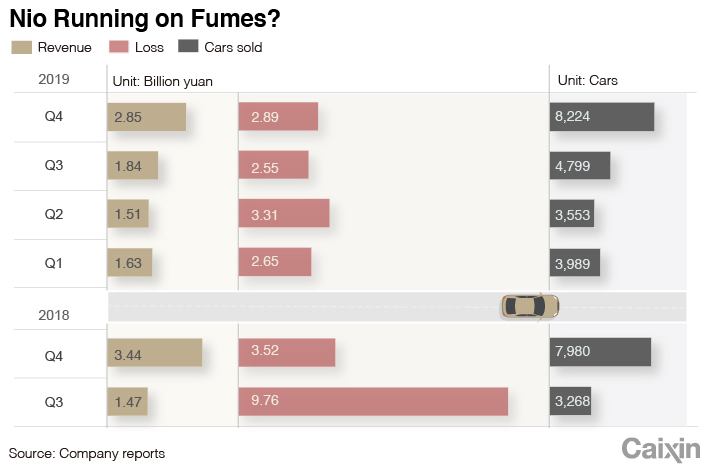

Nio’s sales trended generally upward last year as the company began to gain traction after the company delivered its first electric cars in the second quarter of 2018. But it forecast its deliveries would fall sharply in this year’s first quarter to between 3,400 and 3,600 cars, less than half the all-time high of 8,224 in the last three months of 2018. It also predicted first-quarter revenue would drop a similar 56% from fourth-quarter levels.

“Given the Covid-19 outbreak in China since the end of January 2020, the China auto industry in general and the production and delivery of vehicles of the company have taken a hit for the first quarter of 2020,” it said in the statement.

Nio gave the outlook as it reported revenue of 2.8 billion yuan ($397 million) in last year’s fourth quarter, down 17% from a year earlier. Its quarterly net loss narrowed 18% from a year earlier to 2.86 billion yuan.

The company has been in constant fundraising mode since netting $1 billion through its New York IPO in September 2018. Its shares have moved largely downward since then, and now trade at less than half their offering price due to the company’s cloudy future. Even before the Covid-19 outbreak, China’s new energy car market was already suffering after Beijing slashed government incentives aimed at boosting the new energy vehicle sector in the second half of last year.

In one of its most recent fundraisings, the company announced a plan earlier this month to raise $235 million through a private placement of convertible notes.

It is using the new funds to feed its cash-hungry operations. According to its latest report, the company had just over 1 billion yuan in cash and cash equivalents at the end of last year, far less than the 8.4 billion yuan it had at the end of 2018.

Contact reporter Yang Ge (geyang@caixin.com; twitter: @youngchinabiz)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas