Chart of the Day: China’s Record-Shattering Pork Imports

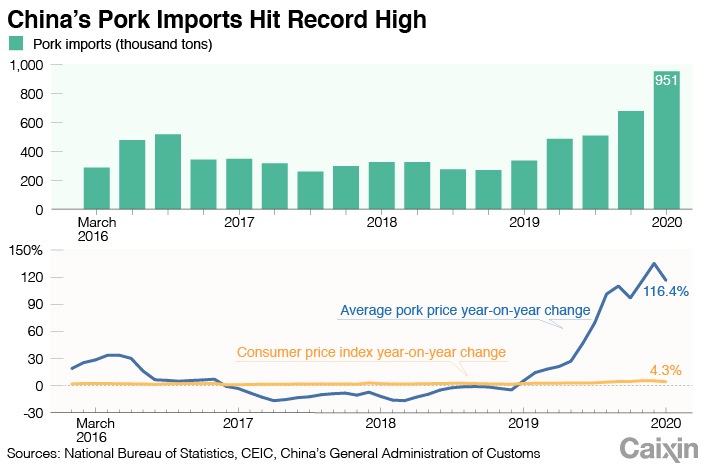

China imported a record 951,000 tons of pork in the first quarter, up 274,000 tons from the previous period, as the nation continued to reel from the impact of African swine fever, which ravaged hog stocks and spiked prices of China’s favorite meat.

Of that sum, 168,000 tons came from the United States.

The figures, released Tuesday by China’s General Administration of Customs, came as Smithfield Foods Inc., America’s largest pork producer, announced it would close two more processing plants — in Wisconsin and Missouri — due to coronavirus outbreaks and supply chain shocks.

|

Smithfield, a wholly-owned American subsidiary of China’s WH Group Ltd., last week closed for disinfection a giant plant in Sioux Falls, South Dakota, responsible for some 4% to 5% of total annual U.S. pork production. Local health authorities said the plant was linked to 644 cases of Covid-19 as of Wednesday, making it the largest known coronavirus cluster in the United States. The plant has 3,700 staff.

Smithfield CEO Kenneth M. Sullivan said the Sioux Falls plant closure, “combined with a growing list of other protein plants that have shuttered across our industry, is pushing our country perilously close to the edge in terms of our meat supply.”

The closure has raised concerns about possible effects on the Chinese market, which last year ate its way through 45% of the world’s consumed pork. Analysts said for now those concerns appear overblown. Pan Chenjun, an analyst at Rabobank in Hong Kong, said if U.S. production continues to be affected, China will likely increase pork imports from the EU, where it gets most of that meat.

Chinese pork production fell 21.3% to 42.6 million tons last year, and U.S. pork exports to China increased 258% to 378,000 tons. America, the world’s No. 2 pork exporter, is also the second largest exporter of the meat to China after the European Union.

Chen said that while China’s meat processing industry and some catering services use imported frozen pork, the Chinese pork market is still dominated by fresh local supply, with retail price fluctuations driven mostly by domestic supply and demand.

Smithfield is the latest U.S. food producer to be impacted by the Covid-19 epidemic sweeping the country. Tyson Foods Inc., the country’s largest meat producer, suspended production at a pork processing plant in Iowa on April 6, while Sanderson Farms Inc., the nation’s third-largest poultry producer, said April 2 that a plant in Georgia had capacity reduced by half after an outbreak meant 415 employees had to be quarantined for two weeks.

Even though America’s meat industry is largely exempt from government’s “shelter in place” orders, cramped conditions in many plants have helped spread the virus between staff, sparking walkouts and shutdowns that have dented capacity.

Smithfield Foods was acquired by Chinese meat producer Shuanghui Group, later renamed WH Group, in 2013 for $7.1 billion and continues to operate as a wholly-owned subsidiary. Smithfield’s U.S. revenues were $13.16 billion in 2019, according to WH Group’s financial report, amounting to 54.6% of its parent’s total revenue.

Contact reporter Flynn Murphy (flynnmurphy@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas