Caixin China General Manufacturing PMI (April 2020)

Operating conditions deteriorate slightly as COVID-19 pandemic weighs on demand

Key findings

Output continues to recover, albeit at a mild pace...

...but total new work declines again as export sales plummet

Input costs and output charges both fall

Data were collected 7-22 April 2020

After broadly stabilising in March, operating conditions across China's manufacturing sector weakened slightly in April. The recent easing of measures to halt the spread of the coronavirus disease 2019 (COVID-19) pandemic underpinned a further rise in output. However, the impact of the virus globally led to a substantial drop in export sales, which drove a further decline in total new work.

Weaker demand conditions prompted firms to reduce their staff numbers and input buying. At the same time, companies reported moderate falls in both input costs and selling prices.

The headline seasonally adjusted Purchasing Managers’ Index™ (PMI™) – a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy – slipped from 50.1 in March to 49.4 in April, to indicate a renewed deterioration in operating conditions. That said, the decline was marginal and much softer than the record pace seen in February when many firms closed down to stem the spread of the virus.

Chinese manufacturers signalled a back-to-back monthly rise in production after a record decline in February, as more firms reopened and were able to increase capacity. That said, the rate of expansion remained marginal overall.

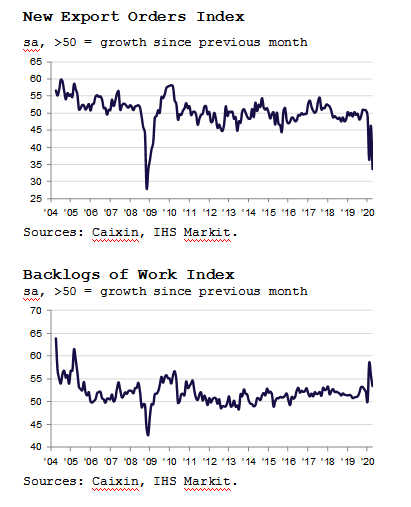

Meanwhile, total new orders fell for the third month running at the start of the second quarter. The modest drop in overall new business was largely driven by weaker foreign demand, according to underlying data. New export business fell at the steepest rate since December 2008, as the COVID-19 pandemic led to temporary lockdowns and business closures across the globe.

|

Reduced amounts of new work led firms to cut their staff numbers again in April. Furthermore, the rate of job shedding quickened from March. Backlogs of work meanwhile rose further as firms continued to process orders from previous months, though the rate of accumulation eased for the second month in a row.

The weaker order book trend also prompted firms to reduce their purchasing activity. Greater usage of current stocks meanwhile led to a further decline in inventories of inputs, though the rate of contraction was only fractional.

Although the time taken for inputs to be delivered to manufacturers continued to lengthen in April, the rate at which vendor performance deteriorated was only modest. Where delays were recorded, they were generally attributed to shortages at suppliers and virus-related travel restrictions.

A combination of increased production and difficulties in delivering products to clients led to a further rise in stocks of finished goods. That said, the rate of expansion remained marginal.

Average input costs fell at the quickest rate in over four years in April amid reports of lower raw material prices. Output charges also declined as firms sought to remain competitive and attract sales.

Concerns over the longevity and severity of the COVID-19 pandemic and its impact on global demand weighed on business confidence at the start of the second quarter. Optimism regarding the 12-month outlook for output dipped to a four-month low in April.

Comment

Commenting on the China General Manufacturing PMI data, Dr. Zhengsheng Zhong, Chairman and Chief Economist at CEBM Group said:

“The Caixin China General Manufacturing PMI returned to contractionary territory in April, coming in at 49.4. China’s economic recovery was hindered by shrinking foreign demand, despite the domestic epidemic being largely contained.

1. While manufacturing output expanded at a faster clip, export orders plunged amid sluggish demand. The output subindex rose further into expansionary territory, the best-performing among the five PMI subindexes and the only one above 50, reflecting further resumption of work. The gauge for new export orders dropped back sharply to a level lower than that in February, pointing to a sharp contraction in foreign demand amid the coronavirus pandemic. The subindex for total new orders worsened slightly from a relatively low level the previous month, amid shrinking overseas demand compounded by limited recovery in domestic consumption.

2. Amid rapid production recovery and falling demand, inventories of finished goods increased relatively fast, and growth in work backlogs continued to slow. The subindexes for stocks of purchased items and suppliers’ delivery times continued to recover despite staying in negative territory, reflecting the fact that manufacturers were well prepared for production.

3. Prices of industrial products continued to fall. Amid a plunge in global oil prices, input costs dropped markedly. The gauges for input costs and output prices had the same reading in April. Meanwhile, downward pressure on the prices of raw materials including glass and steel grew amid large inventories and limited demand recovery.

4. Both the gauges for business confidence and employment dropped. Unlike in February and March, manufacturers’ confidence was not high in April as the coronavirus’s hard hit on external demand forced them to reassess the pandemic’s impact: the economic shock may be greater than previously thought, and it may take longer for the economy to recover. Amid sluggish demand, employment contracted at a steeper rate.

“To sum up, the sharp fall in export orders seriously hindered China’s economic recovery in April, although businesses were gradually getting back to work. Amid the second shockwave from the pandemic, the problems of low business confidence, shrinking employment and large inventories of industrial raw materials became more serious. A package of macroeconomic policies, as suggested in the April 17 Politburo meeting, must be implemented urgently. It is particularly necessary to aid weak links including small and midsize enterprises and personal incomes.”

|

Contact

Dr. Zhengsheng Zhong

Chairman and Chief Economist

CEBM Group

T: +86-10-8104-8016

zhongzhengsheng@cebm.com.cn

Ma Ling

Senior Director

Brand and Communications

Caixin Insight Group

T: +86-10-8590-5204

lingma@caixin.com

Annabel Fiddes

Principal Economist

IHS Markit

T: +44 1491 461 010

annabel.fiddes@ihsmarkit.com

Bernard Aw

Principal Economist

IHS Markit

T: +65 6922 4226

bernard.aw@ihsmarkit.com

Katherine Smith

Public Relations

IHS Markit

T: +1-781-301-9311

katherine.smith@ihsmarkit.com

About Caixin

Caixin is an all-in-one media group dedicated to providing financial and business news, data and information. Its multiple platforms cover quality news in both Chinese and English.

Caixin Insight Group is a high-end financial research, data and service platform. It aims to be the builder of China’s financial infrastructure in the new economic era

For more information, please visit www.caixin.com and www.caixinglobal.com.

About IHS Markit

IHS Markit (NYSE: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers nextgeneration information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

IHS Markit is a registered trademark of IHS Markit Ltd. and/ or its affiliates. All other company and product names may be trademarks of their respective owners © 2020 IHS Markit Ltd. All rights reserved.

About PMI

Purchasing Managers’ Index™ (PMI™) surveys are now available for over 40 countries and also for key regions including the eurozone. They are the most closely watched business surveys in the world, favoured by central banks, financial markets and

business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends. To learn more go to ihsmarkit.com/products/pmi.html.

If you prefer not to receive news releases from IHS Markit, please email katherine.smith@ihsmarkit.com. To read our privacy policy, click here.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to IHS Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without IHS Markit’s prior consent. IHS Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers’ Index™ and PMI™ are either registered trade marks of Markit Economics Limited or licensed to Markit Economics Limited. IHS Markit is a registered trademark of IHS Markit Ltd. and/ or its affiliates.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas