Pinduoduo: A New E-Commerce Goliath?

Pinduoduo (Nasdaq: PDD) is one of the fastest-growing internet companies in the world, nearly surpassing Alibaba and JD in gross merchandise value, active users, and revenue growth in just five years, but is much less well-known to global investors. It sprinted past the trillion yuan GMV mark after less than five years, shattering the 14-year and 20-year records set by Alibaba and JD respectively.

The company accomplished this with a few key social commerce innovations:

- Group buying: PDD offers products at a significantly reduced price once a minimum number of buyers sign up for the deal. As PDD users share the deal with more people, they can “price chop” and incrementally bring the price down near to zero if enough people join. PDD users share the deal with their friends via the ubiquitous messaging app WeChat, plugging PDD directly into a powerful advertising network.

- Gamification: PDD employs a range of techniques designed to increase user stickiness and encourage users to share links to the app. These ‘growth hacks’ range from daily check-in rewards to mini-games like “Duo Duo Orchard” which allows users to water a virtual tree each day until it ‘grows’ large enough that they can receive a box of real fruit.

-Targeted advertising: About 80% of PDD’s revenue comes from advertisements. Unlike Alibaba, which has expanded its “search ads” business by acquiring Yahoo, PDD employs “targeted ads” that are closely tailored for each consumer. This Facebook-like advertising strategy has reduced marketing costs for PDD sellers, most of whom are relatively small and can’t spare much on advertising. It also allows PDD to provide a highly personalized shopping experience, built on the back of data gathered via group buying and other social integrations - PDD can recommend users items their friends have purchased, which “helps solve the ‘trust deficit’ of retail in China’s developing cities, where more than 80% of retail is unorganized and consumers rely heavily on social recommendations to initiate transactions.” [Y Combinator company data; https://blog.ycombinator.com/PDD-and-the-rise-of-social-e-commerce/#footnote5 ]

Following is a glimpse of its unique business model, and a close-up on its competitors, partners, strengths and weaknesses.

Market positioning

With over 630 million online shoppers, China has the largest and fastest-growing e-commerce market in the world. Two of the biggest e-commerce industry players in China, Alibaba and JD, made up the majority of the market cap until PDD pushed its valuation to $70 billion in mid-May. PDD accomplished its explosive growth due as much to its focus on an under-served market segment as its social commerce innovations.

PDD’s cheap prices and wide product range appeal to China’s so-called “sinking market consumers,” (下沉消费市场) a term often used by domestic market analysts and media to refer to lower-tier cities, small towns, and rural areas in China. While Alibaba and JD put their emphasis on capturing city dwellers willing to pay more for better quality products, PDD began on the other end of the spectrum, selling cheap unbranded goods, agricultural products and groceries.

PDD’s high performance has pushed Alibaba and JD to shift their attention to the sinking market as well, which is poised to be the next battlefield. Alibaba has now launched a discount version of its Taobao platform, and provided some 10 billion yuan in subsidies for its group-buy service. JD, on the other hand, has made its own social commerce app Jingxi. Using PDD-style techniques, both of the two giants are determined to tap into the same lower-tier market PDD built its success upon.

Key metrics

-User acquisition: During the first quarter, PDD attracted 42.9 million new users, while Alibaba brought in 15 million and JD 25 million. At this rate, PDD will overtake Alibaba in about two years’ time as the ecommerce platform with the most users. This feat is especially commendable if you consider that PDD has only one platform, while its competitors have numerous apps.

-Revenue growth: Accelerating user acquisition helped PDD nearly double its revenue year-on-year to 1,157.2 billion yuan according to their Q1 earnings. Such rapid growth has also drawn great interest from investors in the capital market, whose positive forecasts for PDD pushed its stock price to $60.32 per share, more than tripling in value from the previous year.

-Low user expenditure: PDD customers’ annual spend remains low, with average annual expenditure of 1,824.4 yuan per user in comparison with more than 9,200 yuan for Alibaba. PDD needs to boost that number and draw in more revenue from sales commissions, but it’s easier for JD and Alibaba to expand down than it will be for PDD to change its image and appeal to wealthier urbanites. Its ability to maintain its position in the “sinking market” while attracting new users from elsewhere will be critical to its success in the medium term. It has made some efforts to attract consumers from higher tiers, such as subsidizing Apple products, but such efforts have yet to turn into cash flows.

- Lack of diversity in its revenue streams: PDD relies primarily on marketing services, which bring in some 90% of its revenue. Alibaba and JD both run a wide range of other businesses to supplement their traditional e-commerce platforms, but PDD doesn’t yet have that capability, due in part to the fact that they require much greater investment in fintech and operations management, where PDD lags behind.

Who to watch

|

Huang Zheng(黄峥) |

Founder and ex-CEO Huang Zheng, a former Googler and serial entrepreneur, became China’s second richest person with a net worth of $45.4 billion dollars, according to Forbes’ Real-Time Billionaires Rankings on June 22. He has expressed his vision for the company as “an exemplification of a multi-dimensional space, seamlessly integrating cyberspace and the physical space. It would be a combination of ‘Costco’ and ‘Disneyland.’”

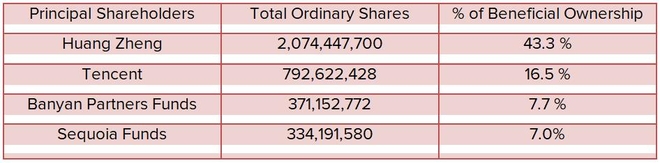

On July 1, Huang unexpectedly announced he would give away nearly 14% of his PDD holdings and step down as CEO. According to a regulatory filing, Huang reduced his personal holdings in PDD from 43.3% to 29.4% that day, worth roughly $14 billion.

He still holds near-complete control over PDD, however, as his voting power was only reduced from 88.4% to 80.7%. Additionally, the CEO role in Chinese startups is ambiguous; stepping down from the office is unlikely to have a big impact on Huang’s control, as long as he holds on to his voting power and position as chairman.

Also worth mentioning is that PDD does not have a CFO. It constitutes a red flag for the company, according to Harvard Law School corporate governance expert Jesse Fried: “That’s true even if a corporate controller serves as board chair and CEO, but not CFO. But what’s unusual and particularly worrisome here is that the controller is also effectively the CFO.” PDD claims it is looking for a CFO, but has not hired one for years.

|

Chen Lei(陈磊) |

Chen Lei, one of PDD’s founding members and CTO, will replace Huang Zheng as the company’s new CEO. He was previously CTO since 2016, before which he worked as a senior system architect and CTO for Xinyoudi Studio. Chen holds a bachelor’s degree in computer science from Tsinghua University and a doctoral degree in computer science from University of Wisconsin-Madison. On a company statement, Huang said he believes the new appointment will place PDD “on an even stronger footing to strive for the next level.”

Major partners

|

Gome(国美) |

Gome is one of China’s largest private appliance retailers, and a key strategic partner of PDD, which agreed to subscribe to $200 million in convertible bonds issued by the company in exchange for the right to sell Gome-branded products and others on the Gome platform including those made by big names such as Siemens, Sony and Haier. If PDD chose to exercise its right to convert to equity, it could become Gome’s largest institutional shareholder, but the financial aspect of the deal is secondary to Gome’s extensive network of stores, which could help PDD address its lack of logistics capacity and physical presence to better compete with JD. On PDD’s Q1 earnings call, Huang said “GOME’s nationwide retail network will play a crucial role in a part of the sales process, and we’re working together to redesign the shopping experience.” But PDD is not the only one with a Gome relationship: on May 28, JD followed PDD’s action and subscribed to another $100 million of Gome convertible bonds.

|

Tencent(腾讯) |

Tencent is one of PDD’s most significant backers, both in terms of its financial stake (worth some $20 billion) and PDD’s role in its proxy war with Alibaba. The rise of PDD has benefitted Tencent both in terms of its financial investment in PDD, which it paid far less than $20 billion for, and by forcing Alibaba to expend resources and respond to its threat in lower-tier markets. PDD remains highly dependent on Tencent’s WeChat as a way to maintain user acquisition, however, and Tencent has also invested in other e-commerce players, so the relationship between the two companies remains highly important to the fate of PDD and merits watching.

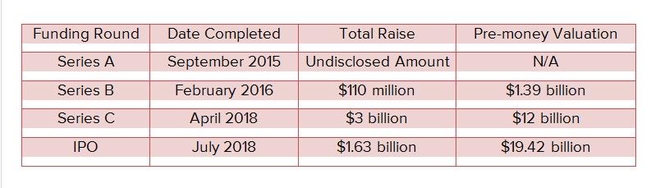

Funding Timeline

|

|

|

CGI Market Insight reports analyze innovative Chinese companies and key trends in the public and primary markets, providing global investors and companies with insight into China's vibrant, ever-changing competitive landscape and the companies shaping it. CGI Market Insight reports are produced by Caixin Global Intelligence, the research arm of Caixin Global. Contact us at cgi@caixin.com.