Caixin China General Services PMI (November 2020)

Service sector activity soars in November

Key findings

• Substantial rise in business activity amid quickest increase in new work since April 2010

• Employment growth strongest since October 2010

• Input costs rise at sharpest pace for over a decade

|

Data were collected 11-19 November 2020

Activity in China's service sector increased at a substantial pace in November amid reports of greater customer demand and a sustained recovery of market conditions after the coronavirus disease 2019 (COVID-19) outbreak. Furthermore, total new business expanded at the quickest rate since April 2010, while business confidence improved to the highest for over nine-and-a-half years. Rising activity and sales underpinned the fastest increase in employment for just over a decade. However, operating expenses rose at a sharp and accelerated rate, which led to a quicker increase in prices charged.

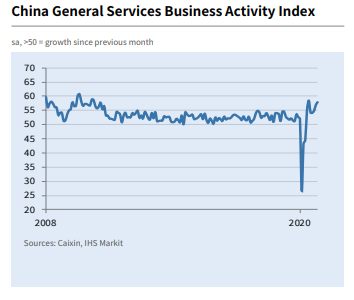

The headline seasonally adjusted Business Activity Index rose from 56.8 in October to 57.8 in November and pointed to a substantial expansion of services activity. Furthermore, the rate of growth was the second-quickest since April 2010, exceeded only by that recorded in June 2020. The latest reading extended the current sequence of rising business activity to seven months as the sector continued to see a strong recovery from the COVID-19 outbreak earlier in the year.

Improved growth momentum was accompanied by a faster increase in overall new orders during November. Moreover, the latest upturn in sales was the quickest since April 2010. New export business meanwhile rose for the first time since June, and at the sharpest rate since April 2019. Panel members frequently commented on greater customer numbers both at home and overseas, amid a sustained recovery in overall market conditions.

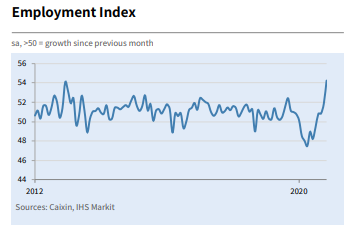

Efforts to expand capacity and rising order volumes led companies to increase their staffing levels for the fourth month in a row. Notably, the rate of job creation was the most marked since October 2010 and solid.

Higher workforce numbers helped to alleviate some pressure on capacities, as shown by a drop in the level of outstanding business. That said, the rate of backlog depletion was only marginal.

Average operating expenses rose further in the latest survey period, with the rate of inflation picking up notably since October. The latest upturn in input costs was the most marked since August 2010 and sharp overall. Anecdotal evidence generally associated the rise to higher raw material and staffing costs.

Firmer demand conditions enabled firms to partially pass on their increased cost burdens to clients in the form of higher output prices. Furthermore, the rate of charge inflation was the steepest for just over ten-and-a-half years.

Business confidence regarding the year ahead strengthened for the third month running in November. The overall degree of positive sentiment was in fact the highest since April 2011 and above the series average. Companies widely expect global economic conditions to recover from the pandemic over the next year, while firmer domestic demand and new product launches are also expected to boost activity levels.

|

|

Comment

Commenting on the China General Services PMI™ data, Dr. Wang Zhe, Senior Economist at Caixin Insight Group said:

"The post-epidemic services recovery continued to pick up speed in November, as the Caixin China General Services Business Activity Index hit 57.8, up from 56.8 the previous month and reaching the second-highest level since April 2010, below only June's 58.4 reading.

1. Services supply and demand both expanded at a faster clip despite scattered Covid-19 cases found in some areas. The business activity index and total new business both expanded for the seventh month in a row, hitting the second-highest and the highest level since April 2010, respectively. Overseas demand was strong, with the gauge for new export business returning to expansionary territory. Uncertainties caused by the pandemic did not slow growth in demand for services exports.

2. Employment improved sharply in November as strong growth in supply and demand had a positive influence on the job market. The employment gauge stayed in positive territory for the fourth straight month, reaching the highest point since October 2010.

3. Inflation pressure became evident. Strong demand in the job market and a rise in raw material costs pushed up input prices, which in turn led to a rise in the prices charged by service providers. The measures for input prices and prices that businesses charged both rose further into expansionary territory, hitting the highest readings since August 2010 and February 2010, respectively.

4. Entrepreneurs were highly confident about the economic outlook. The gauge for business expectations reached the highest point since April 2011. A majority of surveyed service providers were confident about the control of the epidemic and the economic recovery, while only 2% said they were pessimistic."

|

|

Caixin China General Composite PMI™

Sharpest increase in overall business activity since March 2010

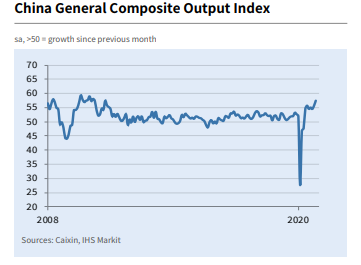

Composite indices are weighted averages of comparable manufacturing and services indices. Weights reflect the relative size of the manufacturing and service sectors according to official GDP data. The China Composite Output Index is a weighted average of the Manufacturing Output Index and the Services Business Activity Index.

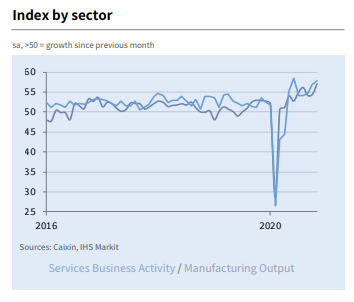

At 57.5 in November, the Composite Output Index rose from 55.7 in October, to signal the steepest increase in total Chinese output since March 2010. The higher headline index reading was supported by the steepest increase in manufacturing output for a decade, while service sector activity expanded at the second-quickest rate since April 2010.

Composite new order growth also accelerated in November, with the upturn the most marked since April 2010.

Employment subsequently rose at a solid pace that was the quickest since May 2010, and business confidence towards the year ahead outlook remained elevated.

Total input cost inflation picked up to a 34-month high in November, which led to a stronger rise in prices charged by Chinese companies.

Comment

Commenting on the China General Composite PMI™ data, Dr. Wang Zhe, Senior Economist at Caixin Insight Group said:

"The Caixin China Composite Output Index came in at 57.5 in November, stronger than 55.7 the previous month. Both demand and supply in the manufacturing and services sectors were upbeat and employment continued to recover. The measures for output, new orders and employment all hit the highest since the first half of 2010.The gauge for future output expectations also stayed at a high level.

"To sum up, both the manufacturing and service sectors recovered at a faster pace as overseas demand kept expanding and employment saw substantial improvement. Manufacturers began increasing inventories to meet strong market demand. The measures for both input and output prices both rose. The gauge for business expectations remained high.

"We expect the economic recovery in the post-epidemic era to continue for several months. At the same time, deciding how to gradually withdraw the easing policies launched during the epidemic will require careful planning as uncertainties still exist inside and outside China.”

Contact

Dr. Wang Zhe

Senior Economist

Caixin Insight Group

+86-10-8590-5019

zhewang@caixin.com

Ma Ling

Senior Director

Brand and Communications

Caixin Insight Group

T: +86-10-8590-5204

lingma@caixin.com

Annabel Fiddes

Associate Director

IHS Markit

T: +44 1491 461 010

annabel.fiddes@ihsmarkit.com

Bernard Aw

Principal Economist

IHS Markit

T: +65 6922 4226

bernard.aw@ihsmarkit.com

Katherine Smith

Public Relations

IHS Markit

T: +1-781-301-9311

katherine.smith@ihsmarkit.com

About Caixin

Caixin is an all-in-one media group dedicated to providing financial and business news, data and information. Its multiple platforms cover quality news in both Chinese and English.

Caixin Insight Group is a high-end financial research, data and service platform. It aims to be the builder of China’s financial infrastructure in the new economic era

For more information, please visit www.caixin.com and www.caixinglobal.com.

About IHS Markit

IHS Markit (NYSE: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers nextgeneration information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

IHS Markit is a registered trademark of IHS Markit Ltd. and/ or its affiliates. All other company and product names may be trademarks of their respective owners © 2020 IHS Markit Ltd. All rights reserved.

About PMI

Purchasing Managers’ Index™ (PMI™) surveys are now available for over 40 countries and also for key regions including the eurozone. They are the most closely watched business surveys in the world, favoured by central banks, financial markets and

business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends. To learn more go to ihsmarkit.com/products/pmi.html.

If you prefer not to receive news releases from IHS Markit, please email katherine.smith@ihsmarkit.com. To read our privacy policy, click here.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to IHS Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without IHS Markit’s prior consent. IHS Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers’ Index™ and PMI™ are either registered trade marks of Markit Economics Limited or licensed to Markit Economics Limited. IHS Markit is a registered trademark of IHS Markit Ltd. and/ or its affiliates.

- PODCAST

- MOST POPULAR