Weekend Long Read: From Housing to Financial Assets, How Chinese Allocate Their Growing Wealth

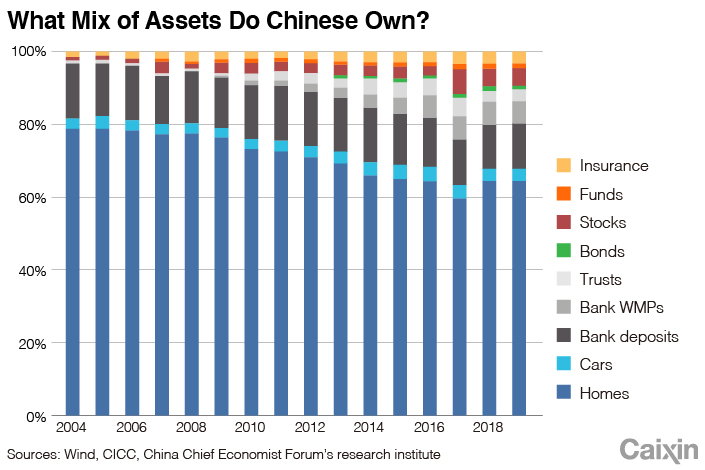

In the past 15 years, there have been two characteristics that have defined Chinese people’s asset allocation: going heavy on housing and a gradually rising share of financial assets. For the latter, they favor stocks and wealth management products (WMPs).

There are two main reasons why housing assets have taken up a large part of Chinese people’s total wealth.

The first is that the urbanization rate has risen rapidly and excessive liquidity has pushed up house prices. The second reason is that China has tight controls on cross-border capital flows and immature financial markets.

China’s aging population will lead to people’s asset mixes relying more heavily on financial assets while the share of risky assets is likely to fall.

Housing is still king

It’s clear that Chinese citizens have gone overweight on housing assets. In 2019, real estate accounted for 64.38% of their total wealth.

Meanwhile, financial assets as a proportion of the total have been gradually rising, reaching 32.33% in 2019, up from 18.79% in 2004. Among financial assets, around 13% were bank deposits, with stocks and WMPs accounting for about 11%. The shares of trusts, insurance, and funds were relatively small.

|

The share of real estate in residents’ asset mix has declined since 2010. However, it remains over 60%, well above the average in countries like the U.S. and Japan.

|

Why was property the asset class of choice?

China has witnessed rapid urbanization in the past 15 years, with the rate jumping from 39.8% to 60.6%. Infrastructure and property investment have become the engines of growth.

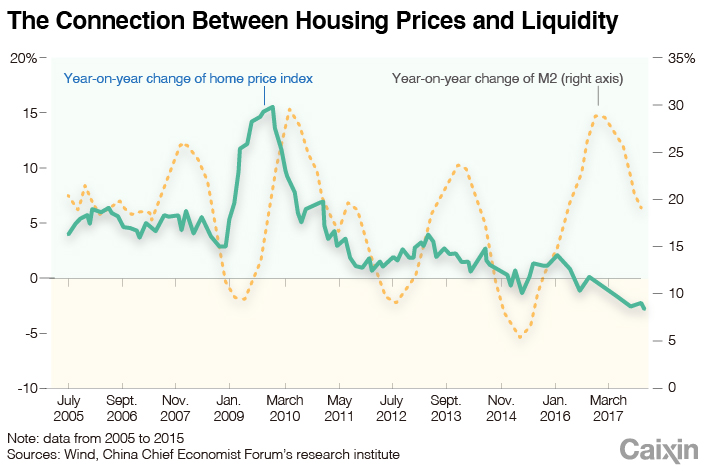

As local government borrowing rose sharply, there has long been excessive liquidity nationwide. The housing market played the role of a liquidity reservoir. Excessive money flooded into the market, pushing up house prices. Thus, residents preferred to buy houses over other asset classes. So the core reason why housing assets have taken a huge share of the total wealth of Chinese residents is the flood of money driving up prices.

|

China’s controls on the cross-border flows of capital and its immature financial markets have also contributed to residents’ overreliance on real estate.

The country’s closed capital account meant Chinese people lacked investment avenues. Also, consumers had little choice when it came to financial assets and their returns were relatively low given the limited offerings and high barriers in the derivatives market. These factors restricted the expansion and development of financial and investment activities.

Meanwhile, between 2009 and 2019, nationwide home prices saw an annual average increase of 7.21%. The run-up in all first-tier cities and some second-tier cities was much bigger than the CSI 300’s annual growth rate of 11.8%.

Rising share of financial assets

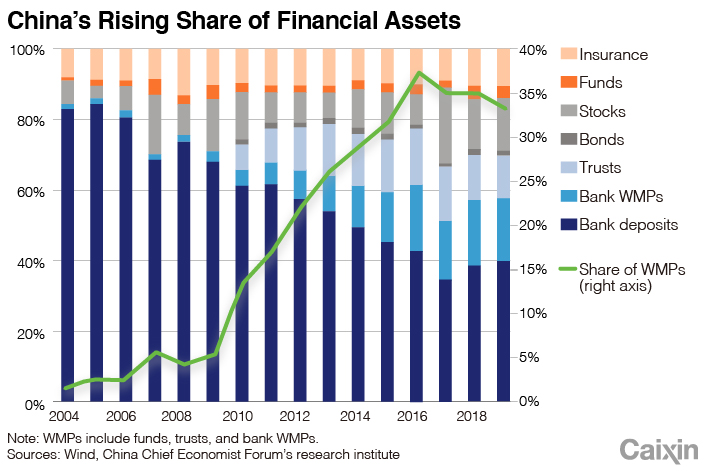

Since 2004, as Chinese people have accumulated more wealth and the scale of capital markets has grown, the proportion of their assets taken up by financial assets, especially risky high-yield assets, has been rising year by year. This can be attributed to two factors.

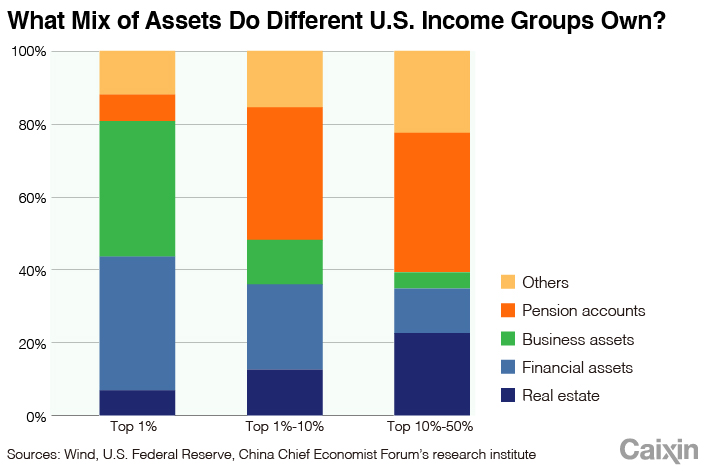

First, demand for the allocation of financial assets has been soaring. Based on the experience in the U.S. and Japan, as the share of young people as a proportion of the population declines, real estate as a proportion of residents’ total assets falls year by year while that of financial assets rises.

Second, as reform of the capital markets has accelerated, China has been seeing faster and more convenient two-way capital flows, with an ever-growing number of investment vehicles and products. Private equity products like PE quant funds, public fund of funds, manager of managers funds, REITs and other WMPs have one after the other become available since 2010.

In terms of market size, the number of A-share listed firms has grown 130% since 2015 and the country’s market capacity has grown far bigger.

The proportion of China’s official reserves to its external financial assets has been over 40% for a long time given continued curbs on outbound investments.

But investment avenues and products have expanded, including through the Hong Kong Stock Connect, the Shanghai-London Stock Connect, the China-Japan ETF Connect, and the QDII2 pilot scheme. Thus, the private sector invests in overseas securities through more channels, and the share of overseas assets in Chinese residents’ portfolios will rise accordingly.

Share of risky assets is likely to fall

With a slowing economy and a rapidly aging population, Chinese people’s risk appetite is likely to fall. Precautionary savings and investments will become their preferences, unaffected by interest rates. They will spend less on high-risk assets, such as stocks and equity funds. In the meantime, they are likely to invest more in insurance, pensions, fixed deposits, and other financial products. The difference in portfolio allocations between Americans and Japanese people is a case in point.

Chinese people’s allocation across major asset classes could be similar to that of Americans’ given their preferences and current demographic structure. That is to say, 20% of the total assets are cash and cash equivalents (including bank deposits and money market funds), 40% in stocks, bonds, equity funds, and other risky assets, and the remaining 40% in insurance, pensions and other low-risk assets.

Moreover, as the financial system continues to mature, tradeable products will gradually proliferate in secondary markets, which will require investors to be more professional. Demand for professionals will rise when allocating risky assets. From 2004 to 2019, the share of wealth management products in households’ financial assets grew. It will be a defining trend that Chinese families will spend more on funds, trusts, and other WMPs.

|

Lin Caiyi is the deputy director of the research institute of China Chief Economist Forum (CCEF). Hu Yiwei is a research fellow at the CCEF.

Contact translator Guo Xin (xinguo@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Follow the Chinese markets in real time with Caixin Global’s new stock database.

- PODCAST

- MOST POPULAR