Caixin Summer Summit 2021: Challenges & Solutions - The Future of Fintech and Digital Currency

20:00-21:00 Beijing/Singapore Time, June 24 2021, Thursday

Fintech’s application has been expanded to digital currency, financial infrastructure and regulation, even serving to build the foundation for high-quality growth of the whole financial industry. Digital currency, in particular, has gained widespread market attention and popularity. Major economies including China are accelerating the development of central bank digital currencies (CBDC).

How can fintech empower the real economy? How will digital currency change the existing payment system and currency structure? What are the new challenges for regulators? Welcome to China Chat @ Caixin Summit 2021: The Future of Financial Technology and Digital Currency. We will discuss the opportunities and challenges of fintech development, the future of digital currencies, and implications for every stakeholder.

Topics

How can fintech support the financial industry and prevent risks simultaneously?

How will digital currencies affect the international monetary system?

What is the prospect of digital RMB? Will the digitalization of RMB the affect its internationalization?

How will fintech find balance among financial inclusion, personal information protection, and anonymous crime prevention?

Invited Speakers

|

Sopnendu Mohanty

Chief Fintech Officer of Monetary Authority of Singapore

|

Huang Yiping

Deputy Dean of the National School of Development (NSD), Director of Digital Finance Institute at Peking University

|

Zou Chuanwei

Chief Economist, Wanxiang Blockchain Inc

|

Martin Chorzempa

Senior Fellow at the Peterson Institute for International Economics

Moderator

|

Li Zengxin

Deputy General Manager, Caixin Global; International Director, Caixin Insight

Language: English

Flow (60 minutes)

1) Speaker presentation (20’)

2) Q&A & discussion (25’)

3) Free chat (15’): Closed-door interactions among speakers and participants

Below is a transcript of the event:

Li Zengxin:

We’ve seen a lot happening in China and around the world in the financial technology and cryptocurrency field. We see China as stepping up supervision of big tech platforms that offer financial services. We’ve seen the central bank expanding the trial of eCNY in multiple cities; we’ve seen the rollercoaster rise in Bitcoin prices, but El Salvador has adopted Bitcoin as legal tender. So today, we’ll talk more on fintech and central bank digital currency (CBDC). But crypto is not excluded either.

Let’s get started. Today, we are happy to have three speakers. Welcome to you all. We also have professor Huang Yiping, deputy dean of the National School of Development, director of the Digital Finance Institute at Peking University. But unfortunately, he cannot be here right now at this time, but he recorded his comments in the video. So first, I would like to ask each of our speakers to talk briefly for about five minutes on his understanding of the topics. First of all, I will ask Sopnendu, who might provide us with a regulator’s view on these developments.

Sopnendu Mohanty:

Good evening, all of you. That’s a very long and very expansive question. Putting it in five minutes is challenging, but let me start from a very personal focus, I think financial technology has in many ways proven that its ability to solve inclusion is real.

We don’t need to debate that. We don’t need to question that. Because technology has brought the cost of financial services dramatically down, it has made accessibility easier because the mobile phone, or smartphone, is making access to financial services much easier now.

And the kind of innovation we have seen in the space of fintech, whether it is a simple mobile banking experience, or it is a higher complex product, technology, user experience distribution models, pricing, has made fintech very attractive when it comes to inclusion, whether at the bottom of the pyramid, or at a high value chain. So that’s pretty much I think, debate doesn’t have to happen, whether they add value or not. Inclusion is a big part of their success. And the bigger question is, which I think I want to bring to the debate is that there’s a role which regulators are playing now actively in the space of fintech. And that role is the rise of building public goods.

Because historically, regulators never played a direct role in a traditional sense, but in a digital world. Regulators and power, broadly speaking, are putting focus on building trusted public infrastructure because of all the issues we are having on trust around digital technology, whether it’s data, or interoperability, or data protection, or access pricing. There are four kinds of foundational public goods, which policymakers are now focused on in many parts of Asia.

One is, there’s a rise of demand for having a trusted digital identity infrastructure, whether it is corporate or individual. That is almost like the bedrock of digital economy, the trusted ID. It is owned by the individual, or the corporates. Second, interoperable payment systems, because we need to move money — we cannot be caught between large corporates, walled gardens, and tech companies, moving money within the ecosystem. It has to interoperate. There’s a need to build a public infrastructure for interoperable payment system. As an example, in Singapore, today, you can move money from account A to account B, zero cost at three clicks, is a public good as well as public infrastructure. Third piece is trusted data exchange. Because there’s a large rise of digital data, you need to trust the data, which people are receiving, and are also able to make the right choice based on the trusted data. So, it is the rise of public infrastructure caused trusted data exchange. As an example, in Singapore, we have something called MyInfo, which is our master data exchange for a lot of personal data, which you can give to third party for certain services; or within the financial sector, we have something called as Findex, where banks can share the data with each other using a trusted layer.

But the fourth one is the most powerful one — the power of consent. I think there’s a need for a public good, where individuals like you, me, Martin, Zou, all of us, should be able to consent electronically the data was shared to third party. The consent may not, cannot, and should not be a large bit of complex legal documents. We want to have very explicit data sharing consent to be there. I think that’s the cornerstone of the foundational digital infrastructure.

There’s a second case, and I have five minutes time, just to close my thoughts on the whole issue around privacy, big tech, and all these challenges. I think it’s all come to three things: trust, accountability, fairness, ethics — and what governs this is if the underlying data has a power of consent, and if my data is used and consumed in a transparent and a fair way, I think this whole debate should go away when it comes to data challenges and regulations around that. So, to me, these are the two distinct views around fintech — public good for the digital economy and regulatory framework for consumer protection, data protection, privacy. But, at the same time, we should have a balance so that you don’t kill innovation by making data too private or too walled garden, and it has to have some balance somewhere.

Li Zengxin:

So much for that top and most important things. Maybe the next question could be how to draw the line — which one should be privileged and which one, the consent on the data sharing? We’ll have Chuanwei, please.

Zou Chuanwei:

Okay, thanks for having me here. I would like to share some slides. I just want to talk about at this stage what do we know about China’s eCNY. Because there’s a lot of discussion on this topic.

The reason why it is China’s retail digital fiat currency, but not a typical central bank digital currency or CBDC. Even the PBOC has been working on this project for seven years, and it has been tested using since last year, the PBOC hasn’t published a white paper explaining how eCNY works. So, we have to guess or estimate, based on the fairly limited public information. At this stage eCNY mostly serves the domestic goal of payment modernization, and it will have some international implications, and I’ll go to this topic later.

|

So, why not a typical CBDC? We need to quote some words from former governor of the PBOC, Mr. Zhou Xiaochuan. Because usually CBDC, no matter it is a wholesale CBDC or retail CBDC, is usually a liability of the central bank or a claim on the central bank. But according to Mr. Zhou’s words … it is not necessarily a claim on the PBOC, but the second-tier institutions authorized by the PBOC such as commercial banks will have the ownership of the eCNY, and this is a very important point.

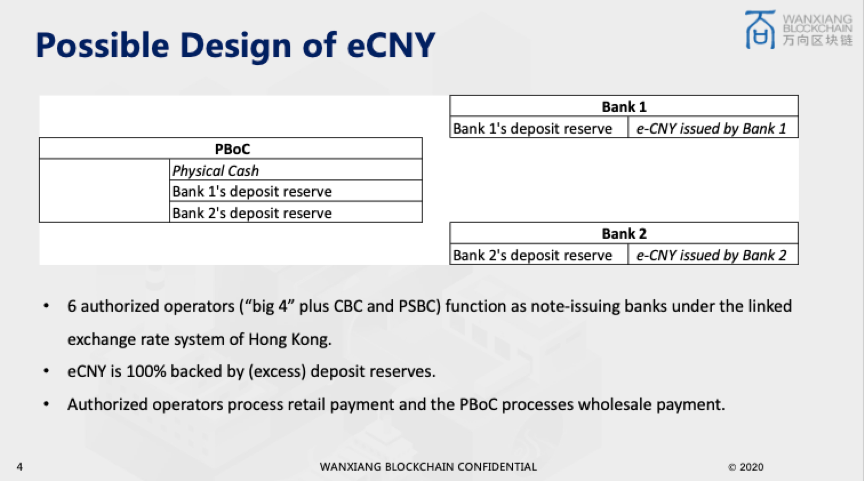

If you look at the relationship between the PBOC and second-tier institutions, it is not a simple wholesale and retail relationship. How does eCNY work? Just my guess, basically at this moment, there will be six authorized operators, the big four banks plus two medium-sized banks. They will function as note-issuing banks, very similar to the mechanisms of the linked exchange rate system of Hong Kong. So, if you look at this chart, eCNY will actually sit on the balance sheet of the authorized operators, but it will be backed by the deposit reserve capital in the central bank. The central bank will continue to offer official cash, and official cash is a claim on the central bank. Until there will be a division of labor and the existence, the six authorized operators will process retail payments and the PBOC will be in charge of the wholesale payment. That’s my guess.

|

|

There are some key regulations of eCNY in China. The first one is who can be the authorized operators? Only the commercial banks with strong capital and technical capabilities, which means the leading payment companies like Alipay and WeChat Pay, they can’t be authorized operators. However, there are two online banks affiliated with those two big tech companies. They will be authorized operators. What are the functions of an authorized operator? Mainly two. The first one is to offer eCNY wallets to users. The second one is to offer the exchange service between eCNY and bank deposits. Authorized operators will obey the PBOC’s quota management policies. This depends on the Know Your Customer (KYC) of users. The authorized operators will set up eCNY wallets with different quota limits.

The eCNY are offered as public goods, similar to physical cash. eCNY will have the feature of controllable anonymity but we need to follow regulations similar to those on general cash measurements and large payment transactions, anti-money laundering (AML), and combating the finance of terrorism.

|

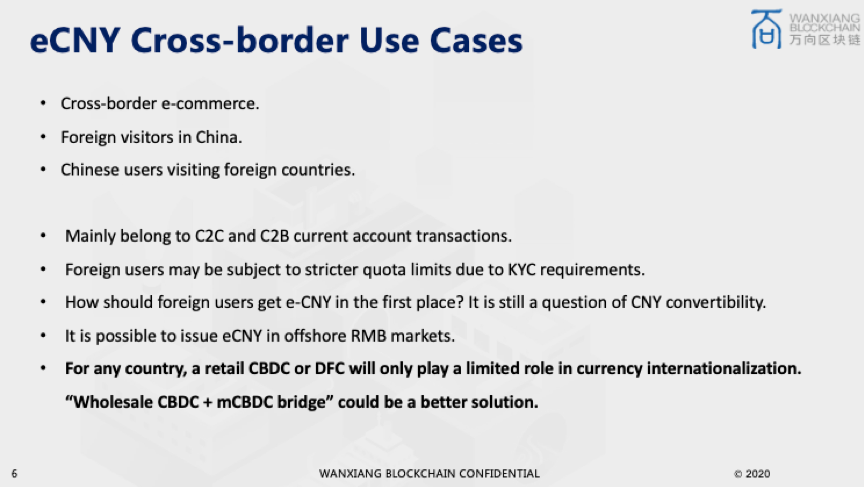

There are a lot of discussions about the international use of eCNY. I think this will happen because at least they are very open systems, which will be open to foreign users. But if we look at the cross-border use case, there will be three scenarios: First, cross-border e-commerce; second, foreign visitors in China because they need to have extra manuals. Foreign officials in China don’t have bank accounts, so they have to rely on physical cash. eCNY will give them a new option. The third is for Chinese users visiting foreign countries. But if you look at this case, it belongs to consumer to consumer payments or consumer to business payments, which belong to current account transactions, not business to business payments.

For the foreign users, because of the KYC requirements, they are subject to stricter quota limits. One of very important questions is the CNY convertibility. Because for the foreign users to have eCNY in the first place, they need to use the foreign currency in exchange for eCNY. So, capital account openness is still under question. However, if we look at the structure of eCNY, it’s possible, for example in Hong Kong, to issue eCNY and just use the offshore RMB as reserve.

|

But for estimating the international implication of eCNY — for any country, I think the retail CBDC or digital fiat currency will only play a limited role in currency internationalization. Because when looking at the financial transactions, post-trade processing and payments versus payments, they still rely on wholesale CBDC. Just to mention the Bank of International Settlements, its sponsor project called multi-CBDC bridge. The PBOC is part of this project. I think, a wholesale CBDC plus multi-CBDC bridge could be a better solution than retail CBDC in terms of promoting international use.

Li Zengxin:

A lot of information here, and you may know that Dr. Zou actually wrote a few books on digital currency and fintech. One of them is called “China’s internet: Finance in China” together with Xie Ping. Next up, we will have Martin. Martin just recently testified to the U.S. Congress about fintech and digital currency. Please, you will have your five minutes now. For our audience, if you have questions, you can click the Q&A button to raise questions to our speakers.

Martin Chorzempa:

I'm going to talk about the international implications. I strongly agree overall with what Chuanwei said earlier and I want to reference also the experience of internationalization of private Chinese fintech and digital currency companies.

What's very interesting is China’s fintech market is the largest in the world, and Tencent is one of the largest fintech companies in the world, and the most successful anywhere. But internationally, they've had relatively limited success. So that success has been quite strong in terms of acceptance. Your merchants all over the world will accept Alipay. My local pharmacy in Washington DC will accept Alipay. But on the other hand, very few if any foreigners actually use Alipay or WeChat pay, unless they're in China. And that is really important, because they’re only one side of a two-sided market. Alipay generally has done very little to reach foreign users. And WeChat has attempted in many countries - South Africa, India - to build on this, and so far, has been unsuccessful. Essentially, Facebook has beaten them with WhatsApp, and they were never able to build out of this.

So, what does this tell us about the eCNY? There are many people in Washington who are terrified by the idea that the central bank digital currency China is launching is going to immediately replace the dollar as a reserve currency because it's digital and all that, but Alipay and WeChat pay despite having immense capital, a great business acumen, and great technology haven't managed to make a dent at all in Visa and Mastercard’s transaction [market] around the world. So why should we expect that the eCNY will be any different in replacing the dollar? I don't think it's going to make much of a difference. If you look at the RMB in use today, despite the fact that China is the second largest economy in the world, the RMB ranks fifth as a global payment currency. And in reserves, it's only about 2%, which means the RMB punches significantly below its weight economically.

The main reason for that, I believe, is because of something that Chuanwei mentioned, which is capital controls. If your currency is not fully freely usable, then it can't really be a reserve currency because people need to know that if they're going through a financial crisis or having some difficulty, they can always access their currency. It's not a free lunch to be reserve currency either, because it comes with a lot of responsibility. You end up absorbing imbalances from the rest of the world. And that can cause difficulties with your domestic monetary policy transmission and stability. And China has so far decided to prioritize domestic stability over the potential benefits of RMB internationalization.

If there was any time that one would expect China to open up its capital account and really push for RMB internationalization, it would be the last few months, where there's been appreciation pressure on the currency instead of depreciation pressure on the currency. It seemed like a golden opportunity. But even people like Professor Wong, who previously advocated for RMB opening the capital account, are now saying maybe there's no good time to open the capital accounts. I don't really expect that to change any time soon. Obviously, as Carstens, head of the BIS (Bank of International Settlement) has said, the digital nature of a currency is not going to mean a change to its position [regarding being a]…reserve currency. I strongly agree with that, mainly because currency that's really transacted at wholesale level is already both central bank currency and digital.

So, if the RMB is going to gain, it has to find a way to be more efficient, faster, secure. And that's going to rely not only on good technology, but also on a whole new set of financial infrastructures which need to be built. And on top of that financial infrastructure, the kind of dynamics markets love like sufficient market participants, providing liquidity and hedging instruments and all that needs to be built. And that's not going to be built very quickly, it's going to take a very long time. For a while, there's going to be no network effects. Because there's really no other country, no other major economy, that has launched CBDC or is really even close.

In the long term, as the initiative takes off, potentially as many other countries adopt CBDCs, there is a real opportunity for China to build a separate financial infrastructure that might be less dependent on the US dollar and the United States. But that's a very long-term prospect. In addition, you know, the Federal Reserve is moving much more slowly than China on digital currency. But it's not just totally asleep. It's watching what's going on. And if there's a widespread adoption around the world of CBDCs, I don't think the Fed will just sit back and let some alternative infrastructure be built. There'll be plenty of time for them to react. So that's what I have to say on that. Thank you.

Li Zengxin:

Right. Great. I wonder how did you convince people you know, the scholars and politicians, that this is not a thing for tomorrow, but a thing for the next decade?

Martin Chorzempa:

I was surprised at the reaction I had from the commissioners, I thought that I was going to be argued against and that they were not going to buy it whatsoever. But they were actually very sympathetic to the argument. I think there's some sense that not everything China does need to cause a complete panic in Washington and some huge counter reaction. There are areas that require Washington's attention, but if you try to focus on everything at once you don't make any progress.

Li Zengxin:

Okay, before the Q&A, I think maybe we can play the video of Professor Huang.

Huang Yiping:

Good evening. I'm mostly delighted to join Caixin Summer Summit. I like to take this opportunity to share with you some of my thoughts about the Chinese Central Bank digital currency, which was previously called the DCEP digital currency electronic payment, but is now more widely known as the eCNY electronic Chinese yuan. The starting point of thinking about the CBDC was probably in 2009, when the first cryptocurrency, Bitcoin, was launched.

At the time, the world just came out of a big global financial crisis and many market participants lost the trust or confidence in central banks as many central banks for many years oversupplied money, which eventually led to either high inflation or big financial risk or both. The attractiveness of Bitcoin was its decentralized system and the total supply of Bitcoin, 21 million, was fixed. The central bank does not play any role in this whole process. However, the downside of Bitcoin was its lack of intrinsic value. Therefore, the value of Bitcoin has always been very volatile. And that is a key reason why many central bankers do not believe that Bitcoin can actually become a currency. However, things change quite drastically. 10 years later, on 18th of June 2019, Facebook published a white paper on its stablecoin, Libra, which was later renamed Diem. Stablecoin is underpinned by a sovereign currency like the US dollar or the British pound, and therefore, the value is much more stable. Plus, Facebook has a global network with almost 3 billion users. If Facebook is successful in implementing such a stablecoin, it could immediately become an international currency and international payment. And that is why many central banks start to become much more serious about developing their own CBDCs.

PBoC was probably among the first in the world to think about a central bank digital coin, in 2014, started to develop its eCNY. Today, we know eCNY is already in test runs in many different places. We don't know exactly when it will be rolled out to the entire country. But I suppose this could happen any time in the coming year.

Two of the key features for eCNY to note are: number one, it's a retail central bank digital coin. To use PBoC’s wording, it only substitutes M0, not M1 or M2. In other words, it really replaces the cash in circulation, not anything else. The second key feature is its two-layer distribution system. PBoC issues the eCNY to authorized institutions, including commercial banks, telecom companies and a mobile payment service institution. And these authorized institutions issue eCNY to the public through their own designed digital warrants.

The impact of eCNY on the financial system can vary, depending on whether we look at the short term or the longer term. I think in the short term, the impact will be limited as according to the definition, it's mainly a substitution for small amounts of a payment in the cash in circulation. But we probably should watch out in two areas. Number one, whether or not it might encourage depositors to convert a lot of current deposits, which receive a very limited interest payments to the digital world if eCNY really becomes convenient and useful in daily lives. But my guess is that in the short term, the amount of conversion will be limited.

The second impact is whether it's going to substitute for the existing mobile payment services like Alipay and WeChat pay. We don't know exactly at the moment. But I also guess in the short term, it will be limited. Partly because for a payment service to be successful, you really need to build a very comprehensive ecosystem. You're using mobile payment, you're using electronic payment, but you need the ecosystem to use it. So that will take some time. The second reason is, even for the mobile payment services, like Alipay and WeChat pay, you can also use the digital eCNY in your wallet, so these services definitely will continue.

So, I think that the impact in the short term will be limited. One key area I think we need to pay attention to is whether this new system is going to change the way of collecting and analyzing data from the payment services. In the past, AliPay and WeChat Pay all collected their own data within their own system. They analyzed this data to provide more services. In the future, I guess this kind of information might become more segregated. For instance, if we pay money from Alipay to ICBC digital wallet, then all authorized institutions will only have one part of the information. The good news is that we then can integrate the entire system. Data will no longer be segregated, as at least in one place, probably PBoC, there will be a comprehensive set of data. But the other side of the story we need to look out for is whether that's going to change the current structure of fintech and the digital economy.

Li Zengxin:

Professor Huang comes back to the data and infrastructure, which is what Sopnendu just talked about. Right now, a lot of things are happening in the fintech world in China, putting some of the big platform companies under financial holdings companies and cutting ties between e-commerce and lending platforms. Sopnendu, what do you see from all these Chinese actions? What was your interpretation or what will it bring to the fintech world in Singapore and Southeast Asia?

Sopnendu Mohanty:

I always start by saying, we define fintech properly. I think there are two kinds of fintech, which help banks to digitize faster. There are fintech which offer financial services directly. I think the question you asked is around fintech which are offering financial services directly using technology as a platform. And they are doing regulated activities. There is some regulatory impact, as you see in China, in many countries, in terms of how regulators are regulating the tech companies which are offering direct finance services.

But before I come to this second bucket, let me give a small update on the first bucket. Some 80% of global fintech companies in the business of helping small commercial banks to digitize faster fall in the category of business-to-business fintech. I think that market and that activity will grow further. Southeast Asia got a lot of benefit out of it. Massive investment will come into the space. Because the institutional ability to digitize is so low, you need small, agile entrepreneurs, small fintech companies that help an institution digitize faster. The only thing which controls them is what they call a tech risk management guideline, which banks are expected to follow as part of the outsourcing controls.

The second bucket is the investing bucket. You recently saw that China, and many countries including Singapore, are progressively putting regulations around tech companies offering financial services. In one specific example, in Singapore last year, we introduced a very comprehensive, very wide ranging modular payment regulation, which essentially means, in a simplistic way, we put a regulation to capture every possible fintech company offering payment services. So, you can't just escape that. But is it a good thing? Yes, it’s a good thing because the regulation now is based on modular activity. Let me explain that. The regulations should be proportionate to the activity that a particular firm is engaged in and the risks it brings in that process. You cannot have a big regulation for a small little activity. And that used to be the case traditionally, when the regulation was disproportionate to the risk that entity is bringing. So, having an activity-based regulation, which looks at a certain activity, and regulating that activity for the risk it brings is the most efficient way to think in the new world of fintech. You build a modular activity-based regulation. An example is Singapore's Payment Service Act, which was a big regulation, but we broke down to seven pieces that we could regulate. Remember the DNR fintech, which go and solve one specific problem and make it very good. That's the DNA of fintech. Try to match your regulation to that DNA, and I think we'll get a better outcome.

Now, there are broader issues, which I think all of us regulators are concerned about, such as data protection, consumer protection, and privacy consent that we spoke previously. I think that's the broader impact, but I don't think regulation per se will have any negative impact on fintech. In fact, fintech will get more disciplined in that thinking. I've also seen evidence in the Asian market that fintech companies are looking for regulation because if they're regulated, they get better credibility, they can go back to the investors and raise more capital. So, having a good regulation helps the ecosystem to become more vibrant.

Li Zengxin:

Next for Chuanwei. You have to explain this further. In your slides, you said that eCNY is not a typical CBDC because eCNY is not necessarily a claim on the PBoC. How come? You have to explain that further.

Zou Chuanwei:

If you look at the case of the Hong Kong dollar, it is not issued by Hong Kong Monetary Authority, the central bank in Hong Kong, but rather by the three note-issuing banks: Bank of China (Hong Kong), HSBC and Standard Chartered. So, the majority of Hong Kong dollar is claimed by only those three banks, that is backed by their US dollar reserve. Capital is provided by the Hong Kong Monetary Authority. So, I guess if Mr. Zhou Xiaochuan’s words are right and he implied that eCNY will follow similar mechanisms, if eCNY is a direct claim on the six authorized banks, and these claims are backed by the deposit reserve capital of the PBoC and follow the regulations introduced by the PBoC, and make sure that eCNY issued by different commercial banks which are equivalent to each other, I think this just actually works. If we look at the monetary design of CBDC around the world, CBDC design has these flexibilities. In many countries, they adopt direct CBDC design. In China, you can call this indirect CBDC or hybrid CBDC.

Sopnendu Mohanty:

Can I make a point quickly? I think there's a simpler word called commercial bank digital currency, that is probably much easier to understand. Because I think there's a similar thing happening in Singapore. I don't know whether you're tracking, a new entity was launched in Singapore by JP Morgan, DBS, and Temasek called Partior, which essentially is a market infrastructure, which will run commercial bank digital currency. And what is important is it is a shared ledger. So, you're creating a shared ledger, by which you can make the process efficient. Today, you think about how money moves to a series of debits and credits, and then you reconcile and you do all of this thing. What about a mechanism by which you share your ledger?

The commercial bank uses digital currencies, and your settlements become atomic instant, overlay that with an asset transfer process. Today, traditional processes are you pay something, and your contract ownership is a separate process. So, there are two processes. They're connected, but they happen at different times.

In the world of digital currency issued by a commercial bank, you can actually make the process one, instant at the point of asset ownership transfer, and you also have a payment made. And that's the beauty of commercial bank-issued digital currency, provided the commercial bank agrees to have a shared ledger so that they don't have a debit card process to add to the ledger system. I think that's the argument Chuanwei was making. In eCNY that is a commercial bank-issued digital currency, the processes become far more efficient and unintuitive.

Li Zengxin:

But the Chinese structure just still baffles me. What’s the point if you still use the two-tier system?

Zou Chuanwei:

There are 1.4 billion Chinese people, so actually it's very challenging for the central bank to face those 1.4 billion users directly, which will just put a very heavy burden on the eCNY system. This design will give the commercial banks flexibilities and give them runways to promote the adoption of eCNY and also will introduce to the viewer the possibility of issuing eCNY in offshore remedy market. For example, Bank of China (Hong Kong) can use the offshore RMB to issue eCNY in Hong Kong. I think the flexibility of this design will be better than the direct CBDC. Because China is a big country, we need to take this into consideration.

Li Zengxin:

Seems that China has been implementing these trials in multiple cities, which issue this CBDC by lottery. If you're lucky enough, you'll get 200 yuan or something like that. What about the older generation, or people who cannot have access to this? Like you said they cannot care about 1.4 billion people at the same time.

Martin Chorzempa:

I can take that question. I pay attention to what the PBoC says, there's some sense that this will exist also potentially in the form of a debit card. And they're allowing it to be transacted with the really interesting bit about CBDC. You asked, what's the point? I think it's a really important question that often gets missed in these discussions. Ultimately, the central banks want to redesign the way that payment systems work today. And they're not fully comfortable with letting that process be led by the private sector. I think China's probably the most obvious example of that, where Alipay and WeChat Pay control something like 95% of the mobile payments market. And that leads you to think that that looks a lot more like infrastructure. So central banks are negotiating now on the border between central bank-run infrastructure, and commercial bank or payment company infrastructure. And where you land depends on the design and a lot of trade-offs. In the PBoC case, one of the problems is that you generally need a bank account in China to use Alipay or WeChat Pay. And actually, there's a huge population, hundreds of millions of people, in China that are still unbanked. And the idea is you're going to create a system of transacting offline, but also one that only requires you to link an account with a phone number, instead of a bank account. That allows you to make relatively small transactions. And for people who are not digitally savvy, they can probably use physical plastic debit card that you can use to make transactions in person. So, the idea is to take people who are currently using cash, and convert it to digital, but still make it accessible. And that's going to be really tough, to get these people to trust something digital when they're used to something physical in their hand. But it is, I think, a worthwhile endeavor.

Sopnendu Mohanty:

But I think the best example of this is not China, the best example of how a central bank was created to implement a smarter payment system using digital currencies is Cambodia. You must go and see how beautifully they've deployed Bakong. It is a commercial bank-issued currency. But what they've done departs from the traditional real-time gross settlement system to what Martin just explained.

Because, as Governor Chea said, a chair was the power behind that whole transformation. In fact, the story goes like she was looking for a request for proposal (RFP) for building a real instant payment system. The commercial RFP cost was through the roof, which she thought was too expensive. So, she decided to leapfrog the whole thing by creating a digital currency construct issued by the commercial bank. And that's the payment system in Cambodia, which is growing very rapidly. Exactly as Martin explained, it’s a phone-to-phone transfer of currency, not necessarily having a complexity of payment system and bank. So it’s a good example, and we should go and examine in depth how it has been implemented.

Li Zengxin:

Great. We will look into Cambodia’s payment system. So here the question for you from our audience. What advice would you give to incumbent banks to compete with the new fintech?

You just said that a big part is upgrading the current systems of traditional finance. What advice would you give to incumbent banks?

Sopnendu Mohanty:

I always say that incumbent banks are not incumbent because the way they've architected themselves for many years. It's an irony that if you ask any IT company today to tell their biggest source of revenue, they'll say financial sector, but if one compares financial sector tech stack against other sectors, they don't make the top 10. So, what is wrong? They pay the highest bill and they actually get the most out of the technology. So, there is something beyond technology there. There's a governance process or a culture, very legacy thinking.

What I think is happening in many progressive parts in Asia is that the banks are shifting from a traditional architecture to an API-based open architecture, which essentially is a simplified way to say they're abstracting the bank's core system by building pipes of data exchange, and they can plug in fintech to that system, and rapidly digitize. That architectural shift is happening with many incumbents today actually giving the fintech startups money. So, I'm sure they're doing extremely well.

ASEAN alone issued 20-plus digital bank licenses in the last two years. In a way, you can call them return incumbent digital bank license. So, they're also completely starting from a green thrill, building a new tech stack, addressing the need. And just to close this, you should also not discount the rise of public infrastructure to support digital economy. The rise of eKYC, the rise of the electronic payments system, ID systems do help the incumbent to fight back this challenge.

Li Zengxin:

Just come back to Martin’s comments that the Fed has been really slow in developing its central bank digital currency. Martin, do you think you will have a CBDC? What kind of form will that be?

Martin Chorzempa:

I think it would actually look very similar to what China’s discussing, at least in terms of the financial architecture, probably the privacy architecture would have to be very different. Americans would not be comfortable with the Fed holding a ledger, which tells them exactly which American owns which amount of currency and is making what transaction. In many countries, especially in Europe that would not be politically acceptable to do, which is going to make it very difficult for them to launch because you can’t have a fully anonymous digital currency, that would lead to immense amount of money laundering and other problems that they would get blamed for. I always say, if cash were invented today, it would immediately be banned, because it facilitates too much crime. But because it exists, you can’t quite get rid of it. So, in terms of the Fed, the discussion has been about making sure you don’t have disruption. And this is what Chinese officials have repeatedly underscored with their two tier-model that they don’t want to disintermediate the banking system, I think some of this is a bit disingenuous to be honest with you, because when they say, it’s only going to replace M0. Well, M0 cash is very rarely used in China today, outside of rural areas, you just don’t see cash anymore in major cities. They’re rolling out the CNY. So naturally, that money, those transactions would have been processed on Alipay, or WeChat Pay, or maybe with a bank debit card, but probably with the first two. So ultimately, this process is about to some extent replacing, or at least providing an alternative to these things, not really cash. I think that’s going to be true all over the place. The Fed, there’s a lot of increasing political pressure on them to act. But I personally think that CBDCs really need to be proven a lot more than they are today. U.S. again, what’s the point, it’s not clear that CBDCs will be able to achieve all of what they’ve promised. And there is a lot of costs associated with it and huge risk renegotiating this line between the central bank and commercial banks, if you’re doing that in CBDC, it is very risky. You don’t know how many deposits are going to flee from the system. You don’t know what cyber risks are going to exist. I think in the U.S., you’ll see a lot more building on the existing dollar infrastructure with commercial banks and commercial bank digital currencies before you see the Fed moving itself. Jay Powell said we want to get it right. We don’t want to be the first. We’ll kind of hopefully learn from China.

Li Zengxin:

We don’t want to replace M0, we want to just replace the tech giants. Chuanwei, what’s your idea? You agree with Martin or not?

Zou Chuanwei:

I think payment regulation is a big story and an easy way and will play a part in this story. But if we look at the payment regulations, and to the central bank, the government introduced the antitrust regulations, and have monitored monopoly in the payment sectors.

Also, the central bank wants the payment business to go back to basics. You can send the embeds and consumer lending business into payment process. And you can send your payment app to see our mutual funds or exotic kinds of financial products. They also have data privacy and the regulations in the payment sectors. For eCNY, it’s just part of the story to make the market fairer and promote fair competitions.

Martin Chorzempa:

If I could follow up on that, I think he touches on something really important here, which is what is the future of the super apps in China, because all of the amazing convenience and services that Alipay and WeChat provide are based on a foundation of payments, that makes it really easy to transact within that ecosystem. And if you take the PBOC, and its word that it wants to link all of this, you might be forced to split this into a bunch of separate apps, and you no longer have super apps, but then does that actually change the substance of what’s going on? If they’re still connected on the back end, but then if you break the back end, you might be able to keep the super app together. But a lot of the transactions and data and infrastructure might be more controlled by the government, more in line with what with interoperability, data privacy and other kind of government priorities. And I think that’s probably more likely than splitting up the front end. But I think it’s a really important thing to consider, the government has to think, can they provide some sort of public infrastructure that still provides those back end benefits of that data being used for financial inclusion, credit scoring, and credit availability, without you know, you don’t want to just split it all up? You don’t want it too much of it to be private, and not to be shared. But you also don’t want it to be excessively shared in a walled garden that gives a big tech company too much monopoly power. And that’s going to be a really difficult thing for the PBOC to grapple with going forward.

Li Zengxin:

Because we also see big super apps coming up in Singapore and in Indonesia.

Sopnendu Mohanty:

I just want to say that they’re super apps from a design perspective. If they’re offering financial services, and it comes from the financial activity, they will be regulated. And once regulation comes in, interoperability becomes a key expectation. Unlike China, the account transfer relies on public infrastructure, which are designed to be interoperable, inclusive, not walled gardens. This whole strategic advantage of moving money within your walled garden gives an unprecedented advantage of many things you can do when you build a super app. Super apps are nothing super built on a superpower of controlling data. There’s no super app in that sense. But if it becomes democratized, interoperable, level playing field, you got to think about very different way about super app: true value and endpoint value.

I want to articulate an example why I think CBDC could be an interesting play in the short run. Other than the retail examples we took. It took me three years to connect Singapore domestic payment system, directly to Thailand’s domestic payment system. The only countries in the world have for the first time, which went live last month, two domestic payment systems connected point to point. In Singapore, we can pay each other by knowing each other’s mobile phone number or national ID. I don’t need to know underlying detail, as long as I received from any of your mobile phone number in Singapore, I can pay to it. It runs in banking well, by the way. Same thing happens for Thailand, something called PromptPay. What we have done, we have not connected those two systems, following all the international expectation of KYC&AML sensitive checking. So, somebody from Singapore or from Thailand can, based on that, by just knowing your mobile phone number and you don’t need to know anything on the line.

Today a typical transfer from Singapore to Thailand before this cutover was 15% to 20% for every $100 dollar sent, and World Bank also says the 8 % to 10% is the average cost. And a fintech today also matches up what they’re competing against. Otherwise, a big payment fintech could manage to send money from Singapore to Thailand around 5% range, the new system running on banking rail has come brought down the cost of transfer from 10% to between 3 and 5%. Huge drop, and dropping that from for every $100 you send, $15, for migrant workers, is a lot of money, now down to $1. So, my challenge to ask a challenge to ourselves, why is still a $3? Why can you be less than $1? So, what should we do to make the cost of transfer less than called sub dollar cost? My argument is dancer licensed CBDC is also CBDC if central banks can find a way to share the ledger, the cost of settlement can bring down the cost of cross-border transfer to sub dollar and some effects efficiency. So, having a whole CBDC and a shared ledger between central banks or multi-CBDC can remove that extra 2% to that, they have then the cost of transfer to less than $1, if that really happens, to Martin question what if you have CBDC, we got something solid finally.

Li Zengxin:

Right. So, the ledger under CBDC also solves the big KYC problem, right?

Sopnendu Mohanty:

Yes. Also the cost of transfer that the last hurdle, the last mile operating expenses which is settlement or other regulatory expectation.

Li Zengxin:

The next one goes to Chuanwei. Martin talked about risks of CBDC. In your eyes, are there any risks? Not just talk about benefits, are there any risk or benefit you want to single out?

Zou Chuanwei:

I think the risk is very limited and also controllable if you follow the solid monetary design and adopt very good technology. Professor Huang has said no very severe risk for conversion, a change between the deposit and CBDC, but I think the central bank has also funded instruments to manage this and the conversion rate.

For most countries, CBDC is 100% by deposit reserve. It will have very limited impact on monetary money supply. So, because actually it is a part of the percentage of bank deposits become CBDC, we know there is a multiplier effect for bank deposits, so there are very small effects of monetary contractions. But those are the tools for the central bank to offset these monetary contractions. My conclusion is if you follow very solid design and use very good technologies, and the benefit of CBDC is much larger than the risk.

Li Zengxin:

One last question before we close. I will ask all of you, how do you see cryptocurrencies? Is it doomed? Or still have a big future? Cryptocurrencies, including everything else from CBDC. We start with Sopnendu.

Sopnendu Mohanty:

I have a very simple answer. I don’t understand, I don’t buy and I don’t sign up. Because I have a simple logic that if you don’t understand, don’t think about it.

Zou Chuanwei:

Cryptocurrency will continue to exist. No matter what regulations introduced by countries around the world, it won’t be an effective instrument for payments, but it will find some true believers and followers. But no matter how many people adopt cryptocurrency, it is impossible for cryptocurrency to stabilize in value. It will continue to be a speculative asset.

Martin Chorzempa:

Yeah, I agree, I think they will continue to exist. And the most interesting piece to me is less how it functions as a currency, and more how it’s an experiment with governance mechanisms, where you have a decentralized method of managing the issuance of the currency of deciding what kind of programmability is there. You know, Ethereum is a fascinating example of governance and action, where you have both decentralized methods, and also a very centralized kind of leading figure who helps adapt the currency and whole like computational system, according to the needs. It’s going to be really interesting because the commercial banks CBDC stuff that’s all very centralized, that’s not really revolutionary. That is a bit less expensive than what exists now, maybe it’s a little bit more efficient, but then it’s not really worth the amount of time that spent talking about these subjects is my personal view. But what can be really revolutionary is if the governance mechanisms could be made to work in a more decentralized fashion. That’s really exciting. But it’s also extremely risky and so far, hasn’t worked out very well. We will need a little while.

Li Zengxin:

We are all playing safe and we think fintech is good, CBDC will have a lot of uses. Great discussion for today. Thank you, Sopnendu, Chuanwei, and Martin for all your excellent remarks and interaction with each other. And thanks all of our readers that have stay tuned with us. See you next time. Thank you again. Bye.