Company Index

UnionPay

UnionPay

NEWS

China’s cross-border e-commerce has increased significantly, with a 15.6% rise in 2023 to 2.38 trillion yuan, driving the cross-border payment industry. Government support is growing, issuing "Opinions" to promote efficient and low-cost cross-border fund settlement services. Rapid expansion and transformation in the payment landscape include significant participation from non-bank payment institutions and ongoing regulatory efforts on licensing and compliance.

Jul.20 2024 13:12 PM

- The Chinese payment industry is undergoing significant changes due to stricter regulations, including the People's Bank of China's (PBOC) "259 Document" which aims to curb illegal practices such as "code matching" by enforcing "one terminal per merchant" and "one code per terminal." In 2023, 50 payment institutions were penalized with fines totaling over 6 billion yuan, with major players like Alipay and Tenpay facing hefty fines for multiple violations.

- The crackdown on irregularities has led to a shift in the industry focus towards acquiring genuine merchants and expanding into real scenarios. Payment institutions are exploring new avenues such as overseas markets, cross-border payments, and providing technological services to merchants beyond payment processing. This transition is driven by the need to find new profit sources after losing income from previously prevalent practices like "code matching."

- The future regulatory landscape will be shaped by the implementation of the "Regulations on Supervision and Management of Non-Bank Payment Institutions," effective May 1, 2024. This regulation sets comprehensive and strict supervisory requirements across various aspects of payment services. Meanwhile, payment license numbers have been decreasing, with over 80 licenses canceled so far, mainly prepaid card licenses, reducing the number of payment institutions from over 270 at their peak to 188.

Mar.23 2024 12:54 PM

- Cecilia Skingsley, head of the BIS Innovation Hub, faced payment difficulties in Beijing due to the prevalence of QR code payments and the decline in cash and card acceptance.

- China's mobile payment adoption rate is 86%, leading globally, but foreign visitors struggle with QR code payments due to registration barriers and privacy concerns.

- The People's Bank of China is addressing these issues by promoting card acceptance, improving mobile payment services for foreigners, and ensuring cash as a backup option.

Jan.13 2024 13:14 PM

Increase signals better risk controls and enhanced safety and stability for the world’s largest provider of debit cards

Aug.24 2023 03:50 AM

China Merchants Bank, China Guangfa Bank and China UnionPay unit punished for violations in payment and clearing businesses

Jan.7 2023 05:47 AM

Russia’s biggest lender Sberbank is considering issuing cards that use the country’s Mir or China’s UnionPay payment systems

Mar.7 2022 15:41 PM

The Biden administration will seek a new round of trade talks with China. WeChat Pay ties up with UnionPay’s Cloud QuickPass

Oct.7 2021 15:39 PM

Tencent’s WeChat Pay now accessible by Cloud QuickPass, the mobile payment service of state-backed UnionPay; QuickPass users can now make payments by scanning WeChat Pay QR codes, and WeChat Pay users can do the same with QuickPass codes

Oct.1 2021 03:09 AM

China slaps a ban on Australia’s biggest grain exporter. Netflix plans to adapt “The Three-Body Problem.”

Sep.3 2020 09:20 AM

Financial services company teams with 17 banks in move to online credit and debit cards replacing physical cards amid pandemic demand for contactless transactions

Sep.2 2020 04:25 AM

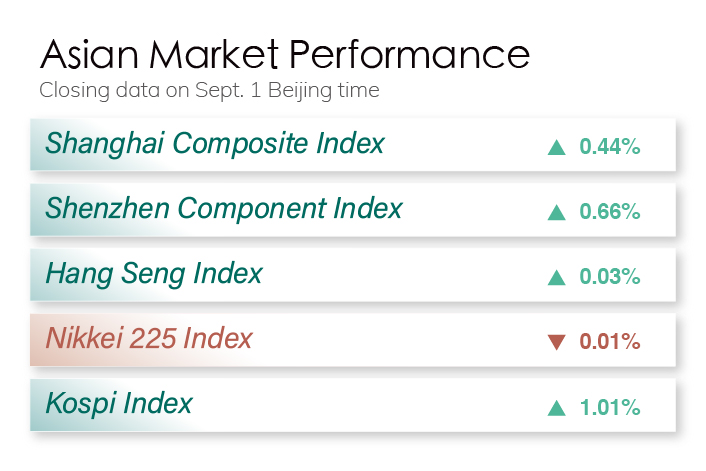

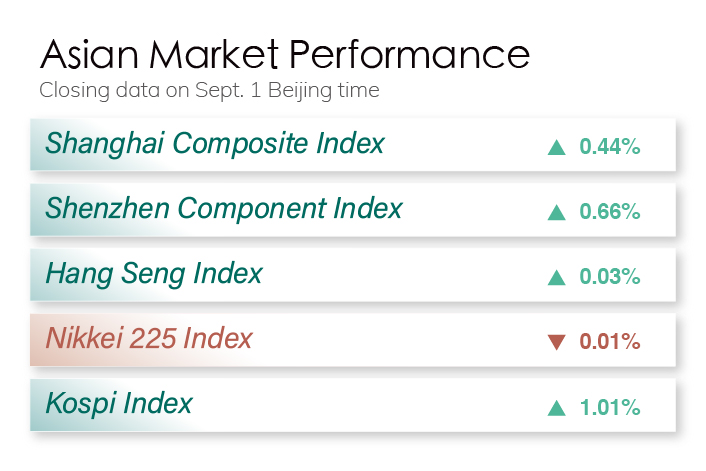

Manufacturing continues to recovery from pandemic; India overtakes Mexico with third-highest Covid-19 death toll; new tech export restrictions may affect more than TikTok

Sep.1 2020 23:35 PM

Cai Jianbo, who also serves as chairman of UnionPay International, has been promoted from executive vice president

Aug.31 2020 20:34 PM

While 3 rivals lure clients with high deposit rates, JD.com-backed new entrant plugs its electronic payment feature and ‘shake shake’ cash rewards for using it

Aug.12 2020 04:02 AM

‘Cash-out services’ allow individuals and businesses to tap their credit cards for cash loans by disguising the transactions as purchases that never take place

Jul.8 2020 20:42 PM

Apr.7 2020 12:22 PM

Tie-up will allow PayPal to ‘explore opportunities’ to expand its reach in China

Jan.23 2020 14:47 PM

Meanwhile, the country won't change its grain import quota despite trade deal with the U.S. And the central bank pays interest to payment providers

Jan.8 2020 09:21 AM

Tech giant has agreed to work with the state-owned bank card monopoly to make their QR code systems compatible

Jan.7 2020 20:14 PM

Central bank proposes unified QR code system that may threaten duopoly of Alibaba and Tencent while benefiting consumers and merchants

Sep.23 2019 06:12 AM

The interbank clearinghouse wants in on mobile payments. Dislodging the top two won’t be easy

Jul.4 2019 18:43 PM

- Jun 16, 2025 02:54 PM

- Jun 16, 2025 02:53 PM

- Jun 16, 2025 02:52 PM

MOST POPULAR

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute