Alibaba Partnership Holds Keys to Company Future, Ant Financial IPO

Last week’s announcement of the retirement of Jack Ma from his executive roles at e-commerce giant Alibaba Group Holding Ltd. has cast a spotlight on the partnership that underlies the company’s board, which will allow Ma to continue exercising influence long after his official departure.

At the same time, the partnership and its history are also highlighting legacy issues that must still be resolved before a highly anticipated IPO by Ant Financial, Alibaba’s former financial services unit whose own past is closely linked with how the original partnership came into being.

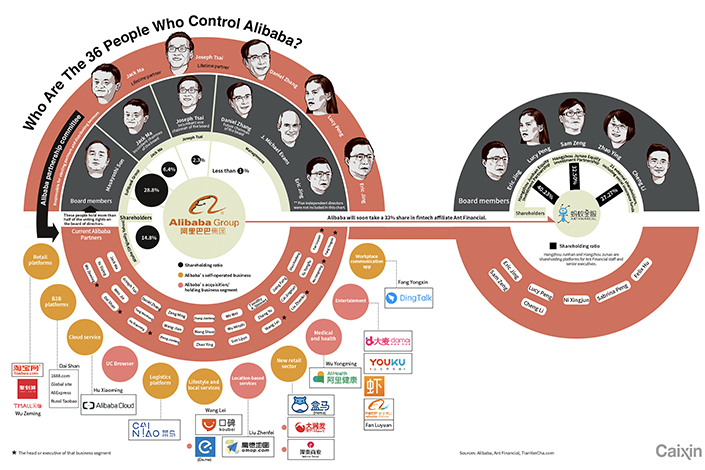

Ma’s announcement that he would retire on Sept. 10, 2019 from the company he co-founded 19 years ago made major headlines last week, as one of China’s best-known internet figures detailed his plan to pass his company to the next generation of leaders led by current CEO Daniel Zhang. Some observers noted Ma would continue to exert influence through his continued presence as a key member of a 38-person partnership that ultimately controls the company.

That partnership is entitled to control more than half of Alibaba’s board seats. The current board numbers 11, consisting of five independent directors, five of Alibaba’s top managers, including Ma, and a lone seat held by Masayoshi Son, chairman of longtime investor SoftBank. Due to its positioning above Alibaba’s board, the partnership is the company’s real strategic planning body.

“Jack Ma, through his far-sighted arrangements, has used the partnership to slowly distance himself from the business of operating Alibaba, even though he hasn’t lost his status, ability and benefits as the one who controls Alibaba,” a senior official at a financial firm told Caixin, speaking on condition of anonymity.

|

Click to enlarge |

Born in conflict

The Alibaba partnership was formed eight years ago as a direct result of a conflict involving Ant Financial at that time. In 2010, a clause in the agreement that bought internet giant Yahoo on as a major Alibaba investor five years earlier kicked in, giving the U.S. search firm an additional director’s position and leaving Alibaba’s top managers in a position of not controlling a majority of the board.

To shift the balance back, Ma and 17 other Alibaba founders gave up their “founding father” status at the company and rolled over their position into the partnership instead. Each of the partnership’s members serves three-year terms that can be renewed, with Ma and Executive Vice Chairman Joe Tsai designated as “continuity members.”

“Ma has said numerous times it’s important for a company to dilute the role of any one individual,” said an insider close to Alibaba’s top management. “He was particularly focused on the issue that no individual should have too big an influence on the company.”

Besides Ma, one of the company’s other most influential members is co-founder Simon Xie. Xie, who is also a member of the partnership, is the only individual outside of Ma who holds an Alibaba Group business license. His name almost always appears alongside Ma’s in most major Alibaba transactions, leading many market observers to call him Jack Ma’s “shadow.”

A primary catalyst behind the partnership’s formation was a contentious development that saw Ma secretly spin off Alibaba’s main financial services asset, the popular Alipay electronics payment service, into a separate company in 2009 and 2010. He transferred Alipay to another firm he controlled, Zhejiang Alibaba, without telling Yahoo and other major shareholder SoftBank, later saying he made the move due to unclear central bank rules that forbid foreign ownership of such financial companies.

That company went on to become Ant, a leader among a new generation of privately owned financial services firms that are now challenging traditional state-owned banks and other institutions that used to monopolize China’s financial sector. Ma ultimately settled the matter with Yahoo and Softbank for undisclosed terms that left Alibaba and Ant as separate companies.

At the time of its record-breaking $25 billion IPO in 2014, Alibaba disclosed that it ultimately planned to hold 33% of Ant, which would have given SoftBank and Yahoo successor Altaba Inc. 9.5% and 4.88% of Ant, respectively, based on their current holdings. Alibaba made a major step in that direction in February when it announced it would buy the 33% stake in Ant in accordance with the 2014 arrangement.

Alibaba hasn’t given a timetable for completion of the original 2014 arrangement. Analysts believe completion of that plan will pave the way for Ant’s long-awaited IPO, which is likely to be the biggest yet for any privately-owned Chinese financial services company.

Contact reporter Yang Ge (geyang@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas