The Fed on the Cusp of Worldwide Inflation

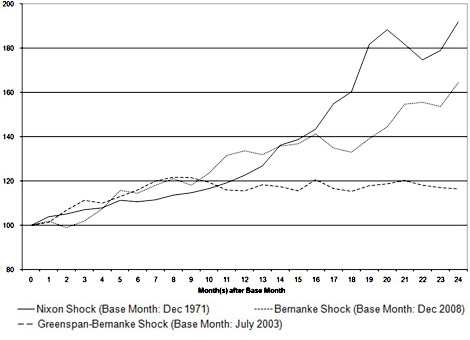

What do the years 1971, 2003 and 2010 have in common? In each case, an easy U.S. monetary policy was accompanied by a weakening dollar – as with the dramatic Nixon Shock of August 1971 when the other industrial countries were all forced to appreciate against the dollar. In all three cases, low U.S. interest rates and the expectation of further dollar depreciation led to massive "hot" money outflows from the United States. The world, then as now, is on a dollar standard where most goods entering foreign trade are invoiced in dollars. Thus in all three cases, foreign central banks intervened heavily to buy dollars to prevent further appreciations and losses of international competitiveness against their neighbors.

- PODCAST

- MOST POPULAR