Domino Risk Grips Zhejiang Bankers, Borrowers

(Wenzhou) – The Zhejiang government is scrambling to settle a credit crisis threatening banks and financial institutions that altogether issued about 6 billion yuan in loans to scores of companies.

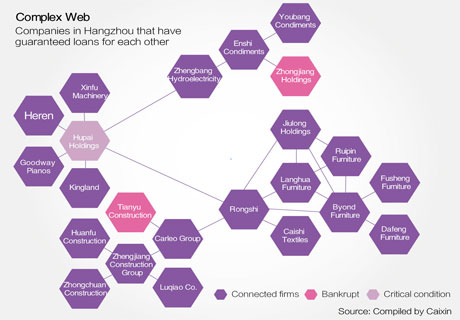

Sources say 62 companies, from furniture makers to import-export traders, have been affected to varying extents by the collapse late last year of Hangzhou-based property developer Tianyu Construction Co. Ltd.

|

The companies were financially linked to Tianyu through a province-wide, reciprocal loan-guarantee network. Tianyu's sudden failure raised the specter of a domino effect of defaults taking down every network participant and devastating their lenders.

- MOST POPULAR