China's Bullet Train Export Hopes Hit a Wall

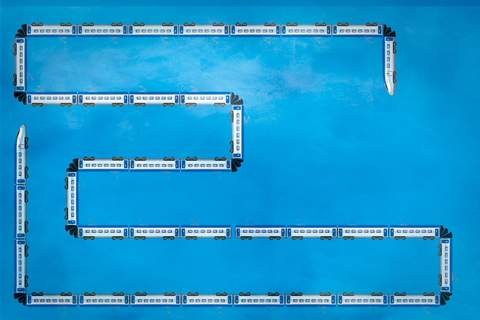

(Beijing) – China's plan to export bullet trains has hit a wall with the abrupt termination of a Chinese-American partnership that was supposed to build a high-speed rail line between a Los Angeles suburb and Las Vegas.

Railway developer XpressWest, which is controlled by the Las Vegas property developer Marnell Cos., said June 9 it had cut ties with China Railway International (U.S.) Group Ltd. (CRI), the U.S. representative of a consortium led by state rail system operator China Railway Corp. (CRC), nine months after they unveiled plans for the 298-kilometer, US$ 12.5 billion railroad.

- PODCAST

- MOST POPULAR