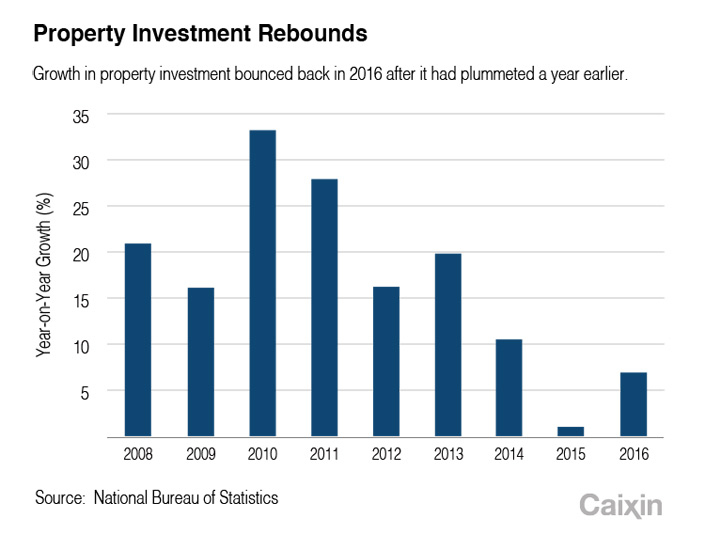

China Property Investment Increases 6.9% in 2016

(Beijing) — China’s property investment rebounded in 2016 as easier access to credit prompted developers to increase investment, and also gave homebuyers and speculators incentive to pour money into the market.

Property investment increased 6.9% year-on-year to 10.26 trillion yuan ($1.5 trillion) last year, bouncing back from 1% growth in 2015, the National Bureau of Statistics (NBS) said on Friday.

The figure was announced along with last year’s gross domestic product (GDP). China’s economy grew by 6.7% in 2016, the slowest growth since 1990 but within the government’s target range of 6.5% to 7%.

|

However, easier access to credit led homebuyers and speculators to rush into the property market in the country’s biggest cities. In Shenzhen, one of the most unaffordable cities in the country, new-home prices were 36.9 times the average annual net income in the city in the first three quarters of 2016, up 49.4% compared with the same period in 2015, said E-House China R&D Institute.

But the problems in small cities and towns have not been solved. Inventories of unsold apartments, which are mostly in third- and fourth-tier cities, fell only a meager 0.03% to 695.4 million square meters in 2016.

Both central and local governments have attempted to cool the overheated market, worried about the economic impact should the housing bubble burst. Since late September, more than 20 cities have imposed rules on home purchases, with banks tightening loans to both developers and individual buyers.

“Houses are for habitation, not speculation,” China’s top leaders said in a statement released in December after the 2016 Central Economic Work Conference, an annual three-day meeting of China's leadership to set the national economic agenda.

Since the introduction of the cooling measures, growth in both home prices and sales has decelerated in major cities. Zhao Yang, Nomura’s chief China economist, expects the growth in the real estate market to continue to slow in coming months, putting a drag on the economy.

“Fiscal policy will remain expansionary to boost infrastructure investment and fill the void left by the cooling property market, but we do not expect it to completely offset this drag,” Nomura said in a note.

The financial services company estimated that property sales will see a high single-digit decline in 2017, while prices will decline slightly by a low single-digit percentage, said Elly Chen, an analyst at Nomura.

NBS head Ning Jizhe said during a news briefing on Friday that he was confident China’s property market will maintain “healthy development” in 2017.

With regard to the stockpile of empty apartments sitting idle in small cities, Ning said that when formulating housing regulation in the future, the government will take local conditions into consideration.

Contact reporter Chen Na (nachen@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas