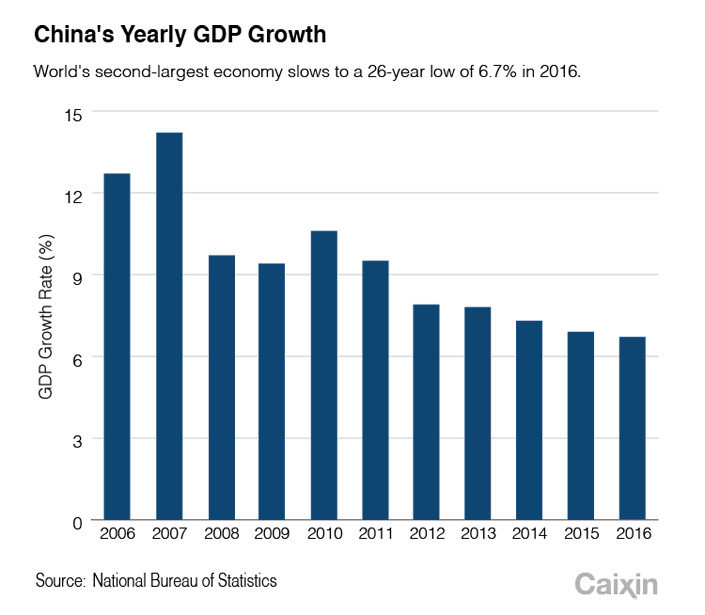

China Slowdown Expected to Continue as 2016 Growth Slips to 6.7%

(Beijing) — Growth in the world’s second-largest economy weakened last year to 6.7%, the slowest GDP expansion rate in 26 years, according to official data released Friday.

Many analysts expect China's economy to continue losing steam this year, a forecast underscored by government policymakers who in December vowed to elevate financial-risk defensive measures “to an even more important position” and step up efforts to “prevent and curb asset bubbles.”

Last year's decline to 6.7% from a 6.9% growth rate in 2015 marked the weakest expansion pace since gross domestic product (GDP) growth hit 3.9% in 1990. And it was the sixth straight year in which growth slowed in China, reflecting Beijing’s effort to shift the growth emphasis to domestic consumption and services rather than exports and government-led investment.

|

The 2016 rate fell within the government’s official target range for the year of between 6.5% and 7%, said Ning Jizhe, head of the National Bureau of Statistics (NBS), at a Beijing news conference Friday.

In a sign that the government's slowdown strategy is working, NBS said retail sales climbed 10.4% in 2016 year-on-year. In December alone, retail spending jumped 10.9%.

Fix-asset investment — a gauge of mainly government infrastructure spending — expanded 8.1% last year from 2015, while industrial output grew 6%, the NBS said.

The government has not said whether it will set an annual GDP target for 2017.

Top policy makers said in a statement after the Central Economic Work Conference last month “maintaining stability” was one of the government's goals for the coming year. But the statement did not include the pledge to “sustain economic operations within a proper range,” which has led many observers to believe that the government may have decided to drop a target for growth.

Chinese leaders for years have been saying they are willing to accept slower, better-quality economic growth, following breakneck expansion and double-digit GDP growth rates seen in many of the preceding years.

The government has thus been pushing for reforms such as reducing corporate-debt ratios and cutting excess manufacturing capacity, particularly in the steel and coal sectors.

Louis Kuijs, an economist with research firm Oxford Economics in Hong Kong, said China's GDP growth pace may continue to slide this year in the face of potential trade friction with the United States under President Donald Trump and Beijing’s focus on containing financial risk.

The government's risk control efforts included tightening measures by many local authorities since the third quarter of 2016 to prevent a housing market bubble by raising down-payment minimum requirements and mortgage interest rates. The moves followed a surge in housing prices earlier last year.

“We expect GDP growth to ease to 6.3% this year due to a harsher climate for China’s exports to the U.S., slower real estate investment and, importantly, a change in the tone of policymakers toward somewhat less emphasis on growth,” Kuijs said in a research note.

Brian Jackson, a Beijing-based analyst with the research firm IHS Markit, said the government’s initiative to cut manufacturing overcapacity through 2020 will “continue to present headwinds for overall growth.”

These and other government economic policy initiatives could be implemented at a faster rate later this year after an expected reshuffling of central government leaders, Jackson wrote in a report. At that time, he said, President Xi Jinping “will have an opportunity to further shift central leadership closer to his preferred reform focus and pace.”

"While expectations are currently limited to China continuing a gradualist approach, China's best course of action would be to surprise on the upside by not only reaffirming its commitment on paper, but also pursuing a clearly faster pace of implementation starting during 2017,” Jackson said.

GDP growth in the fourth quarter of 2016 edged up to 6.8% from 6.7% in the January-through-September period, slightly higher than a median 6.7% gain forecast offered by economists surveyed by Bloomberg LP.

Analysts attributed stronger-than-expected performance in the fourth quarter to faster expansion of the service industry rather than any resurgence for traditional manufacturing. But they're not convinced this trend will extend into 2017.

Some analysts cited last year's boom in banking lending for the economy's improvement late in the year. The central bank said lenders issued a record 12.65 trillion yuan ($1.85 trillion) to nonfinancial borrowers last year.

Kuijs estimated the nation's total outstanding credit, which includes bonds issued by local governments, grew 16.1% in 2016 year-on-year compared to 15.2% in 2015. And government, commercial and consumer debt levels rose to around 260% of GDP at the end of 2016, up from 250% a year earlier.

Contact reporter Fran Wang (fangwang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas