Smartphone Maker Xiaomi Joins Elite Club of Chip Developers

(Beijing) — Xiaomi Inc. has unveiled a self-developed central chip to power some of its models, as the smartphone maker tries to differentiate itself from a crowded field of rivals whose models look and perform similarly in part due to use of chips supplied by third parties.

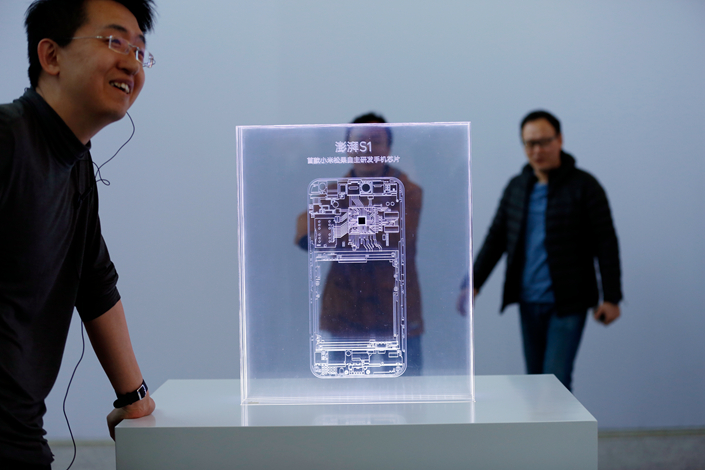

Xiaomi took three years to develop the chip, the Pengpai S1, which was formally unveiled on Tuesday alongside a new smartphone model, the Mi 5C, that will incorporate the technology. That phone will sell for 1,499 yuan ($218), generally considered a low to midrange price for smartphones.

The move makes Xiaomi a new member of a relatively small group to develop their own central chipsets, alongside global leaders Apple Inc. and Samsung, as well as domestic rival Huawei Technologies Co. Ltd. Most other manufacturers use chips supplied by third parties such as U.S. giant Qualcomm Inc., Taiwan’s MediaTek and China’s own Spreadtrum.

Xiaomi co-founder and CEO Lei Jun acknowledged the big risks involved with such chip development, but said such a move was critical for any brand’s long-term development.

“People have already told me that making a smartphone chip costs 1 billion yuan just to get out of the gate, and more than $1 billion by the time you get to the finish line,” he said.

Xiaomi has had strong state support in the effort, reflecting China’s determination to build a world-class microchip sector. Despite being the world’s largest consumer of such high-margin chips that power items as diverse as smartphones and home appliances, China actually imports most of its products from foreign companies like Qualcomm, Samsung and PC chip giant Intel Corp.

In a bid to build up the industry, Beijing has backed an aggressive field of domestic companies that have embarked on a multibillion-dollar global buying spree for foreign chip-making technology.

In Xiaomi’s case, the company got help from state-owned Datang Telecom Technology Co. Ltd., which supplied some of the basic technology for the new chip’s development through a 100 million yuan licensing deal that also included a strategic cooperation agreement.

“Technology isn’t created in a vacuum. It starts with the basics and develops one step at a time from there,” said Sheng Linghai, an analyst at Gartner, explaining the significance of the Datang tie-up. “Perhaps without the (Datang) platform, it would have been very difficult for Xiaomi to come up with an initial chip structure.”

Xiaomi is rolling out the chip as it attempts to come back from a weak performance in 2016. The company was once one of China’s hottest technology names, rising rapidly to become the nation’s top smartphone brand in 2015, just five years after its founding. But it stumbled badly last year due to stiff competition at home, and slow progress on its global expansion.

Lei Jun has said that 2017 will be a year of rebuilding, with a goal of companywide sales of 100 billion yuan.

Contact reporter Yang Ge (geyang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas