In China, Private Funds Outrun Others in First Six Months

Private funds in China have outperformed mutual and index funds during the first half of this year — at least among the top performers in each category.

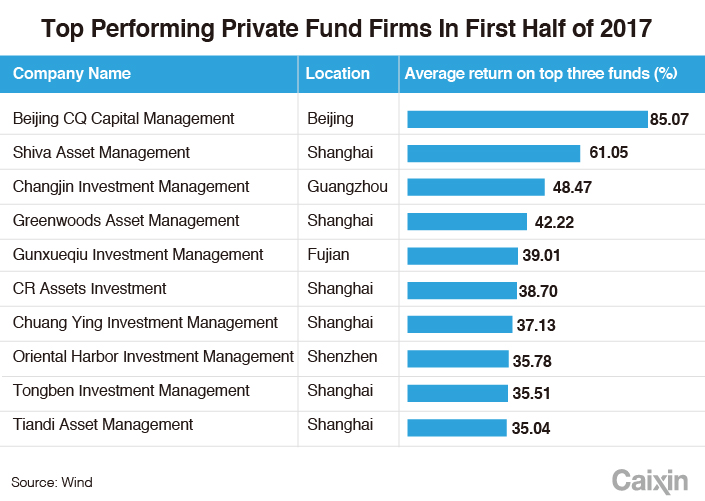

During the first six months of 2017, the country’s best-performing private fund firm was Beijing CQ Capital Management Co., according to financial data provider Wind. The average return of Beijing CQ’s three best-performing products reached 85.07%, much higher than 61.05% scored by the runner-up Shiva Asset Management Co.

In comparison, the top-performing mutual fund, managed by E Fund Securities, achieved a return of 34.75% from January to June.

The CSI 300 Index, which tracks the share prices of 300 companies on China’s two major stock exchanges, rose 10.78% during the same period.

|

As of the first quarter, three of Beijing CQ’s funds collectively become Hubei Golden’s largest investor with 21.5 million shares.

Hubei Golden is seen as a beneficiary of a new economic zone just south of Beijing. Xiongan New Area, which has been compared to the Shenzhen and Shanghai special economic zones, is expected to boost the economic development of the Beijing-Tianjin-Hebei region.

Dozens of companies including Hubei Golden saw their shares rise by the daily limit of 10% after China announced the new economic zone, as investors believed the companies would benefit from new businesses brought about by the economic initiative.

Private funds raise money, generally from no more than 200 designated companies or well-off individuals, and invest it in securities, financial derivatives, stakes in unlisted firms and other assets. Unlike mutual funds, which are available to the public, private funds usually target wealthier investors with a higher tolerance for risk.

Contact reporter Liu Xiao (liuxiao@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas