Norway’s Salmon Run Into China Spawns Success

Although China has a voracious appetite for salmon, what you might really be eating here is rainbow trout, according to an official from the Norwegian Seafood Council.

“China is currently producing a similar species to Atlantic salmon, the rainbow trout. This is mainly produced in freshwater bodies and not in the ocean like Norwegian salmon,” said Sigmund Bjørgo, director of the Mainland China and Hong Kong department at the Norwegian Seafood Council.

The issue of rainbow trout being sold as salmon in the country is one of the issues that Bjørgo discussed with Caixin in a wide-ranging email interview on his country’s seafood industry and how it is growing in China.

“We see a lot of rainbow trout being sold as salmon (in China). … The first thing I notice is the price, which is too low to be Atlantic salmon. It also has a different color, and sometimes they market the product as Chinese-produced salmon. … We find this unfortunate, as the product isn’t salmon.”

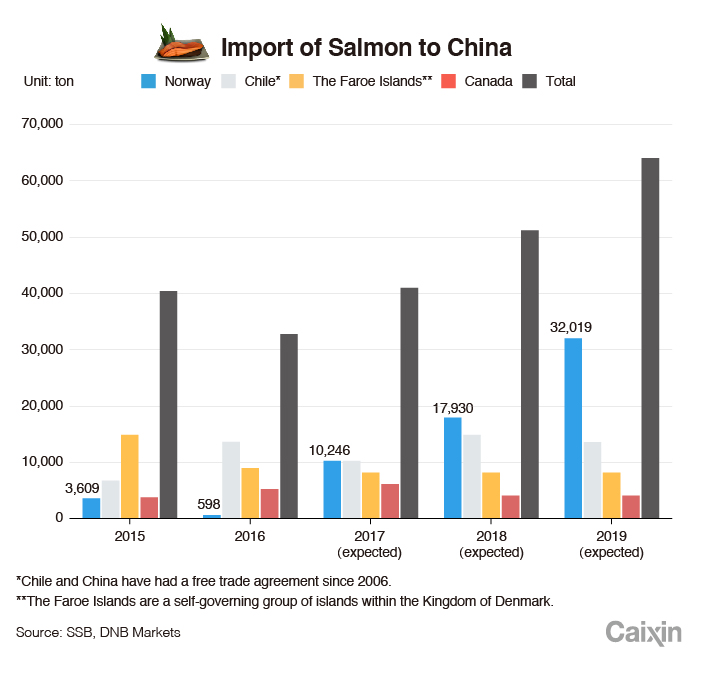

But it is difficult to weed out the imposter salmon, given problems with tracing the origins of fish and livestock. China currently imports salmon mainly from Chile and the Faroe Islands, a Danish self-governing archipelago about 200 miles north of Scotland. But soon, it is estimated that half of the tender, pink fish meat that dominate the sashimi plates in China will come from the cold ocean off the coast of Norway.

“Norway has a very good habitat for salmon, with a long coastline and cold and clean water, which makes it optimal for salmon production,” said Bjørgo, whose organization works with Norwegian fisheries and the aquaculture industry in order to develop markets for Norwegian seafood.

Norwegian bank DNB estimates that the Scandinavian country’s current salmon market share in China of 2% will jump to 50% by 2019. But what’s fueling this leap?

“Chinese mainly consume salmon raw, like sashimi and sushi, and prefer consuming the best quality — that is, chilled, not frozen, salmon,” Bjørgo said.

“Norway has very good logistics compared to other countries. If there are no delays, the Norwegian salmon can arrive in China in three to four days. No other country can currently transport chilled salmon faster than this.”

The two countries are also planning to start negotiating a free trade agreement (FTA) this year. After Norwegian Prime Minister Erna Solberg’s visit to China in April paved the way for deeper trade ties. Solberg signed a seafood trade agreement that allows Norway to export nearly $1.45 billion worth of salmon by 2025. This can be seen as the first step in cementing the Scandinavian country’s position in the Chinese market, which currently imports only an estimated $300 million worth of salmon a year.

Technological cooperation related to salmon has also entered the mix. China’s Wuchang Shipbuilding Industry Group, a subsidiary of China Shipbuilding Industry Co., is partnering with Norwegian fish farm company SalMar ASA to build six deep-sea offshore fish farms worth a total $300 million. Made in China, they will be in Norwegian waters in the Atlantic Ocean.

These aquafarms expect to breed 8,000 tons of salmon every 14 months, and what is unusual about them is that that they do not need to be near the shore.

|

Ocean Farm 1, which was recently completed in Qingdao, Shandong province, is currently being transported to Norway. But would China ever grow its own salmon?

“I think there are many challenges to overcome before China can produce Atlantic salmon,” Bjørgo said. “It will most likely have to be land-based, where you have high costs in pumping water, temperature controls, expensive tanks and buildings, etc.”

“However, at the same time, the expression ‘never say never’ is a wise one,” he added.

|

A worker looks at Ocean Farm 1, an offshore ocean farming facility being delivered by China to Norway, being towed in Qingdao, Shandong province, on June 14. Photo: IC |

In an email interview, Bjørgo explains Norway’s current “salmon run” into the Chinese seafood industry.

How does Norway’s fishing industry, specifically that surrounding salmon, operate? Who besides China are Norway’s big markets?

Salmon farming is actually a technologically complicated industry due to salmon being a demanding species and very particular about of its surroundings. Water temperature is crucial; salmon can’t stand waters that are too warm, and it grows slowly in cold water. Feeding is important; there is a need to make the feed efficient and sustainably produced. In Norway, the salmon industry controls the value chain from eggs and hatching, through broad stock. Following the first phase of the salmon’s life cycle in fresh water, it is set in the ocean and starts its growth phase. After one and a half to two years, the fish is ready for harvest in modern processing plants.

Actually, China is not among the largest markets for salmon. China consumes around 70,000 to 80.000 tons annually, which accounts for 3.5% to 4 % of the global production of Atlantic farmed salmon. The United States of America is the largest salmon market in the world, followed by Japan. However, in Japan they also consume a lot of their own wild salmon, which they cook and don’t eat as sashimi. For Norwegian salmon, the European market is the largest. EU countries buy around two-thirds of Norwegian salmon. The major European markets are Poland, France, Germany and Spain.

What has given Norway such a competitive angle in the ability to export salmon internationally?

More than 40 years ago, some Norwegian pioneers started experimenting with salmon farming. In the first years, it was low technology. The development was based on trial and error. They caught young salmon in rivers, kept them in simple cages and gave them feed based on leftovers from the other fishing industries like cod. Over time, Norway has been able to develop an advanced salmon farming industry and has invested heavily in related technology and the management of resources. Breeding, feeding, hatching, equipment, and disease control are all important technologies, which have been developed together with the Norwegian salmon industry and its suppliers. In addition, Norway has a very good habitat for salmon, with a long stretched coastline, and cold and clean water, which makes it optimal for salmon production.

|

Consumers buysalmon in an imported-goods shopping center in Zhengzhou, Henan province, on June 28. Photo: Visual China |

Chinese mainly consume salmon raw, like sashimi and sushi, and prefer consuming the best quality; that is, chilled, not frozen, salmon. All chilled salmon in China is airborne from other countries. For airborne salmon, Norway actually has very good logistics compared to other countries. If there are no delays, the Norwegian salmon can arrive in China in three to four days. No other country can currently transport chilled salmon faster than this. As for Chilean salmon, they first fly it from South America to Europe, then fly the salmon from Europe to China, and their salmon takes almost a week to arrive to China.

What is the environmental impact of Norway’s salmon aquaculture industry?

All food production leaves some kind of environmental footprint. This is something the Norwegian seafood industry and government are very aware of, and they are doing their best to reduce the footprint to its minimum. Strict environmental management and research lays the framework in how the industry operates and grows. Production has to grow in a sustainable way ensuring minimal impact on the environment. Compared to other animal production like pork, beef and chicken, Norwegian salmon leaves far less of an environmental impact on important matters like carbon dioxide emissions, use of fresh water and medicines. There are few, if any, other farmed seafood that have less of an environmental impact than Norwegian salmon. This is something the Norwegian industry is very proud of, and is continuously working on limiting its environmental footprint.

What does technological cooperation between Norway and China, like the construction of the ocean farms, mean for industrial fishing in the future?

SalMar’s ocean farm is a highly innovative development in the fish farming industry. Wuchang Shipbuilding Industry Group and other sub-suppliers have spent many years in collaboration with Norwegian technology research companies in order to be able to develop the ocean farm. The scheduled arrival of the ocean farm in Norway is planned in August. I look forward to closely following the project when they actually start producing salmon. Other companies are also developing other highly innovative concepts for the ocean farming of salmon. The idea is to be able to do salmon farming farther out in the ocean. Currently, the salmon farms are sheltered behind islands along the coast. This limits the available space for salmon farming. If we can go farther out into the big ocean, where the ocean waves and weather are much harsher, it will open up for an increasing amount of production areas. This can have a major impact on the global salmon industry and the increased production of salmon.

How does the free trade agreement between China and Norway affect the seafood trade?

All measures to facilitate free market access and trade are in the big picture positive. Norwegian salmon has experienced market access challenges in several countries over the past 20 years, in the EU, the USA, China, Russia and Indonesia, to mention a few. The seafood industry is very concerned about market access, as Norway exports more than 95 % of the seafood it produces. Therefore, seafood is often an important part of the free trade agreements Norway negotiates with other countries. The entire Norwegian seafood industry is hoping for an FTA with China, and the negotiations will start after this summer.

The current import tariffs in China on most Norwegian seafood species is 10%. Chile has an FTA with China, and thus has no tariffs on salmon. This gives them a competitive advantage. With an FTA between Norway and China, we hope for no tariffs on Norwegian seafood. It can both supply Chinese consumers with high-quality Norwegian seafood at a lower price, as well as allow Norwegian seafood to become more competitive against other countries. This will give an even higher growth phase for Norwegian seafood export to China.

In the future, could we expect China to replicate Norway’s fishing industry domestically? If so, what would this mean for Norwegian industries linked to fishing?

China is currently producing a similar species to Atlantic salmon, the rainbow trout. This is mainly produced in freshwater bodies and not in the ocean like Norwegian salmon. We see a lot of rainbow trout being sold as salmon (in China). … We have seen rainbow trout in China sold under the product name “salmon.” The first thing I notice is the price, which is too low to be Atlantic salmon. It also has a different color, and sometimes they market the product as Chinese produced salmon. ... We find this unfortunate, as the product is not salmon.

I think there are many challenges to overcome before China can produce Atlantic salmon. The natural conditions are different. Salmon needs stable and cold temperatures, the right salt level, clean water, and on top of this, there are a lot of biological challenges in salmon production. Norway has many of these conditions “for free” as the Norwegian coastline is most suitable. For China to produce Atlantic salmon, it would most likely have to be land-based, where you have high costs in pumping water, temperature controls, expensive tanks and buildings, etc. However, at the same time, the expression “never say never” is a wise one. China has in the past shown its capability to develop complicated products, so who knows what the future will bring.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas