LDK Solar Stares Into the Abyss

The future of debt-laden LDK Solar, once a star of the global photovoltaic industry, looks increasingly precarious as creditors owed almost $8 billion remain locked in a standoff with court-appointed administrators trying to find investors to buy parts of the group and save it from liquidation.

Almost two years after a court in Jiangxi province approved bankruptcy reorganization proceedings for LDK Solar’s four biggest subsidiaries, which hold most of the group’s 51.6 billion yuan ($7.8 billion) of debt between them, hopes are fading that the company will be able to rise from the ashes.

Some of China’s biggest banks, including China Development Bank, the country’s top policy bank, and China Construction Bank, one of the Big Four state-owned commercial lenders, are opposing the latest reorganization plan. The plan would see the group’s main subsidiary, solar wafer producer Jiangxi LDK Solar Hi-Tech Co. Ltd., sold to a private investment firm with suspected links to LDK Solar’s founder and former chairman, billionaire Peng Xiaofeng.

Creditors have rejected the two options put forward by the potential investor, Chengdu Busheng Investment Co. Ltd. — a debt-to-equity swap or a cash offer that promised to pay 94% of the purchase price in 10 years’ time.

The banks claim the financial terms of both options are unfair and would see most creditors, mainly banks who made unsecured loans, receive less than 1% of the money they are owed, far less than that received by the creditors of other companies in the industry.

Representatives of bank creditors that Caixin spoke to say they want the privately owned company to be liquidated. But with no other investors on the horizon, they worry that one way or another they will be forced to accept the plan put to them by the administrators who were appointed by the Intermediate People’s Court in Xinyu, the eastern city where LDK Solar is based. They fear they will either be pressured by the local government, which wants to save the company, the taxes it pays and the thousands of people it employs, or that the court will issue a compulsory execution order to force them to vote for the Busheng Investment deal.

The standoff is the latest example of a battle that is increasingly being played out across China between creditors on the one side and local governments on the other, as they attempt to grapple with the consequences of the country’s massive buildup of corporate debt over the past decade and deal with zombie companies. Banks and other creditors are being pressured to keep failing companies afloat as local governments worry about the negative impact of any collapse on social stability and on the local economy — both in terms of jobs lost and slower economic growth.

“If banks want to stay in business, they have to build good relationships with local governments. When local governments ask banks not to reduce credit, the banks follow orders if they know what’s good for them,” a credit manager with a state-owned bank that lent money to LDK told Caixin, speaking on condition of anonymity.

Zombie Companies

Local governments are also dominating the reorganization process even though they have little experience or expertise in dealing with insolvent enterprises, often paying little heed to the interests of creditors.

The provincial government of the northeastern province of Liaoning fought a long and often acrimonious battle with the creditors of Dongbei Special Steel, a state-owned specialty steelmaker, which owed more than 55 billion yuan, including 44 billion yuan to the banks. Creditors told Caixin their interests were being ignored as desperate officials sought to save the company, which was finally bailed out in July.

These high-profile corporate collapses also expose the shortcomings of the Bankruptcy Law that came into effect in 2007 and the unequal treatment of creditors, with courts often working closely with local authorities to work out solutions in their favor. Court-appointed administrators also tend to be made up of officials from local government agencies, leaving creditors skeptical of the process and concerned that they will be treated unfairly.

|

LDK Solar was set up in 2005 by entrepreneur Peng Xiaofeng and became one of the world’s biggest players in the solar power industry, listing on the New York Stock Exchange in 2007. It had more than 20 subsidiaries in a complex shareholding structure, although most of its assets were in four units — solar wafer producer Jiangxi LDK Solar Hi-Tech Co. Ltd., solar cell manufacturer LDK Solar Hi-Tech (Xinyu) Co. Ltd., photovoltaic silicon maker Jiangxi LDK PC Silicon Technology Co. Ltd. and polysilicon supplier Jiangxi LDK Solar Polysilicon Co. Ltd.

Overcapacity Killer

Solar power was named as a strategic emerging industry by the government and enjoyed a series of favorable policies, including subsidies. The industry boomed and banks showered solar companies with loans as they supported the aggressive expansion without paying enough attention to the risks. But as capacity expanded, the industry began to suffer from serious overcapacity. As the glut worsened and the impact of the global financial crisis spread, prices fell, profits sank and debts soared.

“The simple truth is that banks want to lend to industry champions,” said an employee of another bank that is also a creditor of LDK. “But that means they sometimes make poor decisions about a company’s actual business situation, which shows they have insufficient risk control capacity and foresight.”

LDK Solar was one of several solar product manufacturers to hit the skids. Other casualties were Suntech Power, Shanghai Chaori Solar Energy and Baoding Tianwei Group

When LDK Solar got into trouble in 2012, the authorities in Jiangxi province sprang into action to support the company. Although the group had cut at least 8,000 jobs amid the industry downturn, it still employed around 4,500 people in Xinyu city and was a major taxpayer and contributor to the local economy. The Bank of Jiangxi was drafted to organize a 1 billion yuan syndicated loan as a “rescue loan,” and the provincial government set up a 2 billion fund to help LDK Solar subsidiaries repay their debts to keep their credit records clean.

In October 2012, Hengrui Xin Energy Co., a company in which the Xinyu City State-owned Assets Supervision and Administration Commission, a government department, held a 40% stake, bought a 19.9% stake in LDK Solar’s U.S.-listed company for $23 million. In November 2013, China Development Bank (CDB) led 10 other banks in a 2 billion yuan three-year loan to the LDK Solar group at a 10% discount to the three-year benchmark lending rate, which was then at 6.15%.

Caixin has calculated that banks granted LDK Solar subsidiaries more than 5 billion yuan in “rescue loans” up until September 2016, pressured by the government to shore up the company.

“Banks kept giving these blood transfusions to LDK Solar, but it just prolonged the agony and its eventual demise. It also left the financial institutions more exposed to credit risks,” said the first employee of a bank creditor.

In August 2013, the provincial government convened a meeting where it urged commercial banks to “properly” deal with overdue interest payments to avoid staining the group’s credit record, people with direct knowledge of the matter told Caixin.

Local financial regulators visited each bank from door to door, begging for favors to rescue LDK Solar,” an employee from a creditor bank told Caixin. “But these rescue loans created even more risk and the support from the banks only fueled more reckless expansion, he said.

Credit Hierarchy

China Development Bank, a big supporter of the solar industry given its strategic importance under the government’s industrial policy, is the group’s biggest individual creditor with outstanding loans of 7 billion yuan, people familiar with LDK Solar’s financial situation told Caixin. China Construction Bank is owed 5 billion yuan and Agricultural Bank of China is owed 3 billion yuan. Other lenders exposed to the company include China Merchants Bank, China Minsheng Bank and Bank of China.

Nearly 80% of LDK Solar’s loans were unsecured, which means no specified assets were put up as collateral. Consequently, the banks rank far down in the hierarchy of creditors and will be among the last to get their money back in any reorganization or if the company is liquidated.

The government’s efforts to save LDK Solar proved futile. In 2014, the U.S.-listed unit entered bankruptcy proceedings after defaulting on a bond. Although the company emerged from bankruptcy in 2015, it was eventually liquidated in 2016.

The Xinyu Intermediate People’s Court put LDK Solar’s China companies into bankruptcy reorganization proceedings in November 2015 after two small creditors, Xinyu City Chengdong Construction and Investment Corp. and China National Grid (Jiangxi Province) Corp. Ganxi Power Branch, applied for the company to be declared bankrupt for nonpayment of debt and project fees of 281.6 million yuan and an unpaid electricity bill of 53.5 million yuan.

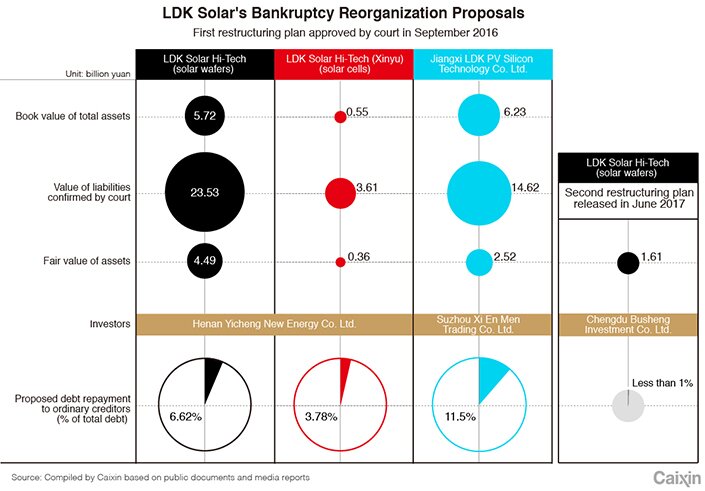

LDK’s three main subsidiaries, which held most of the debt and assets, were ordered to undergo reorganization: solar wafer producer Jiangxi LDK Solar Hi-Tech, solar cell manufacturer LDK Solar Hi-Tech (Xinyu), and photovoltaic silicon maker Jiangxi LDK PV Silicon Technology. Their combined debts amounted to 41.7 billion yuan, 80% of the group’s total. About two-thirds of this debt was held by just 12 banks. The book value of their combined assets amounted to 12.5 billion yuan. A fourth subsidiary, polysilicon supplier Jiangxi LDK Solar Polysilicon, was ordered to be liquidated.

The court appointed administrators to oversee the reorganization. The administrators were mostly associated with or employed by the local government. For example, the director of the administrators committee for Jiangxi LDK Solar Polysilicon was Xu Shaorong, the deputy party secretary and management committee director of a high-tech industrial development zone in Xinyu.

Administrators released their first reorganization plan in August 2016 and creditors were given just one week to study the documents before voting whether to accept it.

Under the plan, Henan Yicheng New Energy Co. Ltd., which supplies crystalline silicon cutting material to wafer makers, would buy 100% of Jiangxi LDK Solar Hi-Tech and LDK Solar Hi-Tech (Xinyu) for a total of 2.83 billion yuan — paying 702 million yuan cash and raising the rest by issuing new shares. Ordinary unsecured creditors would be repaid 6.6% of the debts owed by Jiangxi LDK Solar Hi-Tech and 3.8% of the debts owed by LDK Solar Hi-Tech (Xinyu).

Up In Arms

The Suzhou-based subsidiary of SN Materials, a South Korean manufacturer of solar materials, put in a bid to buy LDK PV Silicon. Under that plan, 40 banks — who between them were owed 11.1 billion yuan — would take a combined 30% equity stake in a new company and would get back 11.49% of their loans.

Creditors were up in arms, complaining that the administrators had not discussed the proposal with them and that they were only given one week to look at the plan before voting on it. The law allows for a period of up to 30 days from the day creditors receive the proposal until a vote is held. Some banks were also angry that at the last minute, the administrators had reduced the value of the three subsidiaries’ assets by about a third, which meant unsecured creditors had even less chance to recoup some of their losses.

There was some justification for their criticisms, according to Wang Zhizhou, a research fellow at the University of Washington School of Law in the US. “Creditors should be given sufficient time and information to review the reorganization plan and they should be entitled to more rights to supervise the asset valuation process,” Wang told Caixin.

Under China’s Bankruptcy Law, the court has the power to force creditors to accept a reorganization proposal and the Xinyu Intermediate People’s Court did just that in September 2016, approving the restructuring proposals through a compulsory execution order.

But the plan got dealt a fatal blow in February 2017 when Henan Yicheng pulled out, citing changes in the “general environment” and in regulatory policies, according to a statement filed to the Shenzhen Stock Exchange in February. The company did not give more details, but there has been speculation that it had lost confidence in LDK Solar. The bid for PV Silicon also fell through, putting administrators back at square one.

The hunt continued for new investors and in June the administrators put forward a second reorganization proposal for Jiangxi LDK Hi-Tech from Chengdu Busheng Investment. No investors have been found for LDK Hi-Tech (Xinyu) or for LDK PV Polysilicon.

Busheng gave creditors two options. The first was to buy Jiangxi LDK Hi-Tech for 1.7 billion yuan with an initial payment of 100 million yuan and the remainder paid in 10 years’ time. The second was to restructure the company through a cash injection and a debt-to-equity swap, although the terms of the swap have not been specified.

Creditors opposed the first option because they believed the offer was too low, and they didn’t want to wait a decade to get their money back. They were also reluctant to engage in a debt-to-equity swap because of the difficulty of coming up with a value for the equity.

Creditor Suspicions

Some creditors were concerned that Chengdu Busheng had no experience in the photovoltaic industry and that it might be a vehicle for LDK Solar’s former chairman, Peng Xiaofeng, to take back control of what’s left of the company. Several creditors told Caixin that in 2016, in the first round of reorganization efforts, Chengdu Busheng joined up with Peng to bid for Jiangxi LDK Solar Hi-Tech and LDK Solar Hi-Tech (Xinyu).

“Creditors suspect Chengdu Busheng has connections with Peng Xiaofeng, and they don’t trust the investor’s ability to run the company,” said an employee from a creditor bank, “That’s why we are strongly opposing this latest proposal.”

So far, creditors have not been asked to vote on the proposal, but the chances of them approving either of the options on the table look slim. Many banks now believe the losses they will have to swallow in any restructuring will be too great, possibly even higher than if the group was just liquidated. They also worry that the local government will once again dominate the process and force investors to accept the reorganization given that the court will probably impose another compulsory execution order.

Chen Xiahong, a researcher on bankruptcy law at the China University of Political Science and Law, said the use of such compulsory orders is controversial if most creditors oppose a reorganization plan. Debtors and creditors should be allowed to work together to reach an agreement without the court having to resort to such a strong lever.

Chen also questioned the second reorganization proposal. “I’ve never heard of another reorganization plan being put forward after the initial proposal has failed to be executed,” he told Caixin. “Otherwise what authority does the court ruling have?”

Under Article 93 of the Bankruptcy Law, if the debtor, in this case LDK Solar, cannot implement the reorganization plan, there is only one solution — the company is declared bankrupt and liquidated, he said. There is no legal basis for the administrators to bring in new investors for another reorganization attempt.

The Chinese authorities have been encouraging the use of the courts to deal with the growing number of companies collapsing under the weight of their debts, either through bankruptcy reorganization or liquidation. The government has also vowed to push ahead with a market-oriented and rules-based bankruptcy process to cut excess capacity in such industries as steel making and coal mining.

But, as highlighted in the cases of LDK Solar and Dongbei Special Steel, the process is likely to be dominated by conflict between creditors and local authorities, both fighting for their own interests and with the courts usually siding with the local government rather than acting as independent arbitrators as they do in U.S. bankruptcy proceedings.

“Looking at the reality of conditions in China, the active involvement of the government can effectively coordinate the resources of all parties to promote the reorganization” of a company in bankruptcy proceedings, said Wang from the University of Washington. “Creditors are willing to accept this because the government has credibility, but this definitely does not mean the government should override the judgment of creditors.”

It’s unclear how long the stalemate at LDK Solar will drag on because the bankruptcy administrators have yet to call a meeting of creditors to vote on the latest reorganization plan. But Xinyu’s deputy mayor, Wang Guangming, who said at a meeting in March that he wanted the process completed by the end of the year, is likely to be disappointed.

Contact reporter Dong Tongjian (tongjiandong@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas