China’s Capital Efficiency Grows for First Time in 10 Years

For the first time in at least a decade, the Chinese economy can now produce the same level of output with less capital than the previous year.

However, as China is still being pulled by competing needs — economic growth, financial deleveraging and reform, and social stability — but efficiency might again end up on the back burner, said Michael Taylor, chief credit officer of Moody’s Investors Service.

“Earlier this year, it looks to us that out of those three (competing needs), the reform and re-balancing side is less important, and the emphasis is on growth and on stability,” Taylor said in a recent interview on the sidelines of the 8th Caixin Summit.

Taylor is also an advocate for separate regulatory bodies for financial stability and consumer protection, the so-called “twin peaks.”

“Now the 19th Party Congress gave a few indications in terms of maybe a greater willingness to tolerate a slower rate economic growth and emphasize more on financial rebalancing and deleveraging,” he said, adding those three competing needs are what he called “China’s Trilemma.”

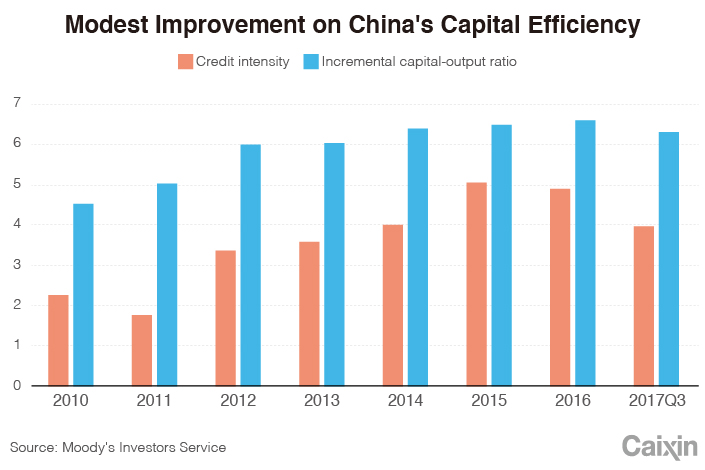

A more efficient economy is often expressed in a lower incremental capital-output ratio. In 2016, the ratio in China hit a near-term peak of 6.5, meaning $6.5 worth of capital investment was needed to generate $1 of extra production. In the first three quarters of this year, China’s ratio dropped for the first time in at least 10 years, Taylor said, albeit only marginally.

Massive government stimulus aiming to propel economic growth has been the culprit of China’s inefficient use of capital, especially bank credit, Taylor said.

Taylor, formerly the head of banking policy of the Hong Kong Monetary Authority, said China’s long-awaited turnaround in efficiency was mainly a result of companies borrowing less from banks, as they retained more profits from improved earnings.

“It’s quite modest (improvement in efficiency) but moving in the right direction,” Taylor said. “But for us, the big question is that whether it was a one-off uplift which goes down to very specific factors that won’t be repeated, or it was something going to be sustained?”

“If sustained, that could be the start of something more significant,” Taylor added.

|

Moody’s downgraded China’s sovereign credit ratings in May for the first time since 1989, citing the country’s rising debt, declining foreign-currency reserves and concerns over whether the government could push through economic reforms.

Some analysts argue that the downgrade overestimated the debt in China’s economy, while others believe the lack of transparency of governance and management of what Taylor called “China Trilemma” eventually weighed on the country’s creditworthiness.

Taylor said what China tries to do is to deal with “two of the trilemma at a time,” while the big unknown is which of the three is traded off.

He said a “golden scenario” would be China shifting toward new economic engines that won’t need debt to power economic growth.

“The government will allow more defaults to take place,” Taylor said.

He added that the government might assume a different level of guarantee for debt issued by different level of governments.

Regarding the boom in consumer finance and in unsecured loans in China, Taylor said the issue may not cause systemic problems, although any flare-up might require the government to shoulder “the cost of failures.”

Nevertheless, he said microlending is a positive industry development, as it offers financial services to those who cannot get it formally from the banking system.

“But the important thing is (for) the sector to be well regulated from (the) financial stability and the consumer protection points of view,” Taylor said, “And to have a regulatory system that is consistently coordinated.”

The downside risks of Asian countries’ sovereign credit also include growing sovereign indebtedness, tighter global liquidity and unpredictable geopolitical risks, especially on the Korean Peninsula, Taylor said.

Contact reporter Leng Cheng (chengleng@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas