China’s Over-the-Counter Market Tries to Stay Relevant

China’s first and largest over-the-counter stock-trading platform is modifying its listing and disclosure requirements, in its latest attempt to drum up subdued liquidity and attract more high-quality startups.

Founded in 2012, the National Equities Exchange and Quotations (NEEQ) is home to 11,640 Chinese startups or midsize companies. Also known as the “New Third Board,” the platform was designed to be a cradle for these companies to grow, in terms of corporate governance and profitability, and then graduate to list on main boards.

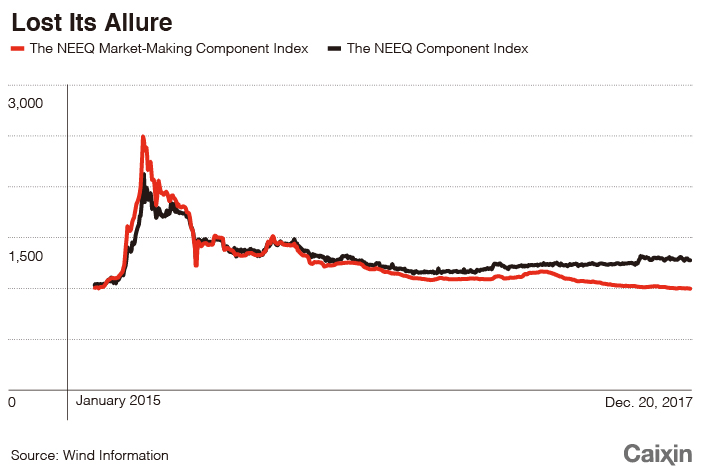

However, few companies have managed to graduate, and the number of companies that have delisted — either voluntary or ordered by the NEEQ — also rose sharply in recent months. Despite the operator’s attempts to lure more market-makers and create a tiered market to help investors identify the cream of the crop, turnover has fallen, scandals have broken out, and one of the two benchmark indexes dropped to a record low Monday.

Instead of adding a new “select tier” for high-quality companies as the NEEQ proposed earlier, there will still be only two tiers: “innovation” tier for better managed companies and “base” tier for those that did not make the cut. About a tenth, or 1,354 companies, are in the “innovation” tier.

|

Starting April 30, the NEEQ’s “innovation” tier will accept companies with annual net profit of at least 10 million yuan ($1.52 million), down from 20 million yuan currently, but with annual revenues of at least 60 million yuan, up from 40 million yuan currently.

“Some of the current listing requirements for the ‘innovation’ tier are unreasonable,” NEEQ’s general manager Li Ming said at a conference in Beijing on Friday. “Some high-performing companies are shut out, while the ones managed to list are facing management difficulties.”

Current listing requirements for the “innovation” tier focus less on sustainability of revenue. There were cases in which companies failed to generate a sustainable income stream and were forced to delist.

Companies on the ‘innovation’ tier must have at least 50 eligible investors. A broad shareholder base is key to good corporate governance.

Meanwhile, the board hopes to boost market liquidity through a new pricing mechanism. The NEEQ will replace the current negotiation-based share transfers with competitive bidding through a call auction, applicable to both tiers.

The previous mechanism for sealing deals privately by more than 10,000 companies was inefficient, and has become a hotbed for insider trading, NEEQ’s Li said.

“The new mechanism sort of rejuvenates the price-discovery function of the New Third Board,” said Zhu Haibin, an OTC analyst with Essence Securities Co. “Since the call auction could improve the trading transparency and provide better offers for investors.”

Still, not everyone agrees the new rules will save the board.

“Drumming up liquidity of the New Third Board can’t be easily done by changing the pricing mechanism,” a source close to the regulator told Caixin.

The source said the key is restoring investors’ confidence in getting a fair price, and weeding out poorly managed companies.

The NEEQ has been policing companies. The market value of China Science and Merchants Investment Management Group, once valued at 13 billion yuan, dropped to less than 6.5 billion yuan on Tuesday after failing to meet the requirements to stay listed.

The NEEQ Market Making Component Index, which measures the value of stocks traded through market-makers, dropped to a record low of 987.53 as of Monday, down from its record high of 2,673.17 in April 2015. The NEEQ Component Index, which reflects price fluctuations on the OTC market, traded flat around 1,200 recently, down from 1,247.2 late May 2016.

According to East Money Information Co., a local financial portal, nearly 500 companies have been delisted from the New Third Board this year, up sharply from 56 in 2016.

Contact reporter Leng Cheng (chengleng@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas