Investment Firm Boss Flees China After Allegedly Raising $5.7 Billion Illegally

A Shanghai-based investment company, whose actual controller has fled the country, illegally raised over 38 billion yuan ($5.7 billion) in public funds through peer-to-peer (P2P) lending platforms and other outlets, local police have said.

The alleged misconduct of Zillion Holdings is one of the biggest scandals to hit China’s troubled internet finance industry.

Zillion Holdings sold wealth management products without official approval in more than 10 provincial-level regions since December 2012 via subsidiaries that included P2P lender Tangxiaoseng, promising annualized returns of 5%-15%, police in Shanghai’s Pudong New Area announced on social media (link in Chinese). The rates are much higher than China’ benchmark one-year deposit rate, which has remained at 1.5% since October 2015.

The police investigation found that the company illegally raised more than 38 billion yuan from investors, according to the police’s post late Friday, making Zillion Holdings one of the biggest illegal fundraising cases in recent years.

Zillion Holdings’ legal representative, Tao Lei, was officially arrested on Friday, while Wu Zaiping, the person who controls the company, was still at large, police said. Caixin had learned previously that Wu had fled abroad.

|

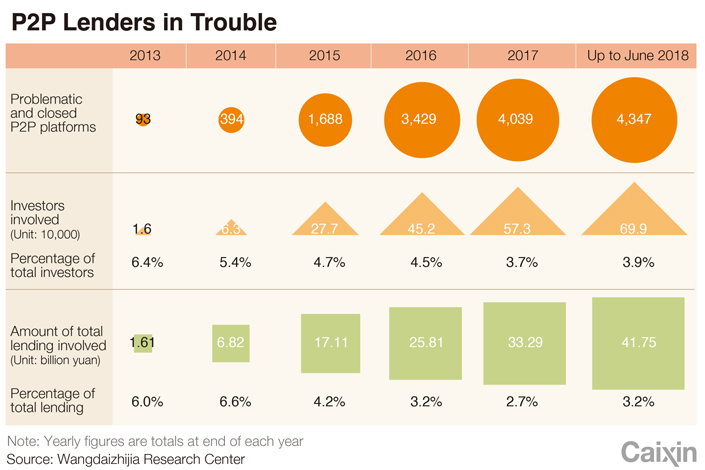

The case is the latest scandal to rattle confidence in China’s internet finance industry, which has had explosive yet unregulated growth in fundraising from typically mom-and-pop investors. Authorities have cracked down on the sector since 2015 as reports of fraud surged.

In December 2015, authorities shut down Ezubo, one of the country’s largest P2P lenders at that time. Investigators later found that the platform had bilked 900,000 investors across China out of more than 50 billion yuan.

In December, the founder of Nanjing-based internet wealth-management and marketing company Qbao turned himself in to police. He stands accused of illegally raising 70 billion yuan.

The central bank said last week that it was extending a two-year-old nationwide campaign (link in Chinese) to crack down on financial violations in cyberspace to root out risks and put the fledgling online lending market under proper oversight. Sources close to the central bank told Caixin earlier that regulators plan to continue the crackdown on illicit P2P platforms and online microlending until June 2019.

A total of 63 P2P platforms either had difficulties meeting investors’ cash withdrawal demands or saw their owners absconding with the depositors’ funds last month, the highest number since August 2016, due to rising costs as regulators tightened rules and investors grew warier of the business amid rising payment defaults, internet lending research firm Wangdaizhijia said in a monthly report earlier in July. There were 1,836 P2P platforms still operating at the end of June, compared with 3,383 at their peak in January 2016.

Contact reporter Fran Wang (fangwang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas