Heineken Taps China With Stake in Nation’s Best-Selling Beer

* Heineken NV also is selling 5.2 million shares to China Resources Enterprises Ltd. for 464 million euros.

* China Resources Beer (Holdings) Co. Ltd. said it aims to leverage Heineken’s global presence and marketing capabilities to help pave the way for Snow beer’s international expansion

(Beijing) — Heineken NV is spending HK$24.3 billion ($3.1 billion) to acquire a 40% stake in the owner of China’s biggest beer-maker, ramping up its efforts to tap the world’s largest beer market.

The Dutch brewer is purchasing an interest in China Resources Enterprise Ltd., the majority shareholder of China Resources Beer (Holdings) Co. Ltd. (CR Beer), which owns Snow beer. Heineken is also selling 5.2 million shares, or a nearly 1% stake, to China Resources Enterprises for 464 million euros ($539.2 million), according to a Heineken statement on Friday.

Under the deal, Heineken will sell its existing China operations to CR Beer, including three breweries, and will license its Heineken brand in China to CR Beer on a long-term basis, it said.

The world’s second-largest brewer said the partnership will “help significantly expand” availability of its Heineken brand in China to fully leverage its potential, while CR Enterprises will be able to advance “its premiumization strategy.”

|

CR Beer’s Snow is the world’s best-selling beer even though it is sold almost exclusively in China. The company said it aims to leverage Heineken’s global presence and marketing capabilities to help pave the way for Snow’s international expansion.

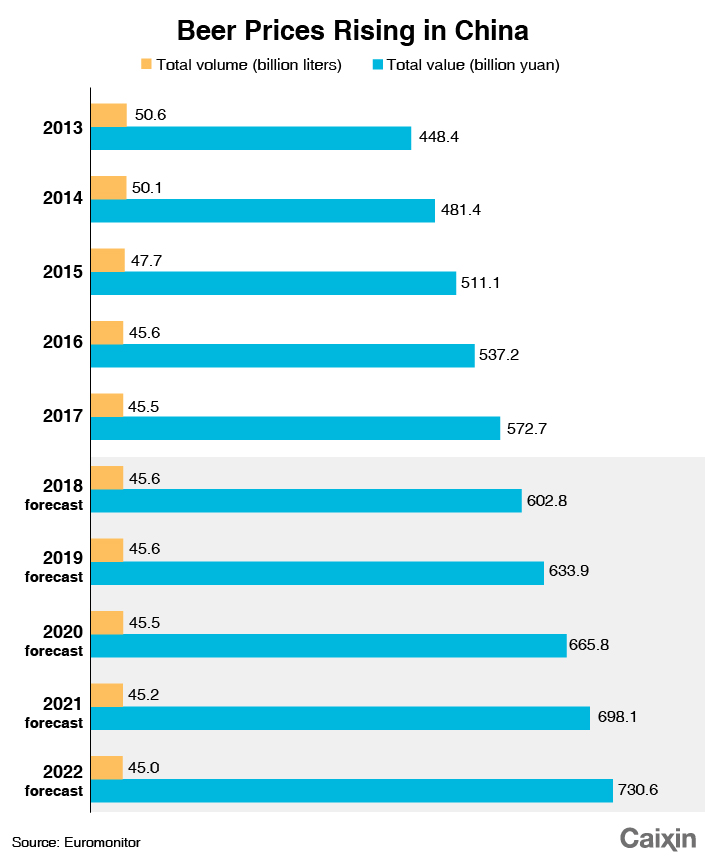

China’s brewery market shows signs of moving into the premium segment, as total beer sales jumped 6.6% in 2017 to 572.7 billion yuan ($83.80 billion), while consumption volume inched down by 0.6% to 45.5 billion liters, according to data-tracker Euromonitor International.

“Profitability of the Chinese beer market is expected to improve significantly, driven by premiumization, demand for international beer brands and cost optimization,” Heineken said.

|

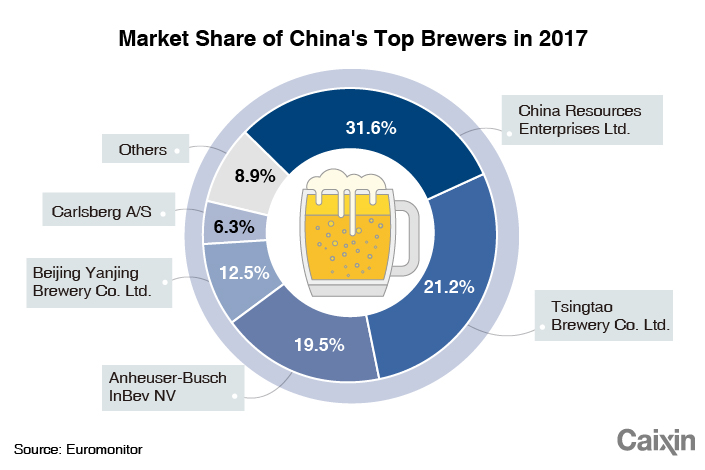

The competitive landscape has pushed out some players. Japan’s Asahi Group Holdings Ltd. announced in December it will to sell its stake in Tsingtao Brewery Co. Ltd. to conglomerate Fosun International Ltd. for HK$6.6 billion, citing a market slowdown.

Contact reporter Jason Tan (jasontan@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas