In Depth: Tencent Refocuses on Business Customers in Major Overhaul

With its first across-the-board overhaul in six years, Chinese internet giant Tencent Holdings is reorganizing to focus more on business customers in response to headwinds from slower growth, rising competition and investment risks.

The Shenzhen-based gaming and social media company unveiled a plan Sept. 30 to revamp its business structure, including consolidating several content-focused business groups and creating a new division devoted to cloud computing and data services aimed at corporate customers.

The restructuring, which will affect the company’s 50,000 employees and more than 30 vice president-level executives, comes as Tencent faces growing challenges to maintaining its momentum after years of uninterrupted growth. The 19-year-old company posted its first quarterly profit drop in 13 years in the second quarter as its core gaming business grappled with increasing government scrutiny.

|

Tencent has been talking about an overhaul since late last year when Chairman and CEO Pony Ma said the company should focus more on business clients. A senior executive told Caixin that Tencent finalized the restructuring plan in late September as the company seeks a major strategy shift to business solutions from consumer-focused internet products.

Under the plan, Tencent will trim its seven business groups to six by merging the social networking, mobile internet and online media divisions into one and creating a new group focusing on cloud and smart industries. Gaming will remain under the interactive entertainment group and WeChat, the popular messaging app, will remain a separate group.

With the reshuffling, Tencent will “further explore the integration of social, content and technology that is more suitable for future trends, and promote the upgrade from consumer internet to industrial internet,” the company said in a statement.

“These changes now will be the starting point for the next 20 years of Tencent’s operations,” Ma said. He called the overhaul a “major strategic upgrade.”

Push into cloud

Tencent’s current corporate structure was created in 2012 as the company sought to win customers amid the mobile internet boom. Unlike Alibaba, where power is highly consolidated under founder Jack Ma, Tencent has a decentralized structure that gives each product-focused division a high degree of independence, industry analysts said.

Zhang Zhidong, a co-founder of Tencent, said recently that the 2012 restructuring allowed Tencent to roll out new products quickly but also led to insufficient sharing of technology and data among units. Zhang said this was blocking Tencent’s progress in the era of artificial intelligence, big data and cloud computing.

|

The latest restructuring plan reflects Tencent’s efforts to improve cloud-based data services for corporate clients to take on Alibaba. The newly created Cloud and Smart Industry Group will merge Tencent’s offerings in cloud computing, online education, health care, transport and mapping, among others, into a unified whole to better harness the huge amount of data and analytics the company receives.

Tencent said it will also set up a technical committee to promote internal coordination in research and development of key technologies that could serve the company’s push into innovative sectors.

Weathering challenges

The restructuring also reflects Tencent’s concerns over the prospects of its core online gaming business, which has been hit by rising regulatory hurdles.

Under the plan, all the content-related businesses such as animation and film will be transferred from the current interactive entertainment group to the newly created Platform and Content Business Group. After the spinoff, online gaming will be the only business under the interactive entertainment group.

The move is seen by analysts as an effort to separate risks related to the gaming business from Tencent’s other businesses.

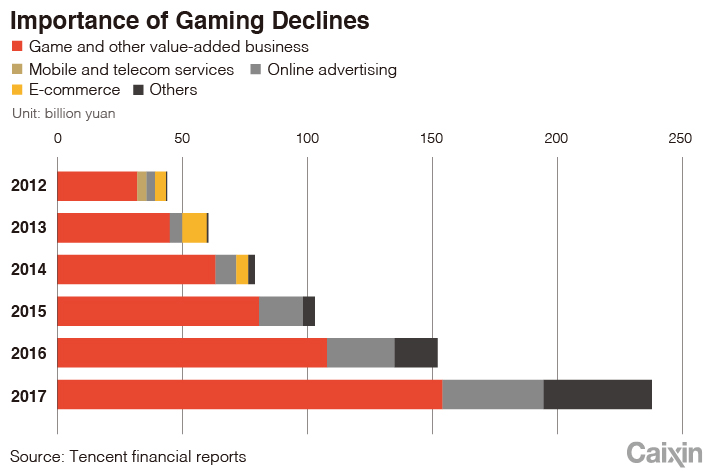

Gaming operations have long been Tencent’s most profitable business line, although the contribution to total revenue declined from more than 55% in 2011 to 34% in the second quarter this year.

|

Amid the regulatory crackdown, Tencent’s gaming business revenue growth slowed to three-year low of 6% in the second quarter.

The consolidation of content-related businesses also reflects Tencent’s effort to bolster its content offerings to compete with emerging rivals such as news aggregator Toutiao.

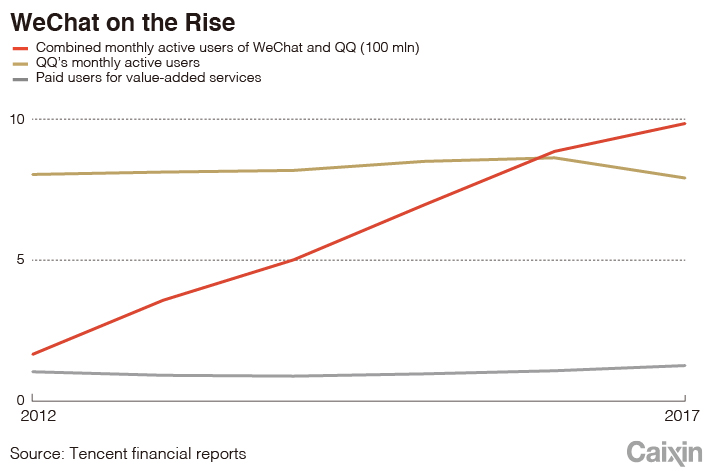

With popular messaging apps QQ and WeChat, Tencent has long controlled the most extensive access to users. But rivals are catching up.

According to market researcher QuestMobile, internet users spent less time on Tencent’s social networking platforms in the first half this year while their usage of Toutiao and its affiliated short-video sharing apps rose.

Tencent has seen Toutiao as a key potential competitor since 2015, a former Tencent employee said. The news aggregator, which was set up in 2012, has grown quickly by keeping people hooked with its news feed services driven by algorithms. As of April, Toutiao had more than 90 million daily active users, according to QuestMobile. TikTok, Toutiao’s short video unit, had 150 million daily active users by June.

Tencent has developed several products targeting Toutiao and TikTok in hopes of leveraging its broad access to users through QQ and WeChat. But none of the products have become strong enough to challenge the rivals.

A person close to Tencent said the consolidation of the social networking and content-related businesses will expand Tencent’s capability for offering content customized to users.

Investment risks

Tencent’s two existing groups WeChat and Corporate Development remain unchanged in the latest restructuring, partly due to their strong performance.

The Corporate Development unit, led by President Liu Zhiping, runs Tencent’s payment service Tenpay, online bank WeBank and the company’s mergers and acquisitions.

Tencent has become one of the most active dealmakers in China’s internet market since 2014. It is now the backer behind around 28% of the country’s unicorns — tech startups that gain valuations of more than $1 billion — including car-hailing giant Didi Chuxing and on-demand service provider Meituan Dianping, according to intelligence platform CB Insights.

This year, Tencent stepped up its investments in retail market, spending more than 20 billion yuan on offline store operators such as Yonghui Superstores and Carrefour.

|

Li Zhaohui, a managing partner of Tencent Investment, said Tencent’s investment strategy is to use market resources in the most efficient way to secure leading positions in different sectors.

A wide range of investment has boosted Tencent’s financials. Since 2017, investment returns have become one of Tencent’s major revenue sources. In the first quarter this year, Tencent reported 61% growth of net profit from last year. But if investment returns are excluded, the company’s profit growth would have dropped to 29%, company financial reports showed.

However, as more and more Tencent-backed startups have started to seek public listing, Tencent has found itself increasingly exposed to risks of stock market volatility. In the second quarter, Tencent’s net profit declined 23% from the previous quarter, mainly reflecting shrinking asset valuations due to stock market turmoil.

Contact reporter Han Wei (weihan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas