Chart of the Day: China’s Growing Household Debt

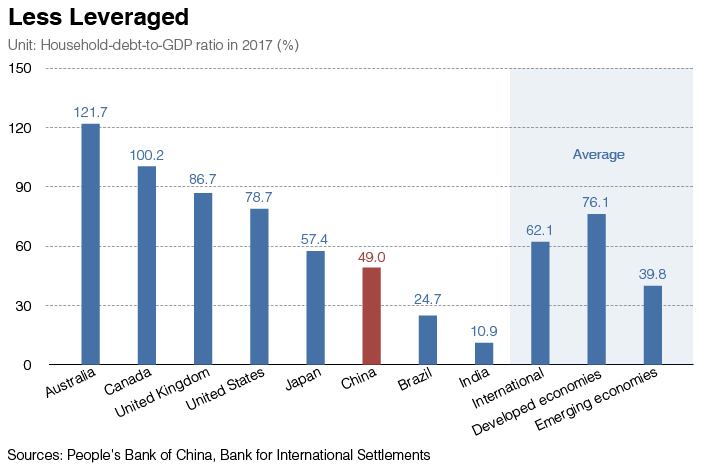

China’s household debt has built up rapidly over the past decade as its gross domestic product (GDP) has surged. The country’s household-debt-to-GDP ratio increased from 17.9% in 2008 to 49% at the end of 2017, according to the 2018 financial stability report published by the People’s Bank of China.

In the report, the central bank said that policymakers need to keep a close eye on the country’s rapidly increasing household debt. However, China’s overall household debt doesn’t stand out when compared with that of other countries.

|

Graphic: Gao Baiyu/Caixin |

China’s household-debt-to-GDP stood at 49% at the end of 2017, below the international average, but higher than the average of emerging economies. The figure is less than the household-debt levels of France and Japan and way below the levels of the U.S., the U.K. and Australia.

According to the International Monetary Fund (IMF), rising household debt can boost a country’s economy, provided that it is low to begin with. However, the economic juicing power of debt diminishes as it grows as a proportion of GDP.

An economy benefits the most from rising debt when its household-debt-to-GDP ratio is under 10%, according to the IMF. When it hits 30%, it can interfere with the country’s medium-term economic growth. Above 65%, it begins to undermine financial stability.

Contact reporter Charlotte Yang (yutingyang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas