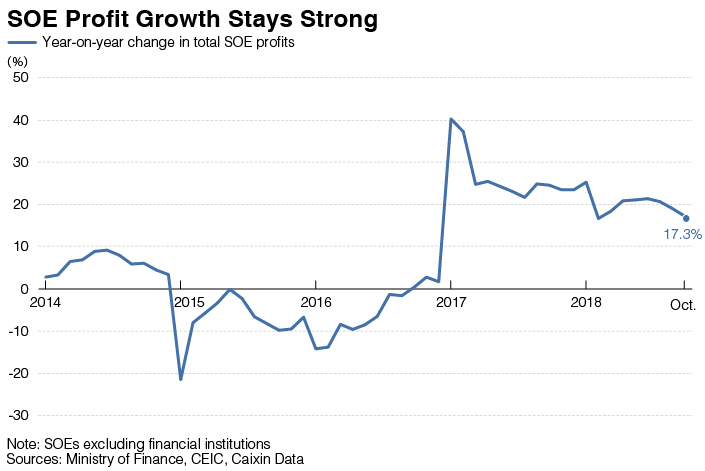

Charts of the Day: SOEs Earning More, Cutting Leverage

While China’s economic prospects are looking increasingly rocky, and the government is announcing it will do more to help the country’s flagging private sector, state-owned enterprises (SOEs) seem to be suffering less in the current environment. The latest government data show that over the first 10 months of the year, SOEs — excluding state-owned financial institutions — have earned more than they did over the same period last year while reducing their leverage.

|

Graphic: Gao Baiyu/Caixin |

For the first 10 months of this year, SOEs’ total profits hit 2.8 trillion yuan ($403 billion), up 17.3% year-on-year. Total revenue expanded 10.6% from the same period last year to 47 trillion yuan, according to a report published today (link in Chinese) by the Ministry of Finance.

While the ministry did not break down the data by industry, it did mention a few industries in which profits are growing fast; namely, iron and steel, petroleum and petrochemicals, and nonferrous metals.

The average rate of return on equity across SOEs stood at 3.3%. Central-government SOEs had a higher rate, at 5.2%, while local-government SOEs’ rate stood at 2%, according to the ministry.

|

Graphic: Gao Baiyu/Caixin |

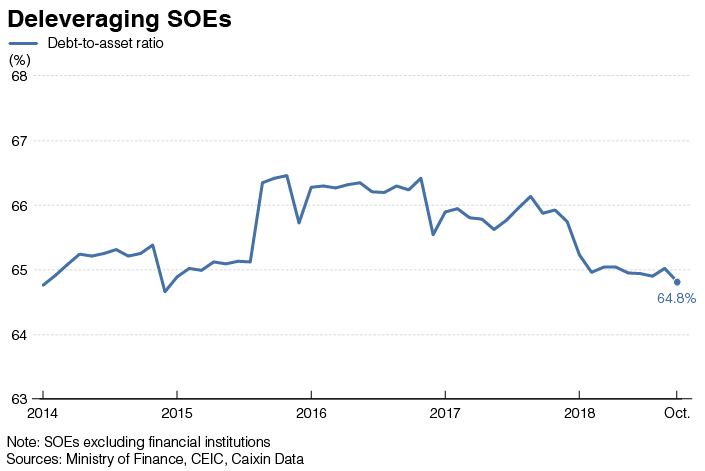

As China’s economic deleveraging campaign continues, both local and central SOEs have reduced their respective debt-to-asset ratios. As of the end of October, SOEs’ total debt-to-asset ratio has dipped to 64.8% from 65.3% the same period last year.

Contact reporter Charlotte Yang (yutingyang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas