Charts of the Day: Throwing Cash at Pledged-Stock Crisis

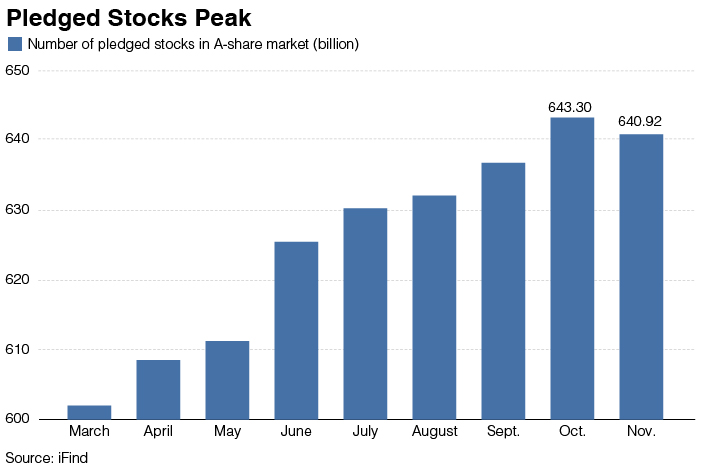

The total number of pledged shares on China’s stock markets declined for the first time this year in November, after local authorities and financial institutions set up bailout funds worth billions of yuan in total to rescue distressed companies that have seen their shares pledged as collateral for loans.

|

Graphic: Gao Baiyu/Caixin |

These companies’ financial problems stem from the government’s crackdown on shadow banking and heightened regulatory scrutiny of the financial sector.

With alternative funding channels drying up, many major shareholders pledged a large portion of their holdings as collateral for loans. As the stock market slid, they had to hand over more shares or cash to compensate lenders for falling prices.

|

Graphic: Gao Baiyu/Caixin |

|

Graphic: Gao Baiyu/Caixin |

|

Graphic: Gao Baiyu/Caixin |

Brokerages and banks that lent money on the back of the pledged shares also started dumping the holdings to minimize their losses when borrowers failed to come up with the additional collateral or to pay back their loans, creating a vicious cycle of downward pressure on share prices that has rattled authorities.

Following the call of the central government to “unwaveringly support the private sector,” local governments started to set up rescue funds in mid-October, and as of Dec. 4, more than 15 local governments have set aside 25.5 billion yuan ($3.73 billion) to bail out affected companies, according to a calculation by Caixin based on public records.

Financial institutions, including brokerage firms and insurance companies, have also joined the rescue campaign. According to the Securities Association of China, as of Nov. 23, 26 brokerage firms have promised to invest 44 billion yuan to set up asset management products that aim to help public companies.

After the China Banking and Insurance Regulatory Commission encouraged insurers to invest in quality private companies to help ease liquidity risks, six insurance companies have set up 86 billion yuan worth of special products.

However, as stock markets have been boosted by the authorities’ support, some shareholders decided to cash out their shares as soon as possible. According to data compiled by iFand, major shareholders sold more than 11.2 billion yuan worth of shares in November, nearly triple the amount in October.

Contact reporter Liu Jiefei (jiefeiliu@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas