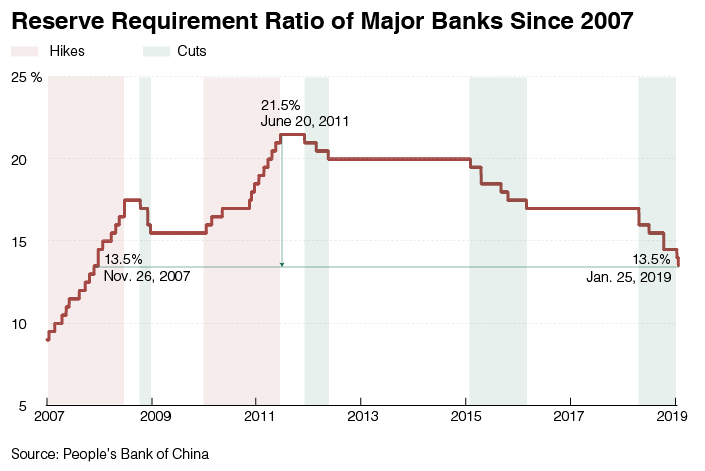

Chart of the Day: Major Banks’ Reserve Requirement to Drop to 11-Year Low

The Chinese central bank’s latest effort to ensure liquidity will bring the reserve requirement ratio (RRR) of major banks down to the lowest level in 11 years.

The People’s Bank of China announced on Friday that it plans to cut the amount of cash that banks are required to hold in reserve, releasing a net 800 billion yuan ($116.5 billion) into the financial system ahead of the Lunar New Year holiday — a time when banks face heightened demand for cash from households and firms. The central bank said (link in Chinese) the cut was introduced to “support the real economy” and “reduce financing costs.”

The RRR will decline by 1 percentage point this month, dropping half a point on Jan. 15 and by another half-point on Jan. 25. These will be the central bank’s fifth and sixth RRR cuts since the start of 2018.

|

Graphic: Gao Baiyu/Caixin |

After the cuts, major banks’ RRR will be 13.5%, the lowest point since late 2007. The rate was last set at this level on Nov.26, 2007, before being raised about a month later.

Smaller lenders’ RRR will be lowered from 12.5% to 11.5%.

From 2007 to mid-2008, major banks’ reserve ratios were raised 15 times, going from 9.5% to 17.5%. Some cuts followed before the RRR peaked in June 2011 at 21.5%.

Contact reporter Charlotte Yang (yutingyang@caixin.com)

- 1In Depth: China’s Sweeping Banking Law Rewrite Targets Hidden Risks

- 2China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 3In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas