With Proton Partnership, Geely Treads Carefully Into Southeast Asia

On Dec. 12 in Kuala Lumpur, Malaysian Prime Minister Mahathir Mohamad officiated the launch of a new SUV produced by Proton Holdings Berhad, once the country’s sole automaker.

The scene echoed the launch 35 years ago of the first Proton model, the Saga, which Mahathir attended during his first term as Malaysia’s leader.

The difference this time was that Proton, which had been a source of pride for the nation, is now 49.9% owned by Zhejiang Geely Holding Group Co. Ltd., China’s largest private automobile manufacturer.

Mahathir founded Proton in 1983 while he was in office. But it was sold to a private enterprise after bleeding cash for years and lost ground to foreign rivals as well as a second homegrown brand, Perodua, which launched in 1993.

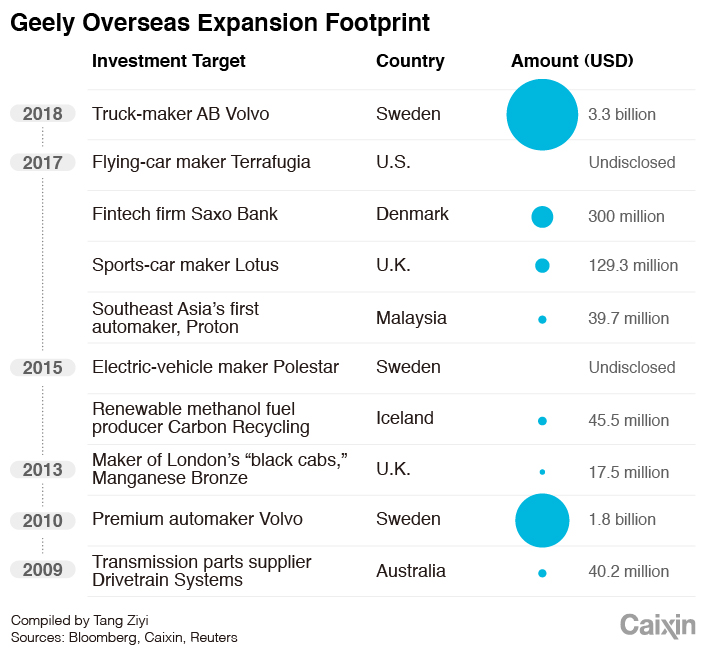

Geely came to the rescue in 2017, reaching a deal with DRB-Hicom Berhad to invest $40 million in Proton, and at the same time taking a 51% interest in British luxury sports-car maker Lotus Cars Ltd., which Proton has owned since 1996.

Founded in 1997 in Hangzhou as the country’s first private automaker, Geely has made a string of global acquisitions. It spent $1.8 billion to buy out U.S. automaker Ford Motor Co.’s Volvo unit in 2010, a move seen as symbolizing the movement of global car-industry power to China from the U.S. and Western Europe. Geely also acquired the British maker of London’s iconic “black cabs” in 2013, and most recently, U.S. flying-car maker Terrafugia.

|

The SUV launched by Mahathir in December was the company’s first model since Geely’s investment in Proton two years ago. The X70 is modeled on the Boyue sold by Geely in China. It’s positioned as a premium model fitted with a 1.5-liter turbocharged engine and priced from 99,800 ringgit ($24,200).

Local reports said early signs were encouraging as more than 10,000 units had been booked before the launch.

Big ambitions

To Geely, the X70 means more than just a copycat for its Boyue in Southeast Asia. It has a more significant meaning — the Chinese carmaker wants to tap Proton to conquer Southeast Asia, which has a market size of 3.4 million units a year, and is currently besieged by Japanese automakers.

It spells new opportunity to Geely, as its home market saw the first slowdown of passenger car sales in 2018.

In 2017, Malaysia’s passenger vehicles sales stood at 514,679 units. The Proton sold 70,991 units, commanding a market share of 13.8%, according to the Malaysian Automotive Association. This was far from its peak in the 1990s, when nearly 4 out of 5 cars sold in the country were from Proton.

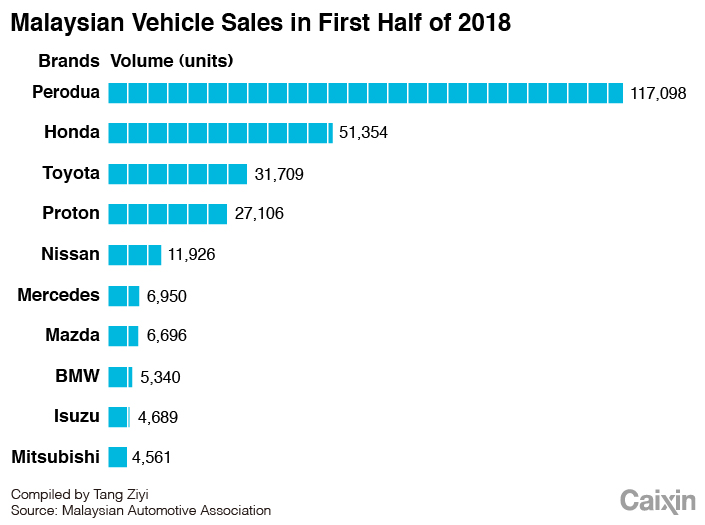

For the first half of 2018, the market leader in Malaysia was Perodua. It sold over 117,000 units. That was followed by Japan’s Honda Motor Co. Ltd. and Toyota Motor Corp., which sold around 51,000 and 31,000 respectively.

Geely is not giving up. It said it aims to make Proton Malaysia’s top brand, as well as one of the top three in ASEAN, by 2028.

Industry watchers are skeptical.

|

The Proton is Malaysia’s national pride, and building trust with its Malaysian partner is critical to ensuring a successful partnership, wrote Dong Yang, deputy director of the China Association of Automobile Manufacturers, in an earlier commentary.

Without mutual trust, chances are that when Proton regains its footing in the future, Geely will be booted out, Dong said. There are previous examples of this. In 2004, SAIC Motor Corp. invested $500 million in its South Korean peer, Ssangyong Motors, only to see it declare bankruptcy in 2009.

Upgrading dealerships

Geely has been cautious not to let history repeat itself.

To shake off Proton’s image of a second-tier automobile with substandard quality, Geely has offered incentives to help dealers transform their network in Malaysia into 4S stores (which incorporate sales, showrooms, services, and spare parts).

Proton CEO Li Chunrong told Caixin that 70% of Proton dealers in the past were providing only sales, or 1S, and that wasn’t an attractive proposition to the public.

“How is this going to attract customers since we are positioning Proton as a mid- to high-end model that is worth paying more for?” said Li, a Chinese national who was appointed by Geely in 2017 to turn Proton around.

At the end of 2018, there were 80 approved 3S and 4S outlets in Malaysia, and Proton expected to upgrade more this year.

Geely has given its word that it will not import Geely-branded cars to Southeast Asia for the next five years, Caixin has learned. That means Proton can breathe a sigh of relief as Geely is poised to promote only the Malaysian brand — at least for now.

The promise has seemed to placate Mahathir, who once exclaimed that the sale of Proton to Geely meant that Proton was no longer a Malaysian brand.

“Since partnering, Proton has been recovering and I believe it will be enhanced with the latest X70,” Mahathir was quoted as saying by local media at the December event. “It’s not a secret that Proton has made tremendous progress since the partnership, and I believe there’s more to come in the future.”

Tang Ziyi contributed to this report.

Contact reporter Jason Tan (jasontan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas