5,000 Online Games Await Government Approval After Freeze

Authorities approved a withering one-tenth of online computer and mobile device games waiting to be green-lit over the past two months, leaving some 5,000 titles yet to be officially judged.

And new games submitted early this year are unlikely to reach the public until 2020, market sources said.

The revelations come after the regulator, the National Radio and Television Administration (formerly known as the State Administration of Press Publication, Radio, Film and Television) approved 91 games for release last week in its sixth batch of approvals since an eight-month freeze ended in December.

China stopped issuing new game licenses in March after a major reorganization of government departments that sent shockwaves through the world’s largest gaming market.

The regulator further tightened restrictions in September when it announced a cap on the total number of games on the market, and said it would explore implementing an age-based system that would restrict the amount of time that minors spent playing games.

|

Approvals finally resumed late in December to cheers from the industry, but the regulator has only issued licenses to 538 titles since then.

One game company executive told Caixin the approvals were issued based on their submission dates, however, only applications through April last year had yet been cleared. Around 5,000 more games have been shelved and the staggering backlog may not be cleared until the third quarter of this year, said the person, who asked not to be identified.

“For new submissions in the first quarter of this year, chances are very likely their companies will only gain permission to release their games in 2020, if not at the very end of this year,” another industry source said.

In the past, authorities typically took three months to clear a game for release.

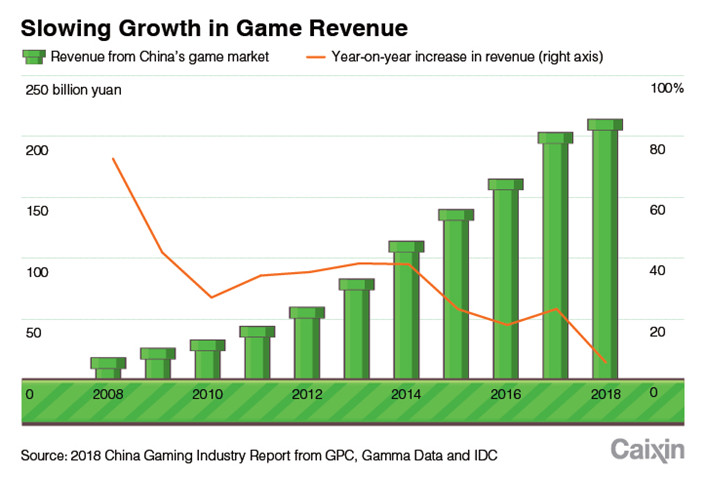

China’s became the world's largest gaming market in 2016 when it surpassed the U.S. and Japan in revenue. There are 620 million “gamers” in China, almost double the U.S. population, according to Newzoo, an Amsterdam-based industry tracker.

But the sector’s rapid expansion created a highly competitive market in which companies spent recklessly to gain market share and raced to release games, leading to a glut of games and game companies.

The suspension of games issuances blasted a hole in industry revenue but may not be all bad. The slower approvals process could encourage consolidation and propel companies into striving for better games and services that will ultimately benefit consumers, industry watchers said.

Contact reporter Jason Tan (jasontan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas