Nearly Three Dozen Industries Favored for Long-Awaited Tech Board

* The Shanghai Securities Exchange has named 34 industries which will be urged to list on the upcoming new high-tech board and explained the rules for listing in detail

* The sectors mentioned include semiconductors and integrated circuits, artificial intelligence, solar and wind power, new energy cars and biotech

(Beijing) — The Shanghai Securities Exchange (SSE) has published a list of nearly three dozen industries that the country’s Nasdaq-like new board will favor and spelled out specifics on the implementation of the rules to list there, such as how valuation of candidate companies should be conducted.

Companies in 34 specific sectors are encouraged to seek a listing on the high-tech board, including semiconductors and integrated circuits, artificial intelligence, aviation, advanced rail transit, advanced nuclear power generation, solar and wind power, new-energy cars, biotech, and high-end medical equipment manufacturing, according to guidelines (link in Chinese) that the SSE released Sunday. The stock exchange will host the new board and review applications for an initial public offering (IPO) on it.

The high-tech board was announced by President Xi Jinping in November and will trial a registration-based system for IPOs. The testing of such a system on the high-tech board is seen as key to long-awaited reforms to China’s stock market as it will allow market forces to play a bigger role in determining issues such as the pricing of a listing than under the existing approval system, which is dominated by rigid rules. Regulators also hope the new board will improve the appeal of mainland stock exchanges to technology firms in competition with overseas bourses.

The guidelines came one day after the country’s securities watchdog released the final version of a slew of rules governing the new board.

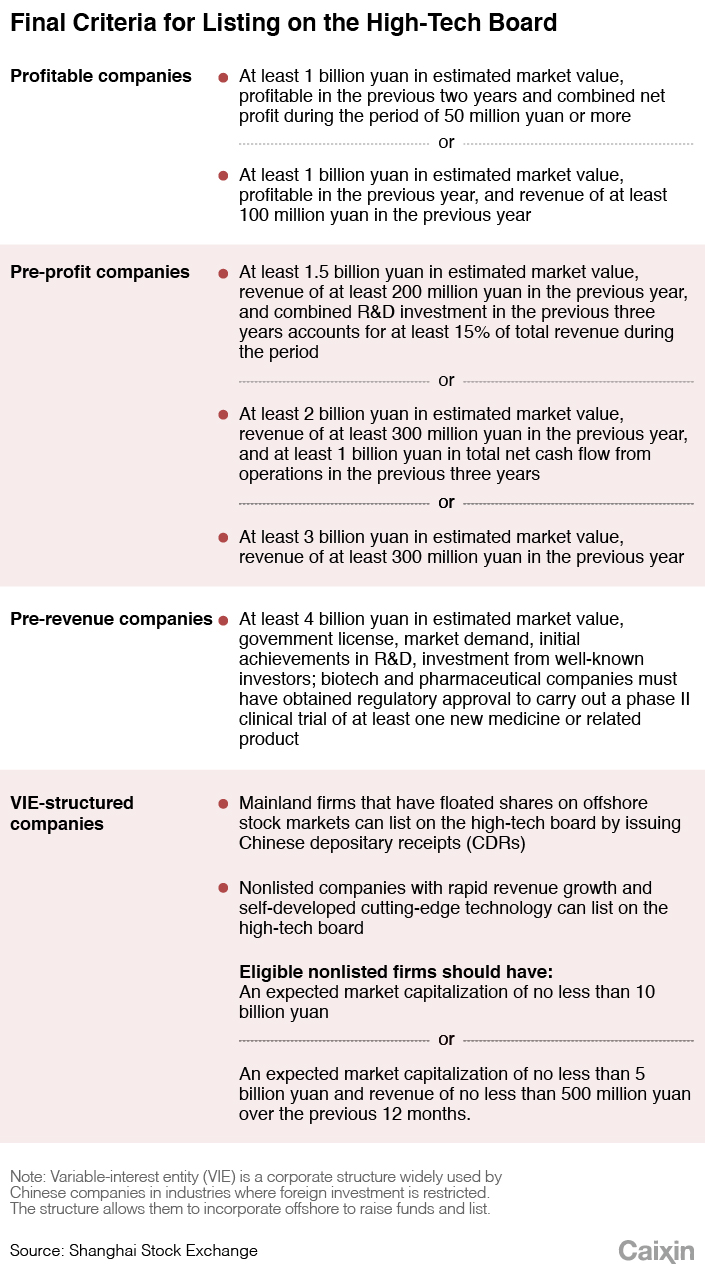

One of the key differences between the high-tech board and China’s main boards is that companies can apply for a listing even before they become profitable or report revenue — provided they meet standards relate to estimated market value.

To ensure the easing does not compromise the quality of firms on the new board, the SSE explained in detail in a separate document issued on Sunday how the valuation of a company should be carried out and what consequences a miscalculation will cause.

IPO sponsors, who advise, guide and educate their client companies on compliance with all the listing rules and procedures, should conduct a preliminary estimation of the candidate’s market value when the company files the application, the SSE said in the 16-point circular (link in Chinese) in a Q&A format. They should pick a suitable and reliable methodology according to the applicant’s specific conditions and the accessibility of valuation data available on the market, and use the company’s latest private equity financing and the valuation of its competitors as guidance.

Demand from institutional investors during the book-building process will serve as a key gauge to measure the accuracy of the sponsor’s preliminary estimate of its client company’s market value. Sponsors must submit explanations to the SSE if the estimated market value, which is to be calculated based on the potential IPO prices according to demand during the book-building process, turns out to be significantly different from their preliminary appraisal. The discrepancy will affect the SSE’s assessment of the sponsors’ performance, according to the document.

Companies should terminate their IPO applications if the estimated market value calculated on the basis of demand during the book-building process is insufficient for it to meet the listing requirements, it added.

|

Contact reporter Fran Wang (fangwang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas