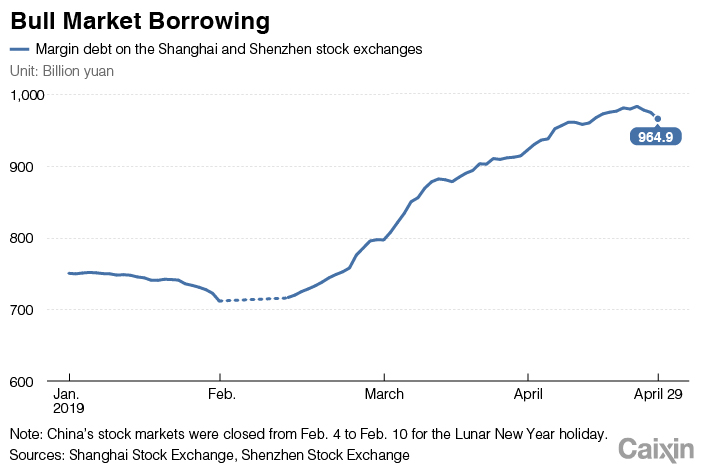

Chart of the Day: Stock Investors Borrow More in the Bull Market

Investors are borrowing more money to play the markets as Chinese mainland stocks bounce back in a big way from a horrendous 2018.

|

Outstanding margin debt, the value of shares that investors buy with borrowed money, reached 964.9 billion yuan ($143 billion) when the markets closed on Monday, according to data from the Shanghai and Shenzhen stock exchanges. That’s up 35.7% since Feb. 1.

The benchmark Shanghai Composite Index closed at 3,078.34 on Tuesday, up 24.9% since the beginning of 2019. The index leapt by 5.6% on Feb. 25, when it met the bar for a bull market.

China’s stock markets were among the world’s worst performers of 2018. The benchmark Shanghai Composite Index lost almost 26% last year.

Contact reporter Timmy Shen (hongmingshen@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas