Chart of the Day: Overseas Investment Rises and Falls With the Mainland Stock Market

The net outflow of overseas capital from China’s stock markets hit 10.9 billion yuan ($1.6 billion) on May 14, the highest since July 2015, as markets tumbled amid the country’s ongoing trade tensions.

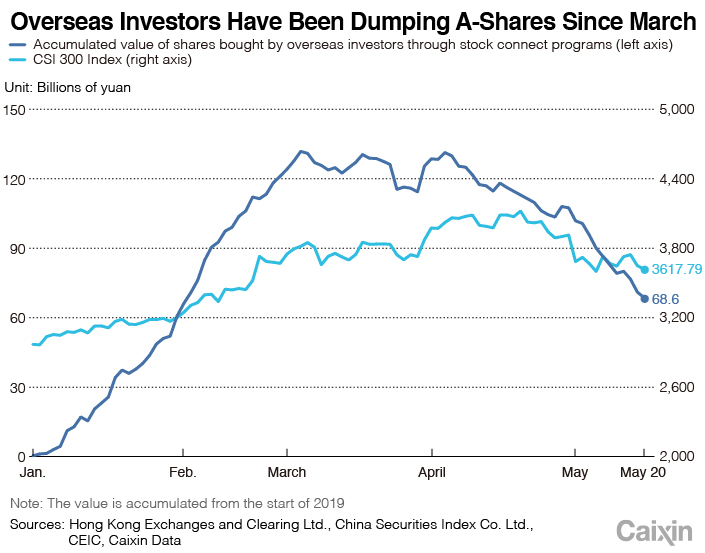

As of the end of trading Monday, the net worth of stocks bought on Chinese mainland stock markets so far this year by overseas investors through the stock connect programs that link the Hong Kong exchange with those in Shanghai and Shenzhen was 68.6 billion yuan. That figure was down sharply from 131.8 billion yuan on March 5, the peak this year so far. The net worth is calculated by subtracting the total value of all shares sold from the total value of all shares purchased.

|

The benchmark Shanghai Composite Index was at 2,870.6 on Monday, down 12.2% from this year’s high of 3,270.8 on April 19. The Shenzhen Component Index was down 14.6% from its year-to-date high of 10,435.8 on April 10.

The reasons why there has been a net outflow of overseas capital are that overseas investors have become less risk-seeking, volatility has increased and trade tensions have reescalated between the U.S. and China, Liao Ling, an analyst with GF Securities Co. Ltd., said in a note on Sunday. However, in the longer period, overseas investment in mainland stock markets is bound to increase as China continues to open up the financial markets, Liao said.

There are two main ways for overseas investors to invest in the mainland stock markets. The first is through the Qualified Foreign Institutional Investor and Renminbi Qualified Foreign Institutional Investor programs, which were launched in 2002 and 2011 respectively. The second are the stock connect programs. The Shanghai-Hong Kong Stock Connect was launched in 2014 and the Shenzhen-Hong Kong Connect in 2016, which are preferred by overseas investors. Overseas investors held 1.68 trillion yuan worth of A-shares at the end of March, of which 1.03 trillion yuan, or 61.3%, were shares bought through the stock connect, according to data compiled by financial data provider Wind.

Yue Yue contributed to this report.

A previous version of this story imprecisely stated the net worth of stocks bought on the mainland stock markets this year by overseas investors through the stock connect programs that link the Hong Kong exchange with those in Shanghai and Shenzhen. The figure was actually 68.6 billion yuan.

Contact reporter Liu Jiefei (jiefeiliu@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas