Charts of the Day: China Unseated as Largest Foreign Holder of U.S. Debt

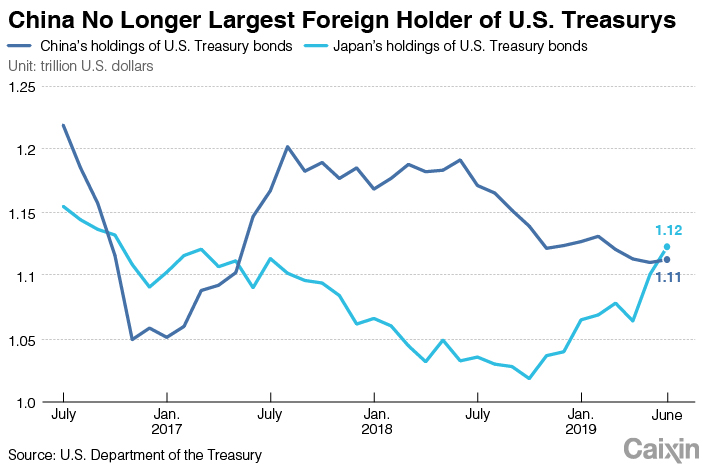

Japan replaced China in June as the largest foreign holder of U.S. government debt amid the escalating China-U.S. trade war.

China’s hoard of U.S. Treasury bonds, bills and notes grew by $2.3 billion to $1.11 trillion in June, bouncing back from a two-year low hit the previous month. However, the rebound wasn’t enough to hold off Japan, whose Treasury holdings jumped for a second consecutive month to $1.12 trillion, the highest since October 2016, according to data released Thursday by the U.S. Department of the Treasury. Japan’s Treasury holdings rose by $21.9 billion from June.

|

The change marked the first time since June 2017 that China wasn’t the largest foreign holder of Treasurys. Furthermore, the share of China’s foreign reserves made up by Treasurys fell to 35.67% in June, its lowest in more than two years, according to Caixin’s calculation based on government data from China and the U.S.

|

The growth in China’s Treasury holdings could ease concerns that Beijing will dump U.S. government debt in retaliation for Washington’s punitive tariffs on Chinese imports. Some analysts have downplayed the concern, arguing that any large-scale sell-off would hurt China along with the U.S.

Earlier this month, the U.S. Census Bureau released data that showed China was no longer the U.S.’ largest trading partner, as it fell to third place on the trade table for the January-June period, coming in behind Mexico and Canada.

On Aug. 1, U.S. President Donald Trump threatened to impose additional tariffs of 10% on a further $300 billion of Chinese imports starting on Sept. 1, causing the trade dispute between the world’s two largest economies to again flare up. Still, the U.S. Trade Representative’s office announced Tuesday that Washington would postpone instituting the threatened tariffs on some Chinese goods until mid-December “based on health, safety, national security and other factors.”

On Thursday, the yield on the 30-year Treasury bond fell to a record low of 1.98%, slipping lower than the yield on some shorter-term U.S. debt. That resulted in what finance types call an inverted yield curve, considered a harbinger for an economic slowdown. The yield curve inversion has “sent the strongest signal of recession” for the U.S. economy, said Hussein Sayed, chief market strategist at FXTM, a foreign exchange service provider. “No one knows when a bear market begins, but if the U.S. and China don’t reach a trade agreement soon, the chance of one is highly likely.”

|

Contact reporter Guo Yingzhe (yingzheguo@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas