China’s U.S. Government Debt Holdings See First Drop in Four Months

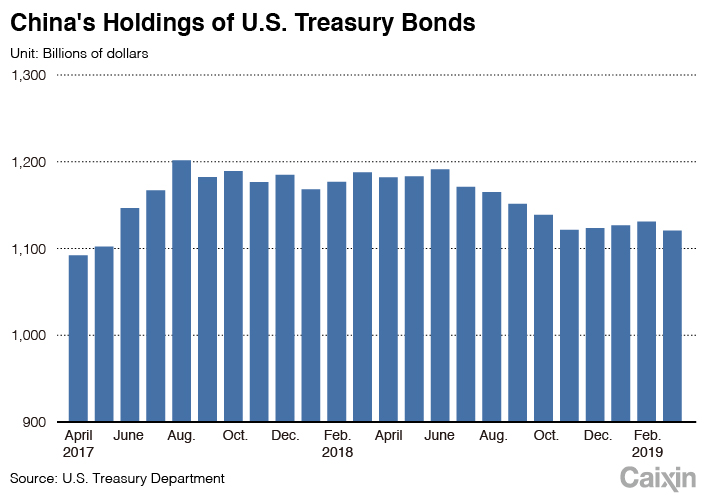

China’s holdings of U.S. government debt fell in March for the first time in four months, hitting the lowest level in almost two years, data released by the U.S. Treasury Department on Wednesday show.

The country’s store of Treasury bonds dropped to $1.12 trillion in March from $1.13 trillion the previous month, the smallest amount since May 2017 when the total was $1.1 trillion.

China is the biggest foreign holder of U.S. government bonds, known as Treasurys, and global markets have become increasingly sensitive to the monthly changes since trade tensions between the world’s two largest economies flared up last year and deteriorated sharply in early May.

|

Some investors are concerned that Beijing may sell its stockpile as part of retaliatory measures against the punitive tariffs on Chinese goods imposed by the administration of President Donald Trump, which could put upward pressure on U.S. government borrowing costs.

However, analysts downplayed the fears, arguing that any large-scale sell-off would not be in China’s interests because even if it dumps Treasurys, it will still hold the dollars and will have to find other dollar-denominated assets to invest in.

No alternative

“I don’t think China will use U.S. Treasury bonds as a weapon to fight a trade war, as it will hurt China more than the U.S.,” Larry Hu, an economist with investment and advisory services firm Macquarie Capital Ltd. in Hong Kong, told Caixin. “It will lead to weak dollar which will hurt (the value of) China’s foreign exchange assets.

“Also, there’s no alternative out there for China’s FX reserves than the U.S. Treasury bonds,” he said, referring to the country’s foreign exchange reserves, which are the world’s largest and stood at $3.095 trillion at the end of April, official figures show.

Trump suddenly escalated hostilities in the Sino-U.S. trade war last week just as the two sides were gearing up to finalize an agreement to resolve their dispute after months of negotiations. The U.S. president blamed China for attempting to “renege” on commitments made during the trade talks and ordered that the punitive tariffs of 10% already imposed on $200 billion worth of Chinese goods be increased to 25%.

The additional tariffs went into effect on Friday and the administration has also threatened to subject another $325 billion worth of imports to a similar punitive rate. Beijing has dismissed U.S. accusations, with officials saying it was “natural” for changes to made in the details of a deal before the final agreement.

In retaliation for the U.S. tariff hike, China said this week it will increase tariffs on American products worth around $60 billion to as much as 25% starting June 1.

|

An analyst said China is unlikely to use its U.S. government bonds as a weapon, as this could hurt the value of the dollar and therefore its own foreign exchange assets. Photo: IC Photo |

Julian Evans-Pritchard, a Singapore-based analyst with research firm Capital Economics, noted that China’s response was “very modest” compared to the U.S. action and indicated that Beijing was “eager to avoid a complete breakdown of trade talks.”

“We think the small scale of China’s planned tariff hikes reflects three factors – a desire not to escalate tensions, the limited scope for further tariffs and China’s ability to use other tools to punish US firms,” he wrote in a report on Tuesday.

U.S. Treasury Secretary Steven Mnuchin said Wednesday that he and U.S. Trade Representative Robert Lighthizer were “mostly likely” to visit Beijing for another round of negotiations before Trump meets China’s President Xi Jinping at the G-20 summit in Japan in late June.

Contact reporter Fran Wang (fangwang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas