Chart of the Day: Chinese Banks Replenishing Their Capital Through Bond Sales

Chinese banks are resorting to selling bonds — especially perpetual bonds — to replenish capital as regulators tighten control of their off-balance-sheet assets and push them to increase lending to the real economy.

As of Oct. 10 this year, commercial banks had issued bonds, including perpetual bonds, worth 977.7 billion yuan ($138.2 billion) for capital replenishment, a record high that is more than twice the value of those issued last year, according to data compiled by Bloomberg News.

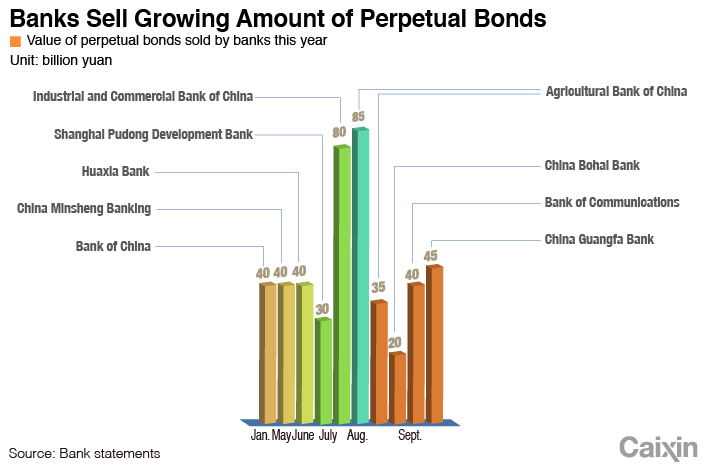

Nine banks have issued a total of 10 perpetual bonds this year with a combined value of 455 billion yuan after policymakers gave the nod to banks’ use of such bonds at the end of 2018. Last month alone, 140 billion yuan of perpetual bonds were issued by four banks. In August and September, Agricultural Bank of China Ltd., one of China’s five largest state-owned commercial lenders, issued two perpetual bonds worth a combined 120 billion yuan, the biggest issuer so far.

|

Perpetual bonds are a type of debt with no fixed repayment date and in which the borrower pays interest indefinitely if needed, or until it chooses to pay back the capital. Selling such bonds can replenish banks’ Tier 1 capital as accounting regulations allow them to be treated as equity rather than liabilities on balance sheets.

Financial regulators have pledged support for banks’ perpetual bonds. After a green light from the cabinet-level Financial Stability and Development Committee, the People’s Bank of China (PBOC) in January announced a new tool to encourage perpetual bonds — the central bank bills swap — under which qualified banks can swap their perpetual bonds for central bank bills to improve the bonds’ liquidity. Pan Gongsheng, a PBOC deputy governor, said in February (link in Chinese) that supporting the issue of perpetual bonds would help raise capital for banks and in turn boost lending into the real economy.

China’s five largest state-owned banks, like many other banks in the country, are facing funding pressure. Asset management rules released last April require lenders to move off-balance-sheet assets onto their books in a bid to crack down on illicit shadow banking activities, which requires them to have more capital to weather potential losses.

Data from the China Banking and Insurance Regulatory Commission showed that the core Tier 1 capital adequacy ratio of commercial banks was 10.71% at the end of the second quarter of 2019. Meanwhile the aggregate Tier 1 capital adequacy ratio was 11.4%, and the general capital adequacy ratio was 14.12%. All were below the figures a quarter earlier.

Core Tier 1 capital consists of equity, retained earnings and other reserves, according to the Basel III international banking regulations, comprising the highest-quality capital a bank has to absorb losses.

Liang Hong contributed to this report.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com), editor Flynn Murphy (flynnmurphy@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas