Charts of the Day: China’s 2019 Stock Market Rally

China’s stock market made a comeback in 2019 after a dismal performance the previous year, as investors shrugged off an economic slowdown exacerbated by the ongoing trade dispute with the U.S.

Total trading volume on the Shanghai Stock Exchange increased 24.3% year-on-year in 2019 to nearly 50 trillion yuan ($7.2 trillion), in contrast with a 20.8% decline in 2018, according to exchange data (link in Chinese). On the Shenzhen Stock Exchange, 73 trillion yuan worth of shares changed hands, up 46.1% from 2018, official data show (link in Chinese).

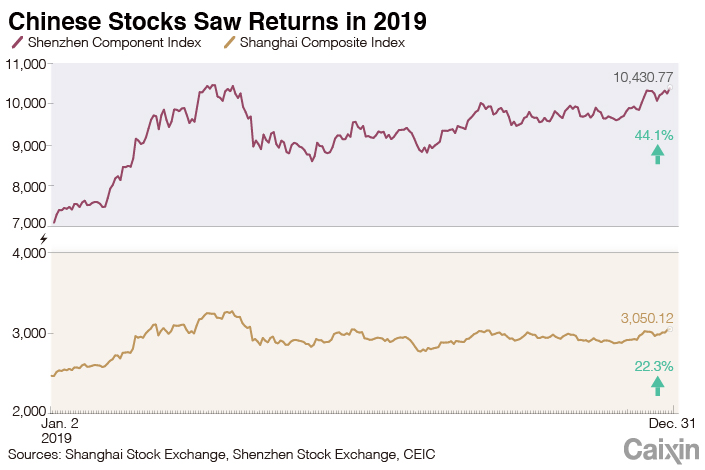

The benchmark Shanghai Composite Index rose 22.3% over the course of last year, while the Shenzhen Component Index jumped 44.1%.

|

|

The rebound came after Chinese stocks saw some of their worst days in 2018, as investors pulled back from capital markets amid uncertainty surrounding breakout of the China-U.S. trade war. While investors still saw external uncertainties in 2019, they did take bolder steps to tap domestic consumer spending and the tech sector, both buoyed by state subsidies and capital market reforms.

Among the most noticeable measures was the trial of a registration-based initial public offering (IPO) system on Shanghai’s STAR Market, a Nasdaq-style high-tech board launched in June. Some aspects of the market-oriented system that simplifies IPO applications are expected to be expanded nationwide with the Securities Law revision approved on Saturday.

Global market conditions for Chinese companies show signs of thawing in 2020, as U.S. President Donald Trump said Tuesday in a tweet that he would sign a phase one deal to ease the 18-month trade war with China on Jan. 15.

Contact reporter Tang Ziyi (ziyitang@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

Caixin Global has launched Caixin CEIC Mobile, the mobile-only version of its world-class macroeconomic data platform.

If you’re using the Caixin app, please click here. If you haven’t downloaded the app, please click here.

- 1In Depth: China’s Sweeping Banking Law Rewrite Targets Hidden Risks

- 2China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 3In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas